Having the world’s largest independent database of current electronic component pricing gives me a unique perspective on pricing.

Having developed the prediction algorithms used inFreebenchmarking.com and Component Cost Estimator — applications that accurately predict what individual companies should be paying for components — I am happy to see my customers saving millions of dollars by using my predictions. Unique perspective and seeing what’s possible in competitiveness transformation provide an opportunity to see things not usually evident to the population at large.

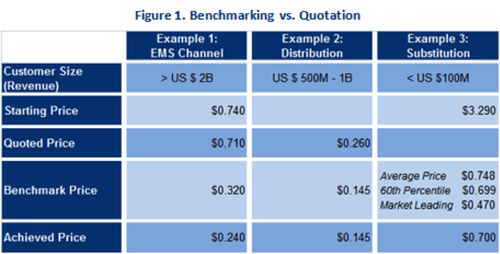

Here are some insights, using common examples, that I have from my unique position at Lytica. I will use Figure 1 for this discussion.

There is nothing exceptional about these examples, except that the customers had lived with these starting prices until they discovered savings through our benchmarking and price prediction process. Example 3 involved a change of manufacturer; all other supply chain factors remained unchanged.

Here are the five:

The range of actual prices being paid for a given components is much broader than anticipated.

Most people understand that different companies would be paying different prices for the same component. They see this as being a function of the cost of supply and can accept some level of gross margin variation tied to negotiation success.

They expect some price variation, maybe 30 percent, but the reality is many times that amount. This is the result of multiple supply chain channels; one example being manufacturer to distributor to EMS provider. Margin stacking and opportunistic pricing very quickly expand the range of possible prices on any specific component. Price ranges of 5 to 10 times the minimum price are common.

All companies are paying too much for some of their components.

Regardless of their confidence, self-assuredness, or unshakable faith in their pricing excellence, we have not yet run a report for a customer where opportunities for cost savings were not found. Most companies do a reasonably good job on pricing where they focus their attention, but no company has the necessary resources to focus everywhere. The result is that all companies have opportunity to improve their materials cost within their existing supply chains.

Companies don’t need to change suppliers, terms, or channels to get savings.

Examples 1 and Figure 2 are proof of this. Knowing your component’s market value changes the negotiation. Most sales people, when challenged with a legitimate pricing anomaly, will act to correct it.

Restrictive practices like “registration” or regulatory qualification restrictions kill cost reductions and maintain prices high.

We have all heard of the military paying high prices for regular items. Military components and components used in medical devices are priced higher than the exact same device sold into more competitive markets. These market segments, along with registered high intellectual property components, hold their prices high. They usually offer no cost reduction year after year.

While there may be little that can be done with devices you currently have in production, new products represent an opportunity for savings. New design awards should not be made without first knowing the competitiveness of the pricing offered and having a negotiation to ensure pricing is in line. The same “know the market value of components” practice should be applied to ODM negotiations as well.

Component substitutions using top-tier component suppliers can yield significant savings.

I have been surprised to learn that manufacturers and suppliers often don’t know the market value of their components. Many are interested in benchmarking with us to fill this void. This lack of market knowledge often leads to the sale of equivalent components (Example 3) where there is a significant difference in price. If you know the market value of your component and its equivalent, you can act to save real money. Often, when real alternatives are tabled, the existing supplier will move their price to maintain their supply position.

By Ken Bradley – Lytica Inc. Founder/Chairman/CTO