Electronics Market: Tariff Threats, Rising Lead Times, and Shrinking Availability the Big Story in February

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $470 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

Special Note: Tariffs in 2025

With tariffs constantly shifting across the United States, Canada, Mexico, and China, we wanted to again highlight one of our latest blogs, offering valuable insights and guidance on navigating these uncertain times.

The New Reality of Tariffs: Navigating Uncertainty in Electronics Procurement offers valuable insights and strategic considerations for managing both short- and long-term tariffs. As the world grapples with this issue, this blog will help shed some light on the complexities and provide actionable strategies to better manage this new challenge.

Slight Price Correction for February, but Likely to Be Short Lived

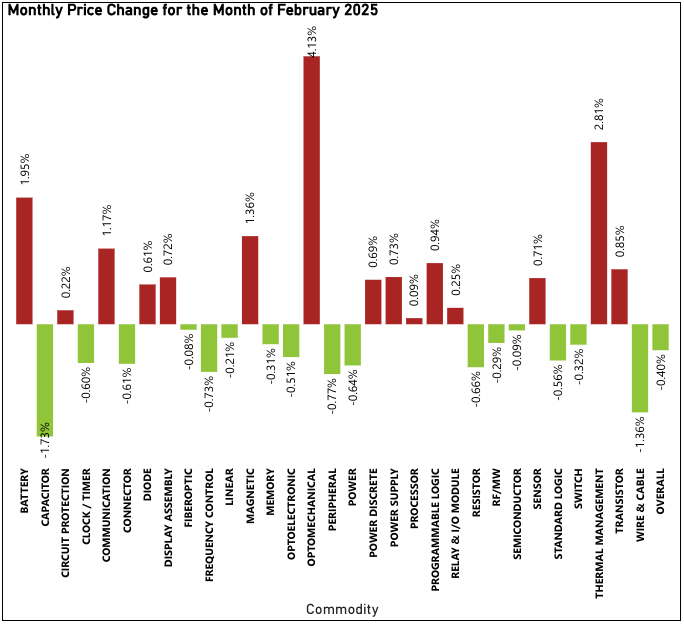

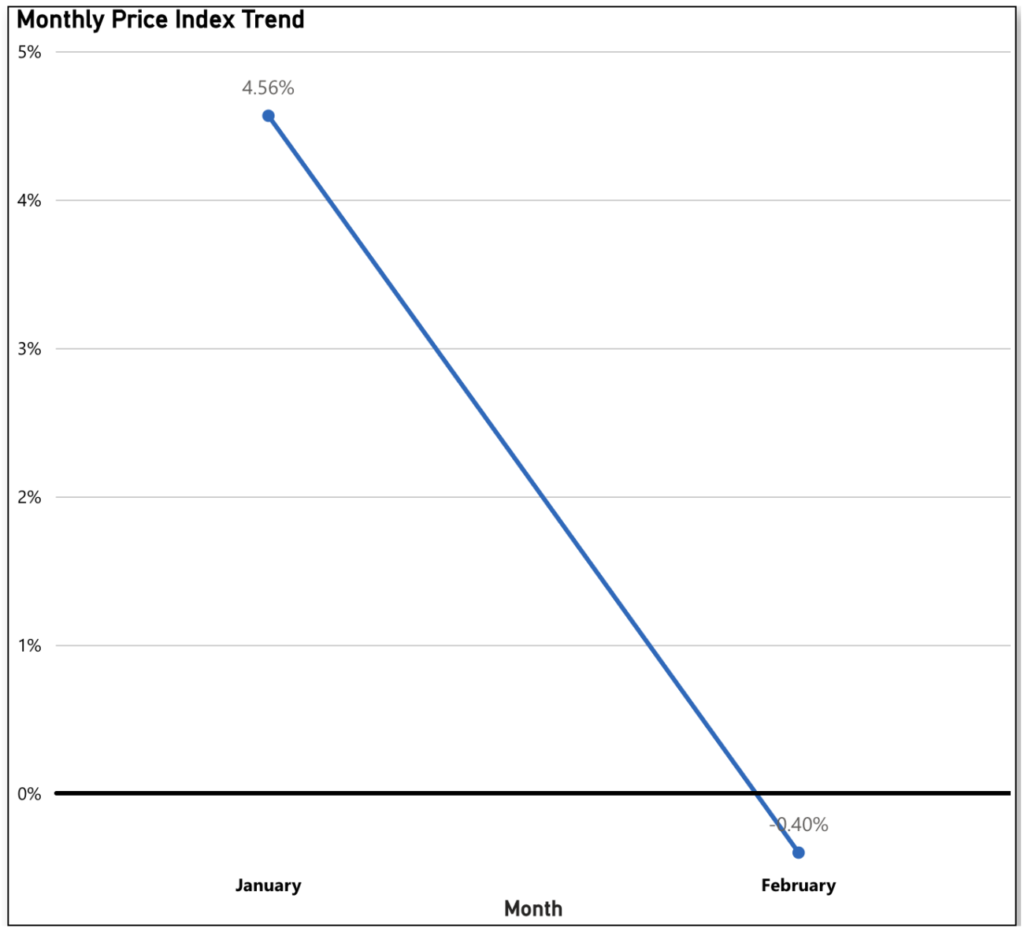

Some welcome news to start the February report, after January’s sharp 4.56% price surge, February saw a slight correction of 0.40%. However, year-to-date pricing remains up 4.16%. With tariff uncertainties looming and market conditions shifting in March, this dip may be short-lived, as trade tensions are likely to drive prices higher in the coming months.

The biggest drivers in this pricing readout include Capacitor (down 1.73% month-to-month), Wire & Cable (down 1.36% month-to-month) Peripheral (down 0.77% month-to-month), Frequency Control (down 0.73% month-to-month) and Resistor (down 0.66% month-to-month).

The commodities pushing upward against this trend include Optomechanical (up 4.13% month-to-month), Thermal Management (up 2.81% month-to-month), and Battery (up 1.95% month-to-month).

Lead Times Continue to Rise with Another Modest Increase in February

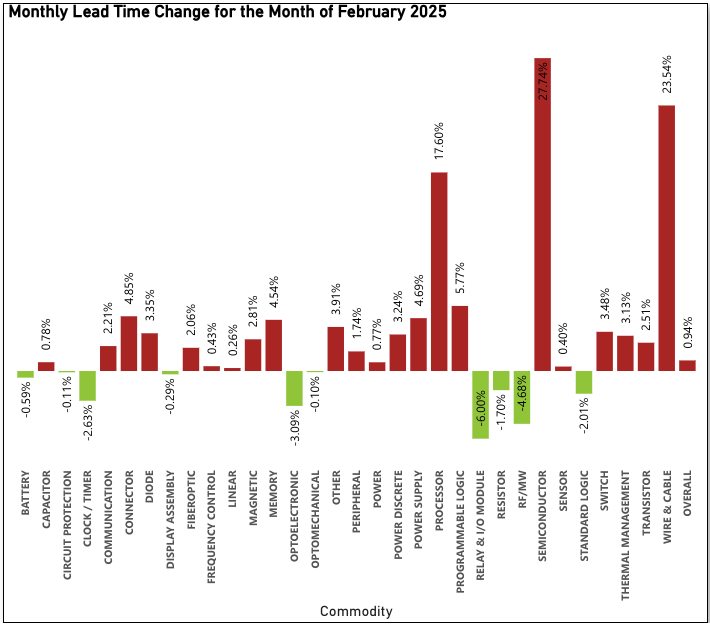

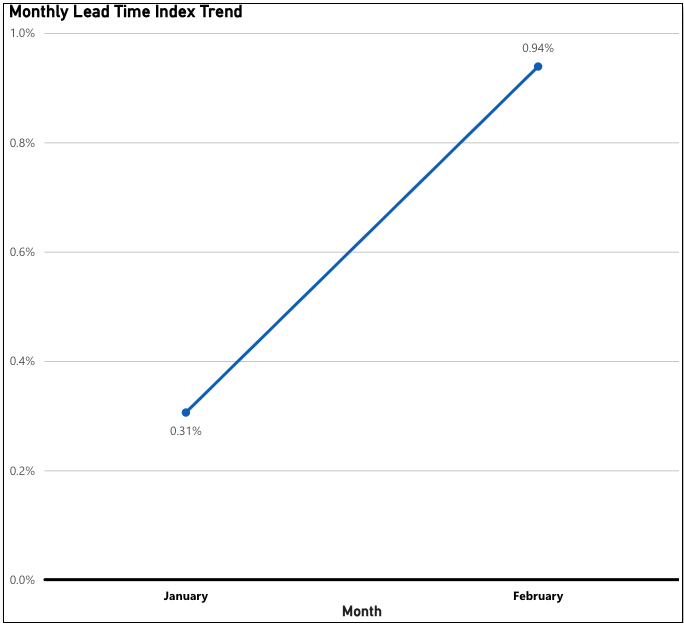

February saw a continued rise in lead times for 2025, with a modest 0.94% increase. Of the 32 tracked commodities, 22 experienced longer lead times, with three surging beyond a 15% increase. This brings the year-to-date lead time growth to 1.25%, compounding on the already rising levels from 2024.

The main contributors to this month’s increase were Semiconductor (up 27.74% month-to-month), Wire & Cable (up 23.54% month-to-month) and Processor (up 17.60% month-to-month).

The commodities pushing downward against this trend include Relay & I/O Module (down 6.00% month-to-month), RF/MW (down 4.68% month-to-month), and Optoelectronic (down 3.09% month-to-month).

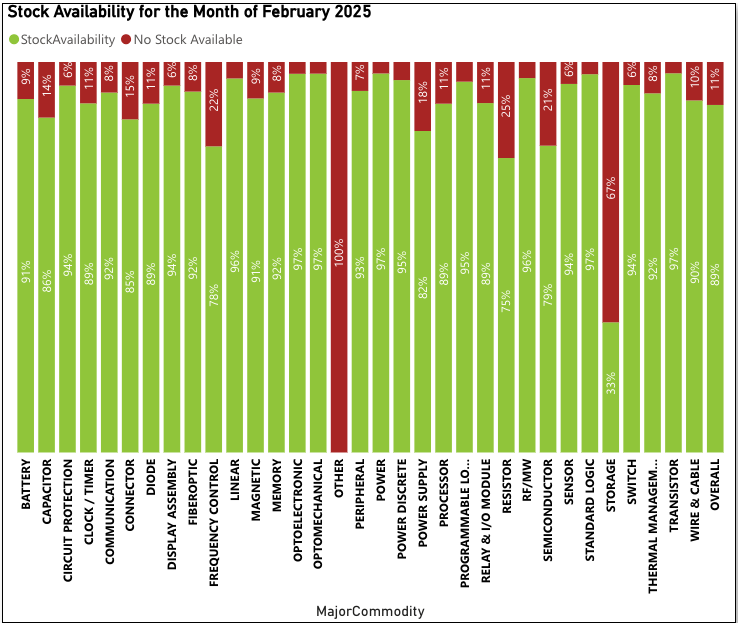

Stock Availability to Lowest Level Since October 2024

Stock levels had remained steady since late 2024, averaging 92% availability. However, February marked the first decline since October 2024, with availability dipping to 89%. Those components leading the way from availability perspective include Optoelectronic, Optomechanical, Power, Standard Logic, and Transistor all at 97% available. Those components pushing downward on this trend include Other (at 0% available), and Storage (at 33% available).

Sign up for our newsletter for more on the electronic components market.