Does Amazon have the potential to disrupt the electronic component industry? It is a question, which all the stake holders in the $450 billion industry are looking to answer.

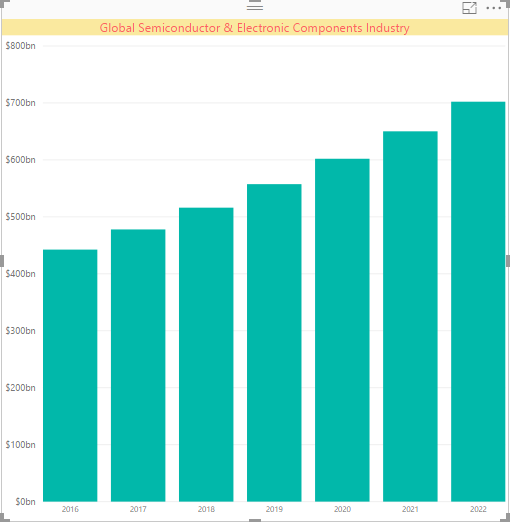

The bar chart below showcases the 2016 revenues and projections till 2022 for the total global electronic component industry. The annual growth projections are set at around 8% [1]CAGR.

While leading electronic components distributors have recognised the trend of growing business to business e-commerce trade in the industry, stepping into the online platform to challenge the advances of Amazon is another story.

Amazon’s new B2B marketplace, Amazon Business revealed in June 2017 that it has passed the 1 million customer mark since launching in April 2015. Its sales crossed the $1 billion mark with in a year and hit a month to month growth rate of 20% as stated by Prentis Wilson – Vice President of Amazon Business back in May 2016. It also ranked at No. 104 in the B2B E-Commerce 300 [2]in June 2017.

Amazon Business is not focusing on just a single market vertical but rather is successfully disrupting many industry verticals and has already taken strides in the electronic components sector. And with Amazon comes greater price transparency, sophisticated offerings as well as superior user experience.

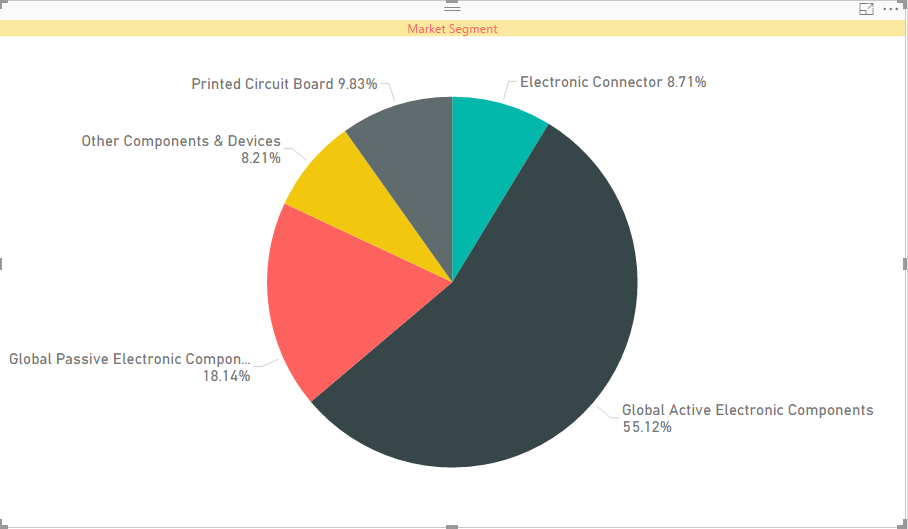

Market Segment – Electronic Industry Figures from IBISWorld

Since passives such as capacitors and resistors are more standardized products and thus can be commoditized, Amazon can quickly leverage this to increase its market share by sourcing from many suppliers and third-party sellers, offering products with similar quality to reach new markets. Over 18% of the total components in industry comprise of passives as represented in the pie chart above.

Does this mean catalog distributors would face heavy losses in the next few years? No says Tamara Jugerson – Senior Vice President for Marketing at Newark elements14. Adding that the distinct complexities associated with B2B components market cannot be easily met by the Amazon Model.

All the major electronic distributors are also authorised components suppliers and have strong relationship with manufacturers, which help in containing many supply chain risks for clients such as counterfeit materials, conflict minerals, material shortage, quality issues (certifications like ISO-9000/14000) etc. Additionally, component distributors also provide various value-added services such as holding stocks for suppliers, educating customers and assisting in product design.

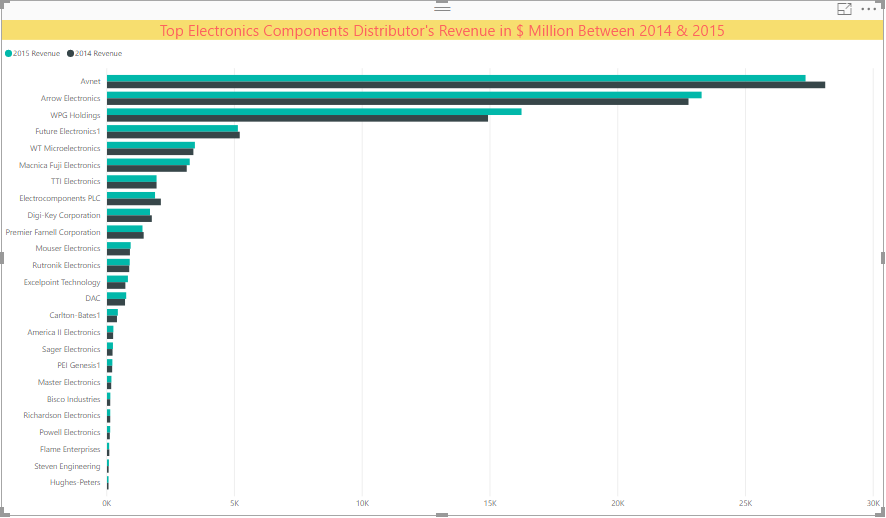

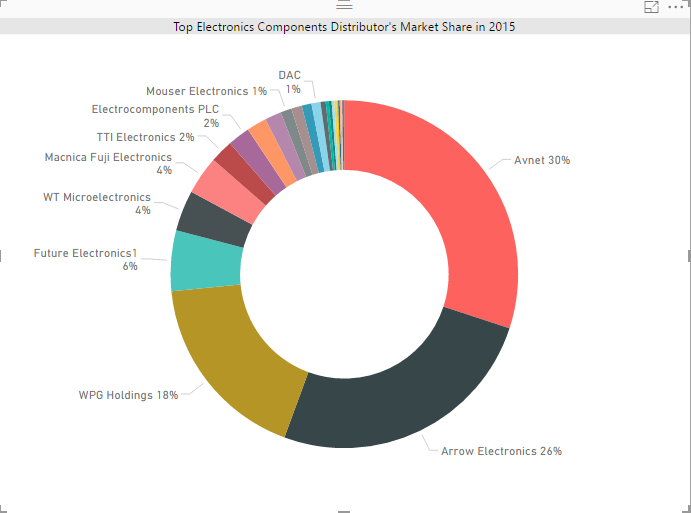

Electronics components distributor’s market is highly consolidated and only the top 10 distributors had annual global revenues of over $1 billion in 2015. The bar graph below showcases the revenues between 2014 and 2015 for the leading 25 distributors.

Revenues in $ Millions

The top four Avnet, Arrow Electronics, Taiwan based WPG holdings and Future Electronics Inc together command close to 81% of the market share majorly due to the vast orders for heavily customized products. Though the big market for customized products would act like a defensive shield against Amazon’s foray into the industry, getting into the passives component market sector could be a different story for Amazon.

As pointed out earlier many third-party sellers and scores of Chinese manufacturers would be more than happy to sell their products through Amazon and reach new markets. In an industry where the margins are already water thin, Amazon’s incursion into the sector would further erode the margins for component distributors. The operating income percentage* to sales for top three distributors are shown below.

Source – Annual Reports *Extrapolated figures for 2017 & 2013 for Arrow

Committing towards digital transformation would allow catalog distributors to provide efficient value-added services and importantly better price transparency, especially for the more commoditized products. This in turn would dissuade the e-Commerce giant to create a monopoly in the market. Revenue contribution by passive components for Arrow and Avnet are shown above in the two pie charts, highlighting the importance of the passive sector for distributors.

Digital transformation includes betterment in areas such as centralization of procurement, price transparency, value added services in managing client’s supply chain and risks.

Another e-commerce giant, Alibaba has already acted in this direction by unveiling 1688[3] Super stores, which provide digital infrastructure and services for corporate procurement that include electronic components.

Bottom line is digitalization would help distributors in not only cutting operating costs to improve margins but also aide in providing superior solutions to customers, increasing satisfaction and repurchase rate.

Vijay Raj is a data analyst with a background in Supply Chain (MBA, Schulich School of Business, York University – Toronto) and economics (Masters, Universite de Perpignan-France).

References

- (2016, October 05). Active Electronic Components Market – Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2015 – 2023. Retrieved November 04, 2017, from https://www.prnewswire.com/news-releases/active-electronic-components-market—global-industry-analysis-size-share-growth-trends-and-forecast-2015—2023-300340188.html

- Investor Relations. (n.d.). Retrieved November 04, 2017, from http://www.wpgholdings.com/investors/financial_highlights/en/annual-reports

- https://www.arrow.com/en/media-center/annual-report-2015

- http://ir.avnet.com/financials.cfm

- https://www.ebnonline.com/author.asp?section_id=4013&doc_id=282618&page_number=1 Alex Moazed, Founder & CEO, Applico

- https://www.ebnonline.com/author.asp?section_id=3219&doc_id=280519 Hailey Lynne McKeefry

- Bort, J. (2016, July 28). A business Amazon launched a year ago has already generated $1 billion in revenue. Retrieved November 04, 2017, from http://www.businessinsider.com/amazon-business-hits-1-billion-in-a-year-2016-7

- 4, 2. P., Paul Demery | Dec 6, 2016, Paul Demery | Jan 12, 2017, Paul Demery | Dec 17, 2015, & Don Davis | Jun 7, 2016. (2017, March 15). Amazon’s billion-dollar B2B portal is growing rapidly. Retrieved November 04, 2017, from https://www.digitalcommerce360.com/2016/05/04/amazons-billion-dollar-b2b-portal-growing-rapidly/

[1] http://www.4-traders.com/INFINEON-TECHNOLOGIES-436299/news/Global-Active-Electronic-Components-Market-Trends-Outlook-Overview-and-2022-Forecast-24956842/

[2] B2B E-Commerce World’s Ranking of Leaders in the B2B E-Commerce

[3] https://yicaiglobal.com/news/alibaba-open-1688com-super-stores-facilitate-corporate-procurement