Electronics Market: Buyer’s Market Continues in April with Decreased Prices and Increased Stock Availability

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $500 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

Price Decrease Continues in April, and New Pricing Charts coming in may

New Pricing Visuals Coming in May

To better serve our readers, we’re introducing an enhanced pricing chart in next month’s report.

Historically, our reports have focused on the share of parts within each commodity group that experienced price increases or decreases. Starting in May, we’ll provide a more complete view, showing both the number of parts that changed in price and those that did not within each group. This added context will offer a clearer understanding of how widespread pricing shifts are across the board.

Stay tuned for the update, and as always, we welcome your feedback. If you have questions or suggestions, feel free to reach out to us through our website. Now, on to the April report.

Price Decreases seen in april

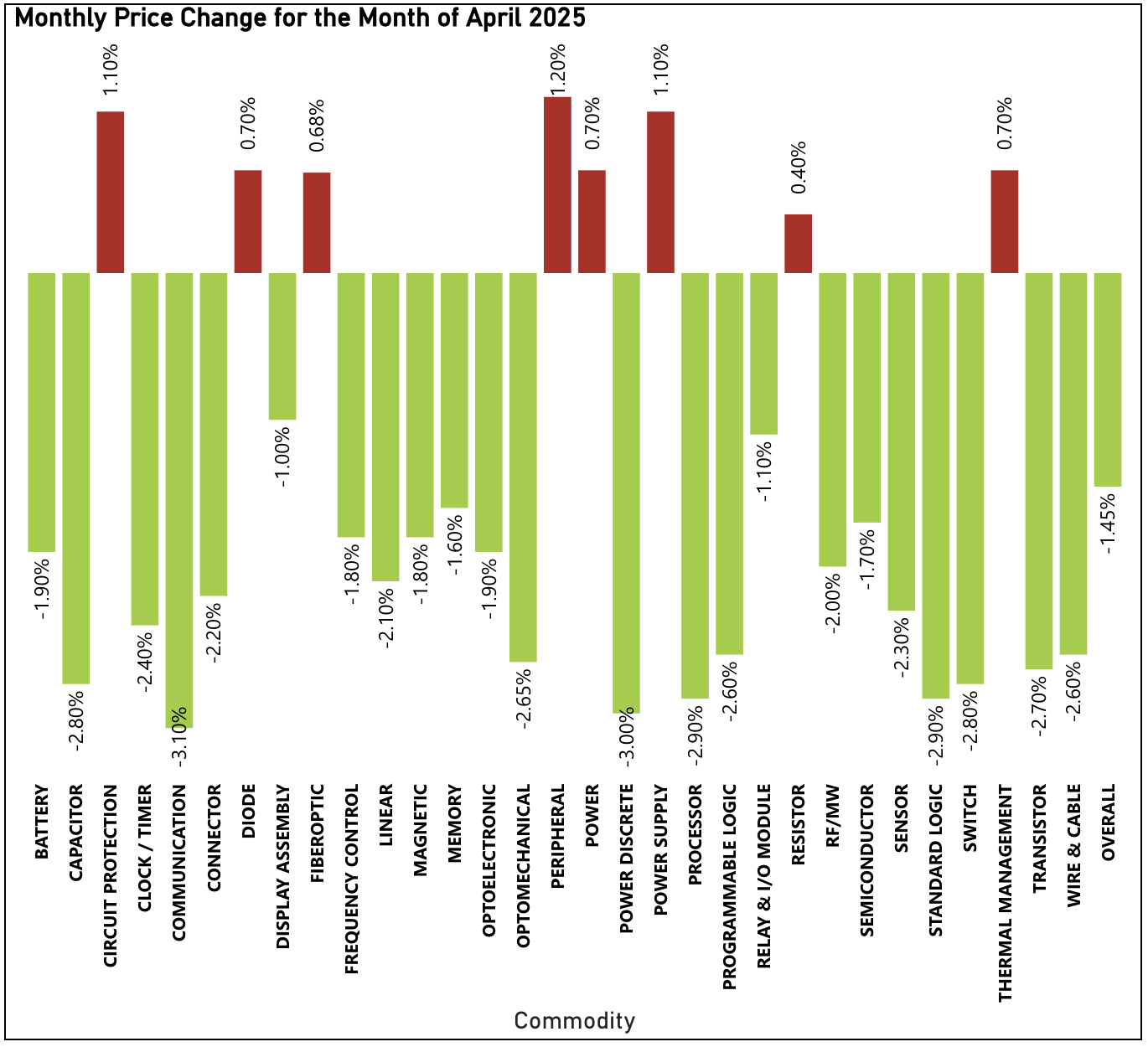

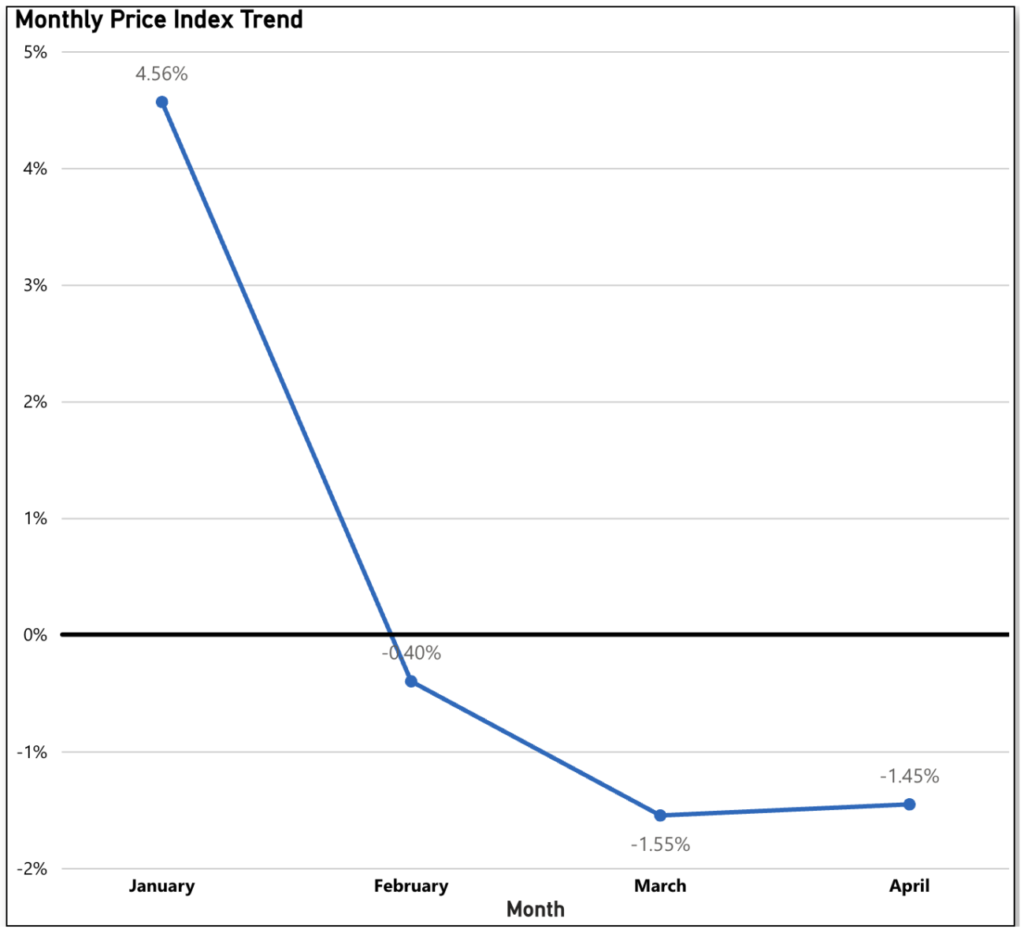

April marks the third straight month of price declines, with average component prices dropping by 1.45%, closely mirroring the 1.55% decline observed in March. Market dynamics, driven by shifting tariffs and ongoing economic fluctuations, continue to shape the landscape. That said, signs of the buyer’s market identified last month remain strong, with increased pricing leverage for procurement teams across several categories.

The biggest drivers in this pricing readout include Communication (down 3.10% month-to-month), Power Discrete (down 3.00% month-to-month) and Processor and Standard Logic (both down 2.90% month-to-month). All but 8 commodities noted price decreases in the month of April.

The commodities pushing upward against this trend include Peripheral (up 1.20% month-to-month), Circuit Protection and Power Supply (both up 1.10% month-to-month) and Diode and Thermal Management (both up 0.70% month-to-month).

April Sees Slight Lead Time Correction After Record-Breaking March

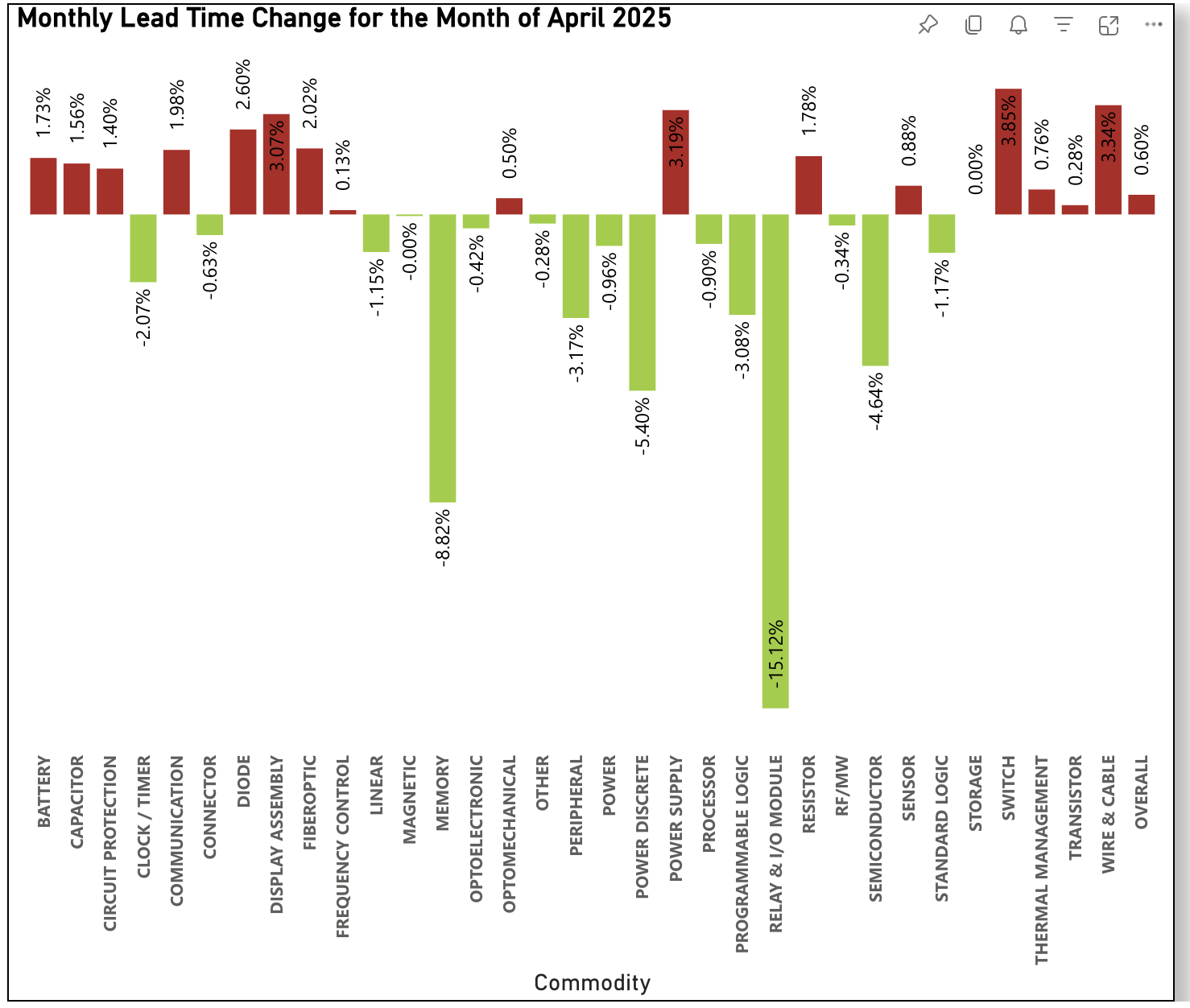

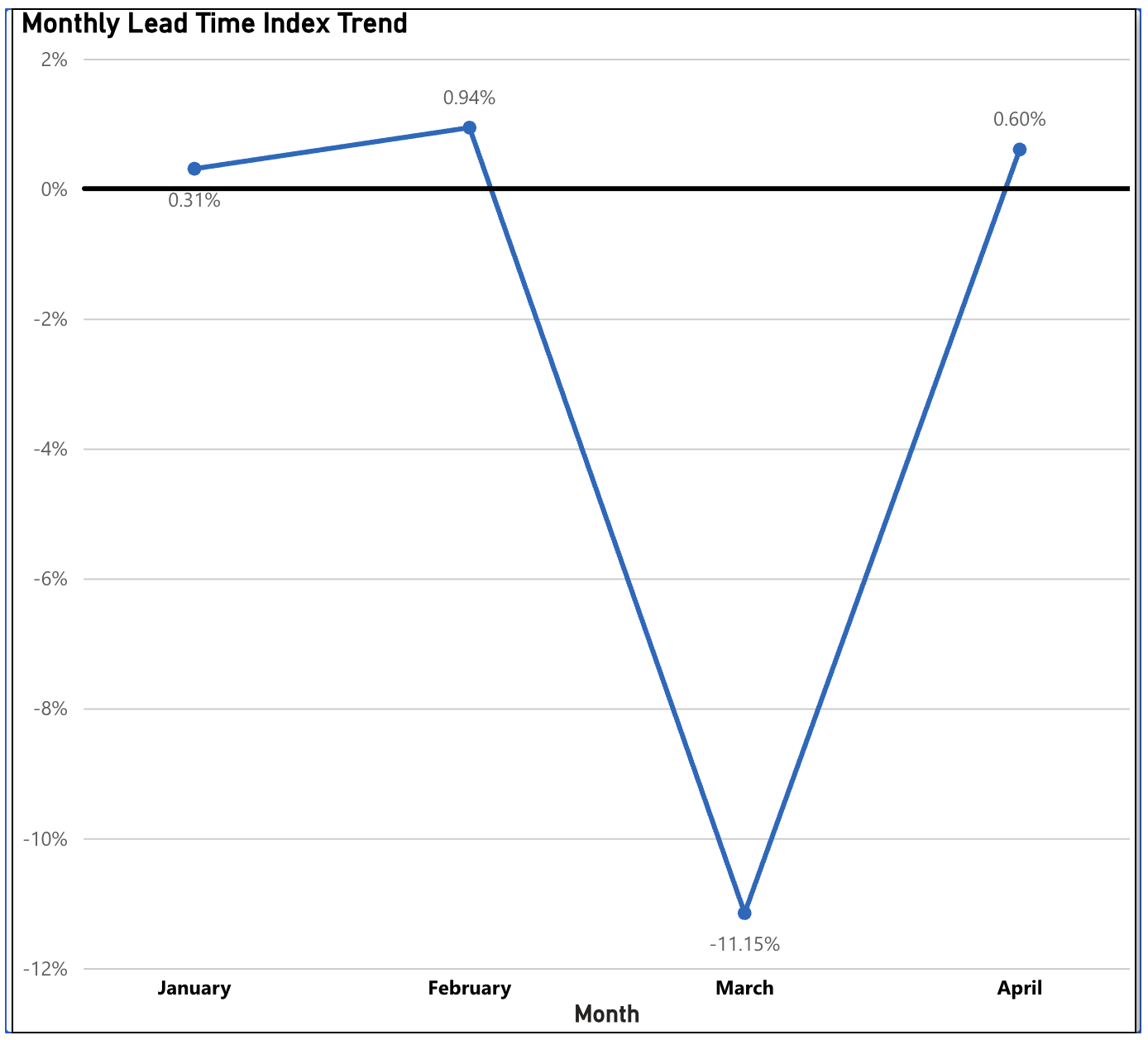

Following March’s record-breaking 11.15% decrease in lead times, April brought a modest correction with a 0.60% increase, bringing averages closer to the levels seen in January and February 2025.

Despite the slight uptick, lead times remain down by an average of 9.5% year-to-date, reinforcing the buyers’ market conditions highlighted in last month’s report.

The main contributors to this month’s lead time increase were Switch (up 3.85% month-to-month), Wire & Cable (up 3.34% month-to-month), Power Supply (up 3.19% month-to-month), and Display Assembly (up 3.07% month-to-month).

The commodities pushing downward against this trend include Relay & I/O Module (down 15.12% month-to-month), Memory (down 8.82% month-to-month), and Power Discrete (down 5.40% month-to-month).

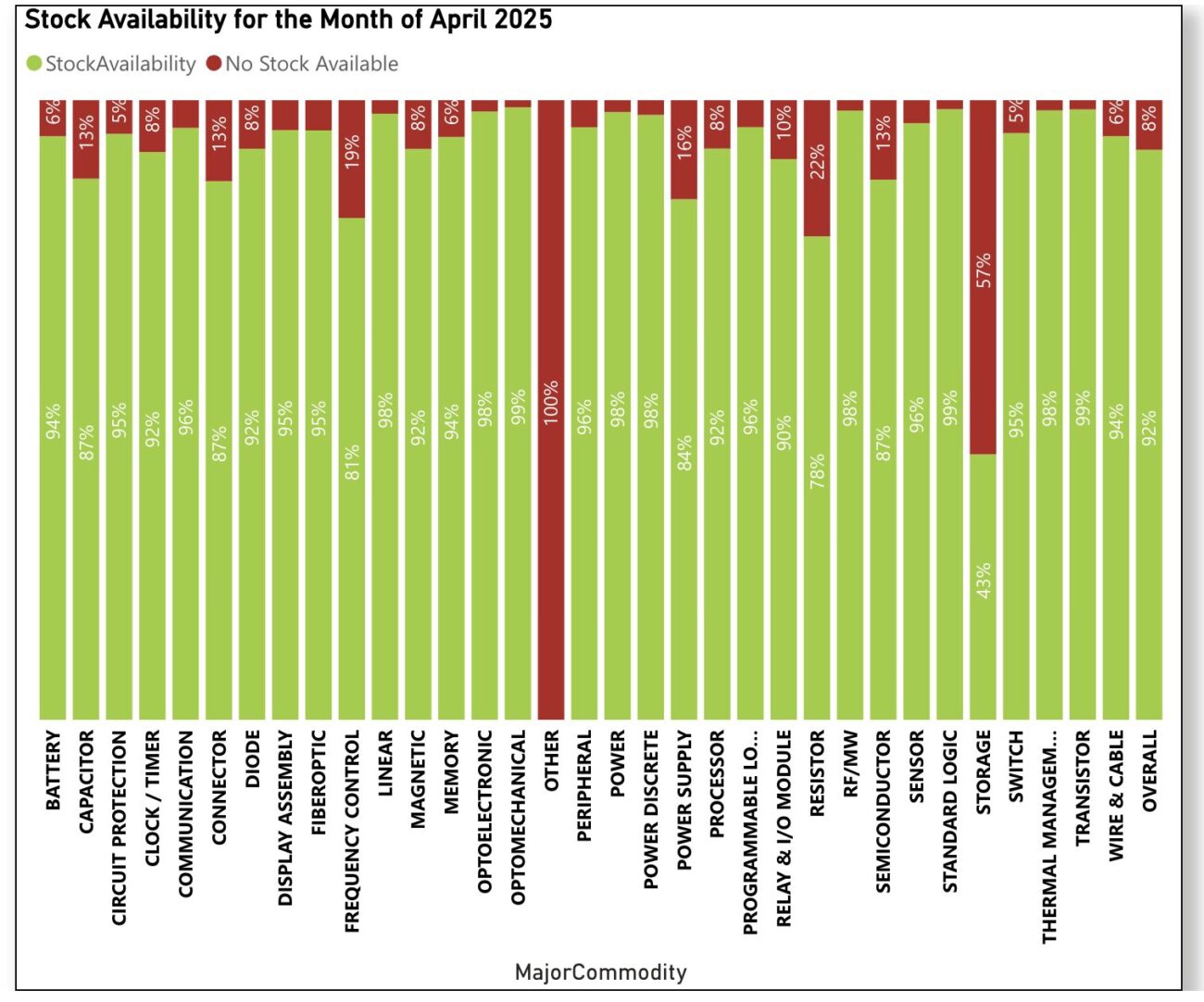

Stock Availability Continues to Climb in April

April marked the second consecutive month of improved stock availability, rising to 92%, up from 91% in March. This brings availability back in line with the 2024 average of 92%, signalling continued stability in supply levels. Those components leading the way from an availability perspective include Optomechanical, Standard Logic, and Transistor (all at 99% available), and Linear, Optoelectronic, Power, RF/MW, and Thermal Management (all at 98% available). Those components pushing downward on this trend include Other (at 0% available), and Storage (at 43% available).

Sign up for our newsletter for more on the electronic components market.