The Electronics Market Continues To Soften

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using actual customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers across industries (including 20% of the Fortune 500) in analyzing over $425 billion in electronic component spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 15,800 electronic components across 22 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

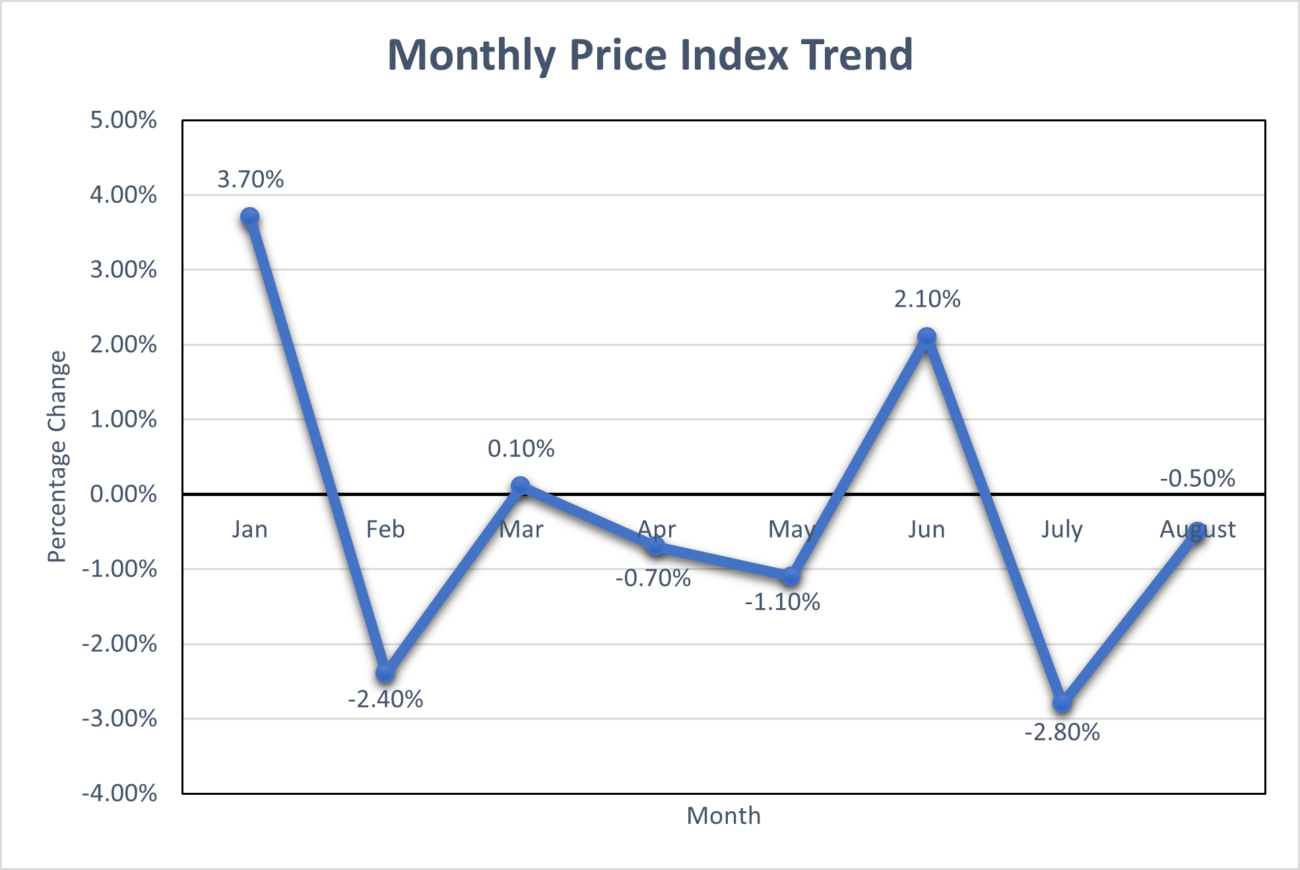

Electronic Component Pricing Fell Again In August

Electronic component pricing fell again in August by 0.5% on average, following a monthly decline in July of 2.8%. There may not be much insight to gain from the August readout given the very fractional move in pricing but the electronics market has seen monthly price declines in 5 of the past 8 months.

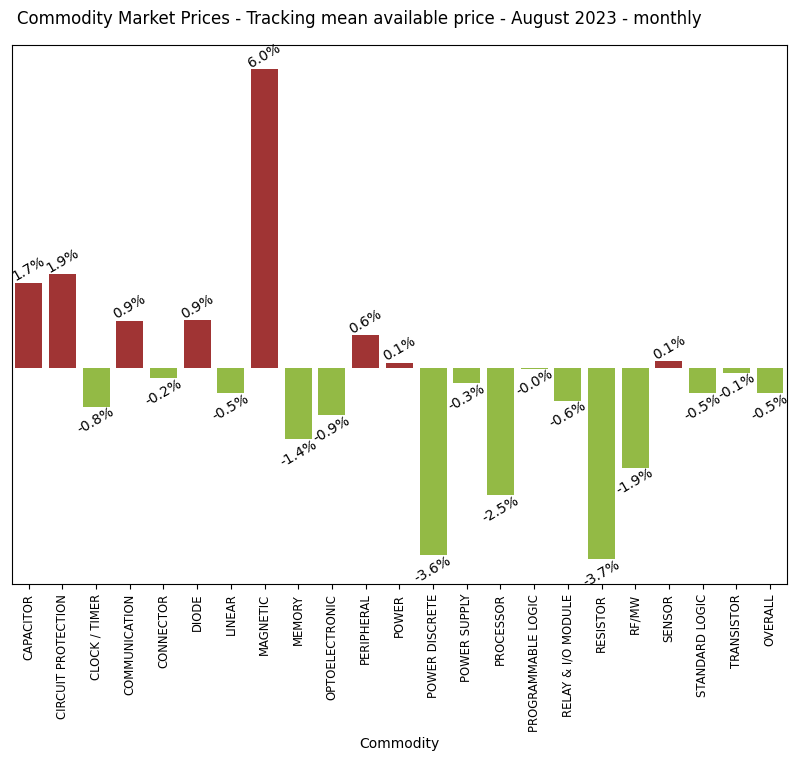

The biggest drivers in this pricing readout are Resistors (down 3.7% Month-to-Month), Power Discrete (down 3.6% Month-to-Month) and Processors (down 2.5% Month-to-Month). It’s worth noting that we have seen a rebound in pricing for Magnetic components (up 6.0% Month-to-Month) and Diodes (up 0.9% Month-to-Month) after big dips in July.

Ultimately, August was another good month for electronics procurement teams to capitalize on falling electronic component pricing.

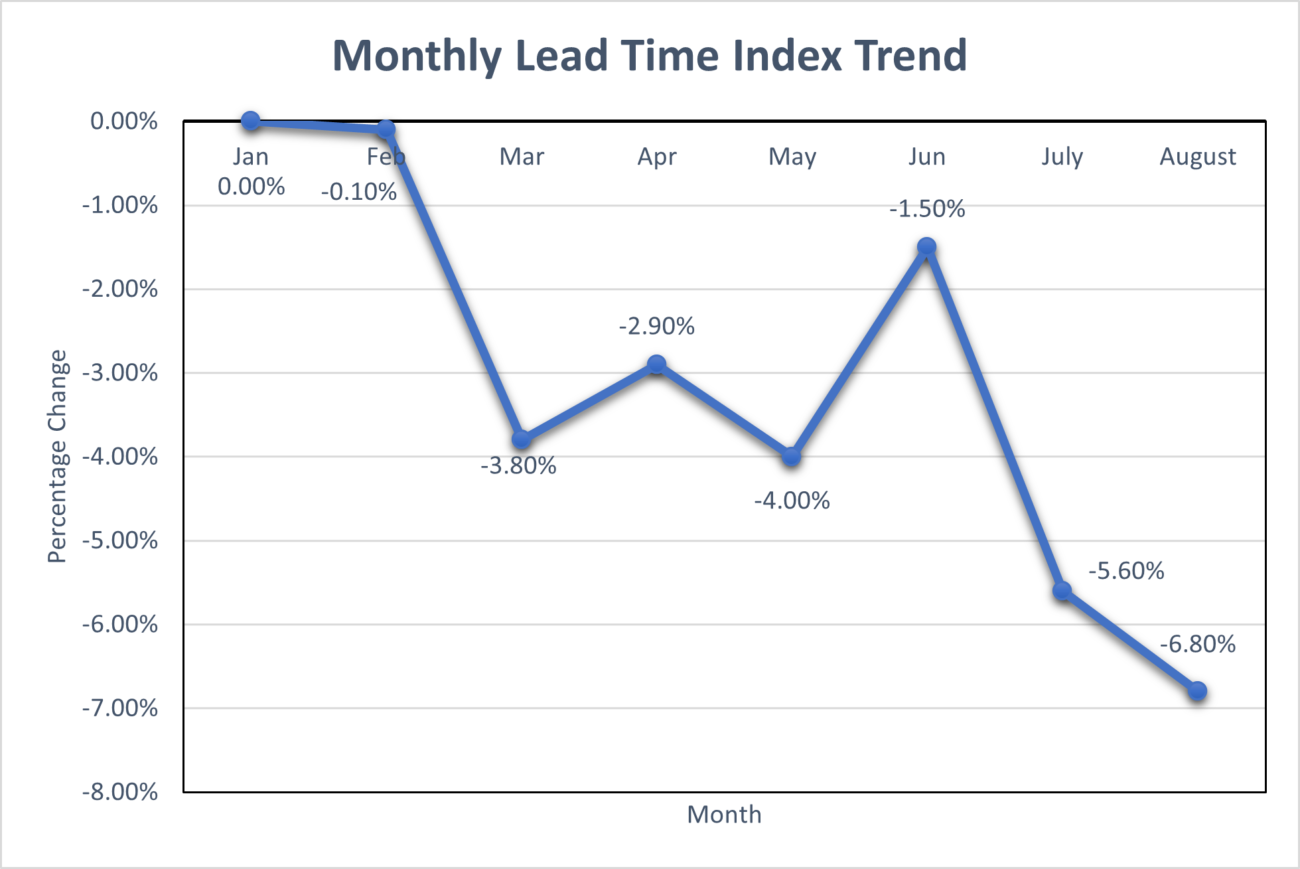

Electronic Component Lead Times Are Dropping At A Faster Rate

In July, we saw average overall lead times for electronic components tracked improve by 5.6%, which was an acceleration from a drop of 1.5% in June. August data indicated that this trend continued with lead times falling by 6.8% Month-to-Month on average. August’s readout continues the trend of lead times improving every month in 2023 thus far.

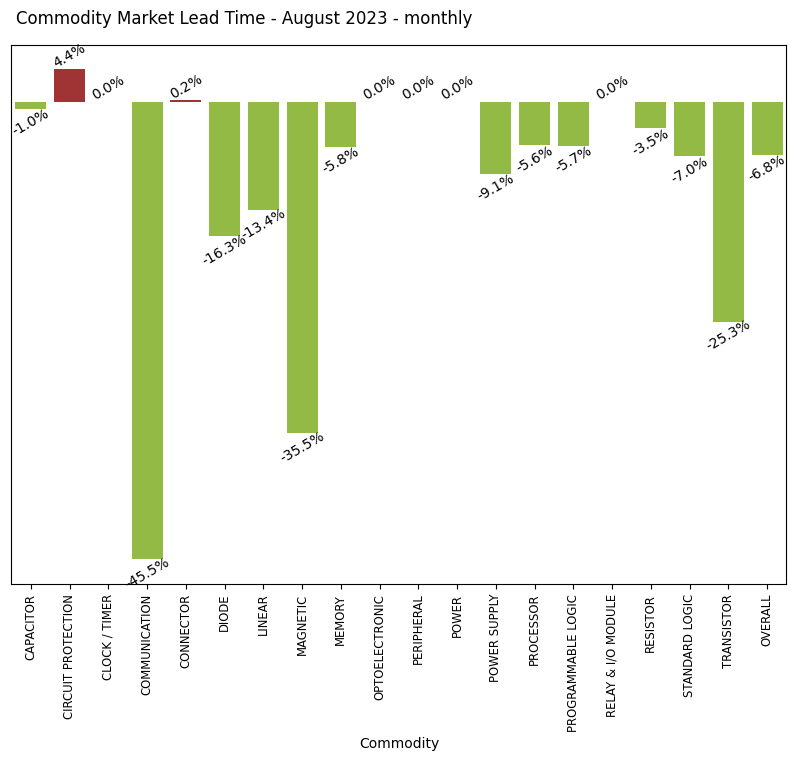

This drop in lead times were driven by Communication components (down 45.5% Month-to-Month), Magnetic components (down 35.5% Month-to-Month) and Transistors (down 25.3% Month-to-Month). Except for Circuit Protection (up 4.4% Month-to-Month) and Connectors (up 0.2% Month-to-Month), there were no other electronic components that saw upwards direction in lead times.

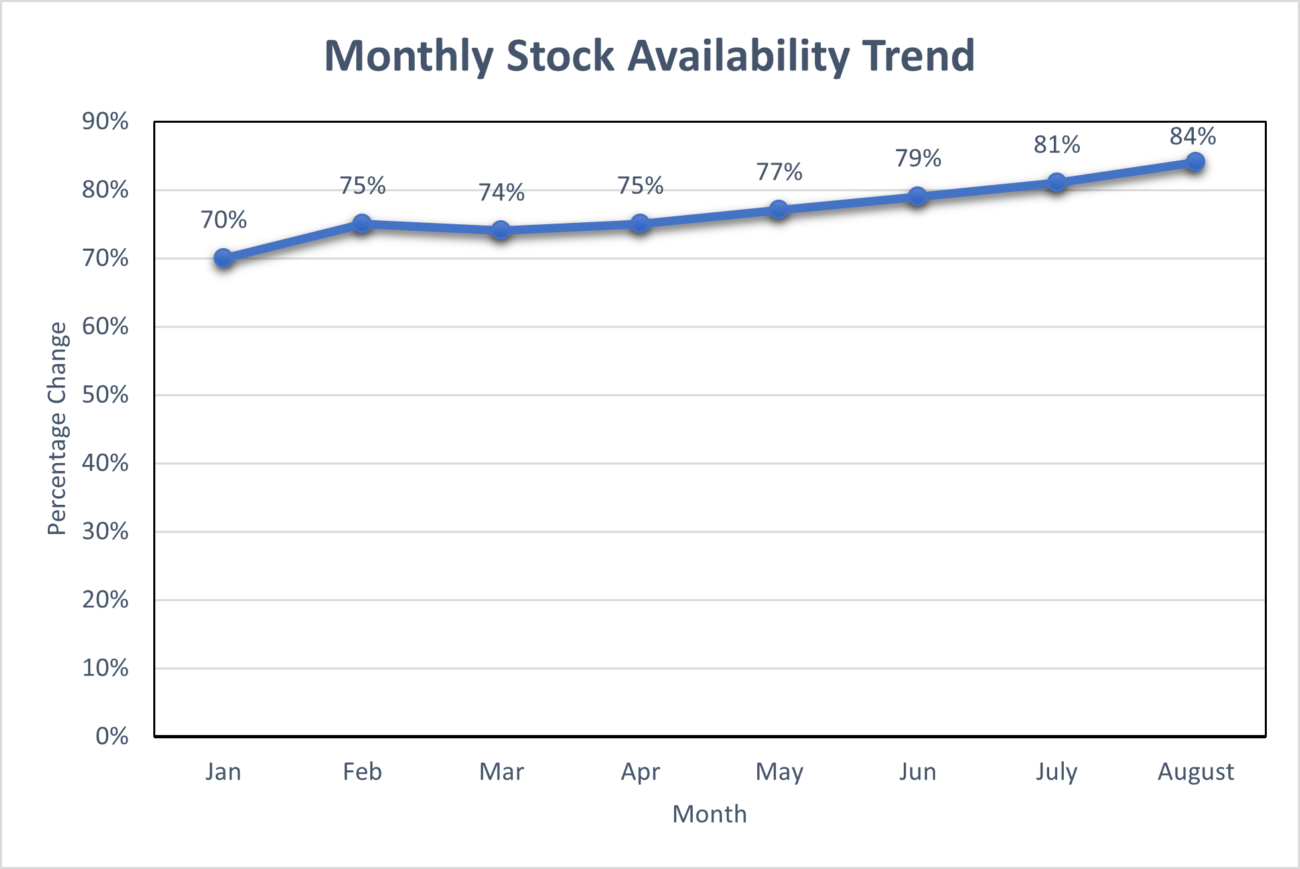

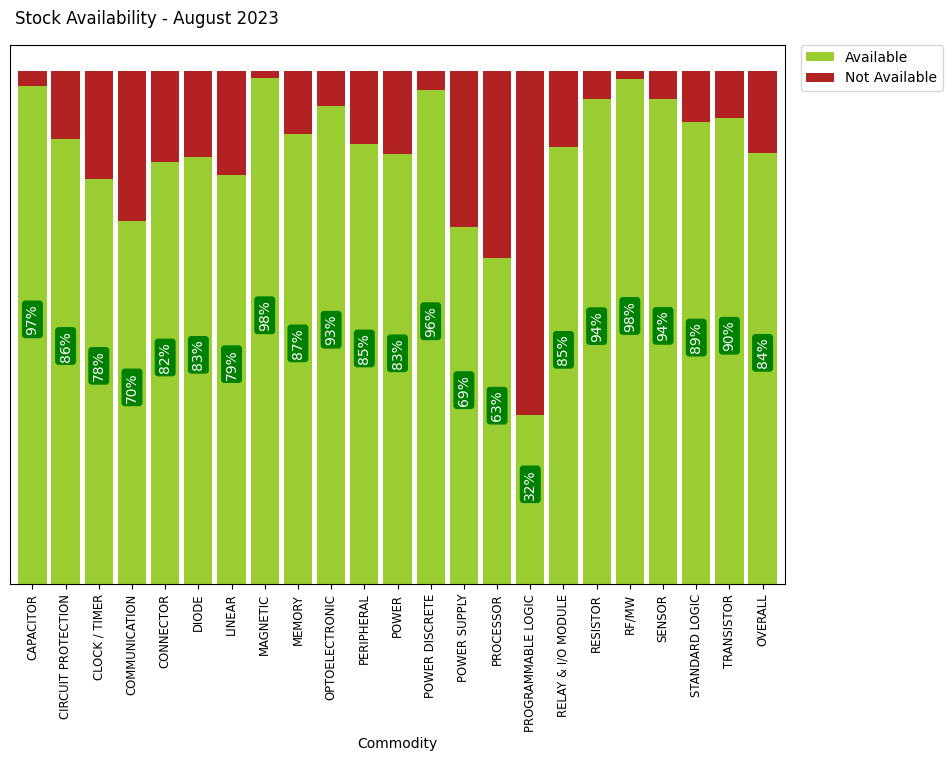

Electronic Component Availability Continues To Climb Higher

Much like July, electronic component availability continued to move upwards in August. Lytica saw another overall improvement of 3% Month-to-Month, with 84% of all tracked electronic components available. Those components leading the way from an availability perspective in August continued to look very similar to those most available in July – and included Magnetic components (98% Available), RF / MW (98% Available), and Capacitors (97% Available)

.

.

Sign up for our newsletter to get access to our next update for September 2023 – where we’ll see if August’s improved market conditions continue.