Electronics Market: Summer Ends with Great Outlook for Component Prices, Lead Times, and Availability

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $470 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 15,800 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

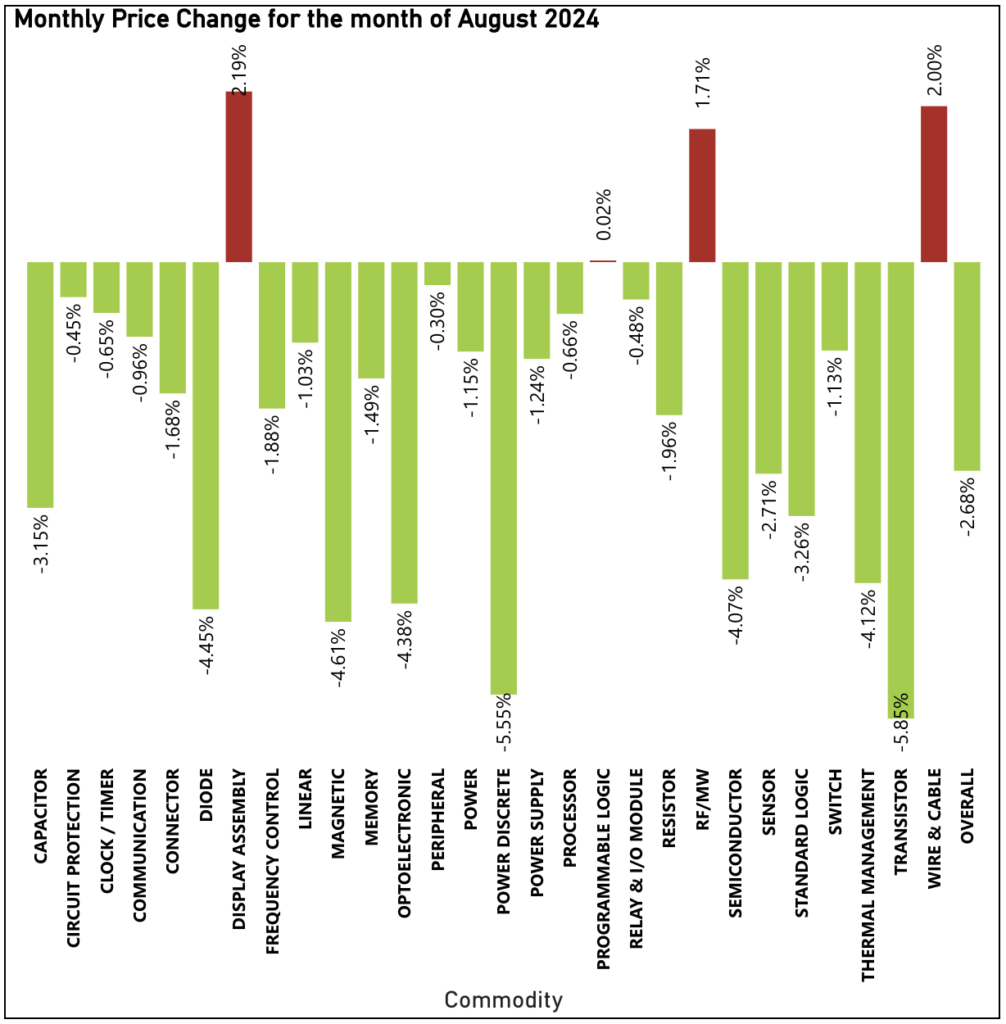

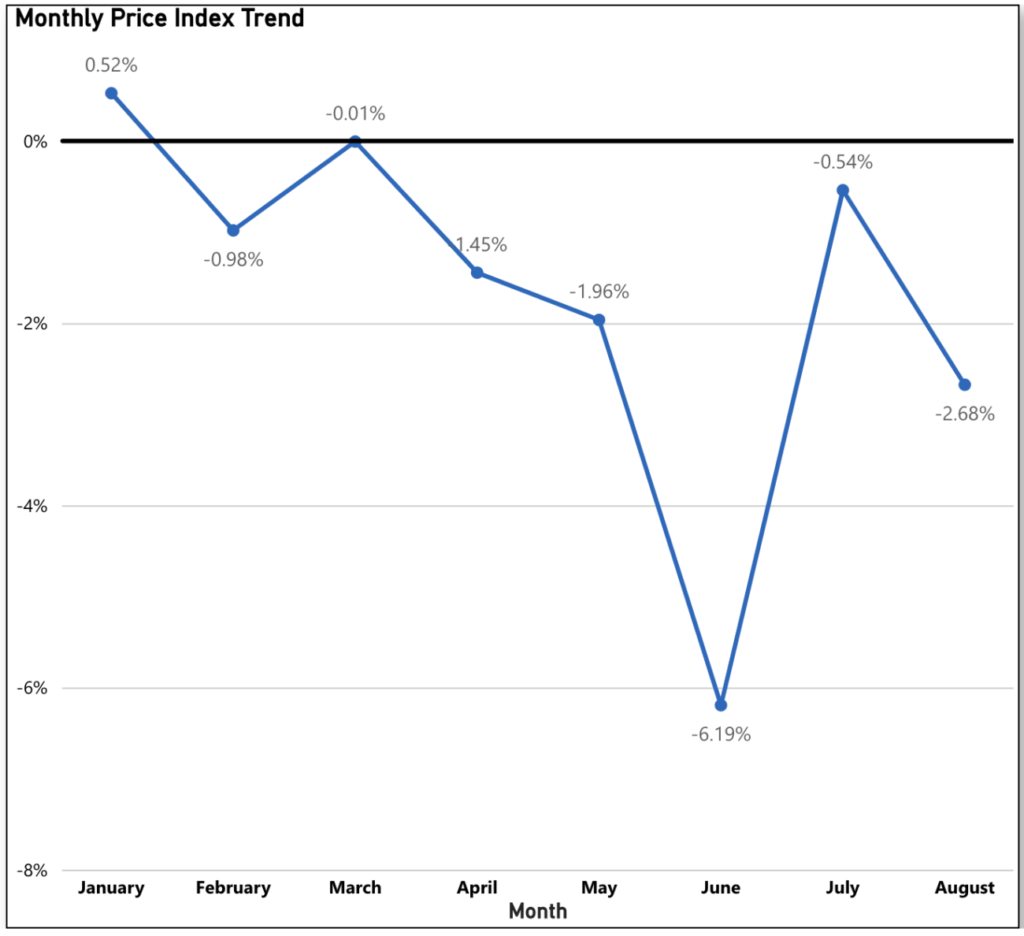

August Sees Second Largest Drop in Electronic Component Prices for 2024

August marks the seventh consecutive month of price declines in 2024, with a notable 2.68% decrease—the second largest drop this year. This trend continues to favour buyers, reinforcing the ongoing narrative of sustained price reductions and a buyer-friendly market throughout 2024.

The biggest drivers in this pricing readout include Transistor (down 5.85% Month-to-Month), Power Discrete (down 5.55% Month-to-Month), and Magnetic (down 4.61% Month-to-Month).

The commodities pushing upward against this trend include Display Assembly (up 2.19% Month-to-Month), Wire and Cable (up 2.00% Month-to-Month), and RF/MW (up 1.71% Month-to-Month).

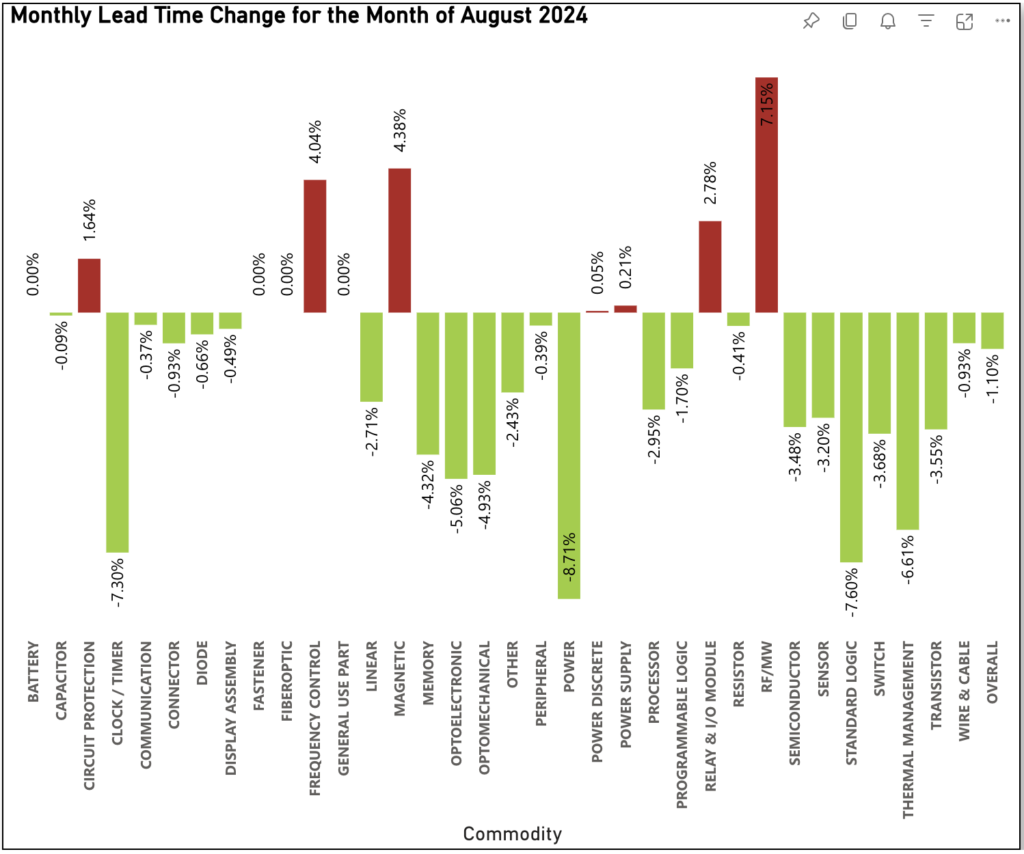

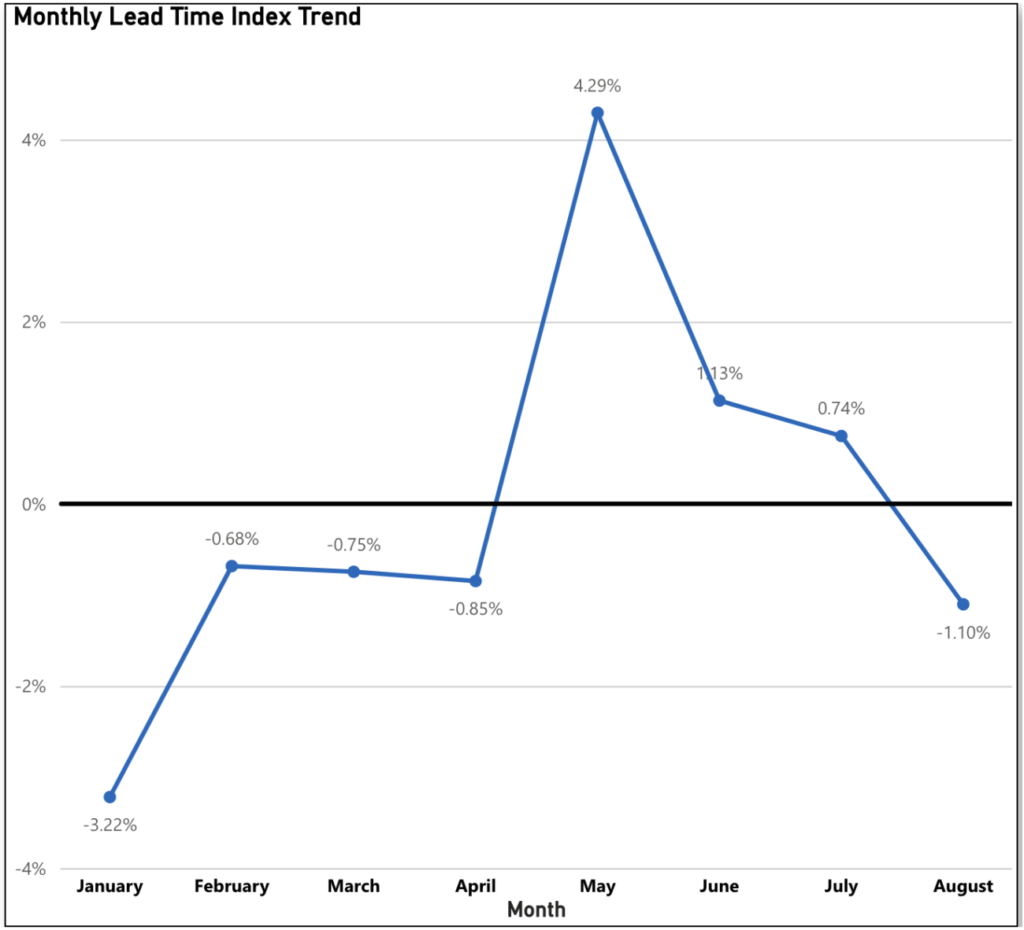

Lead Times Decrease for First Time Since April

In August, lead times showed improvement, decreasing by 1.10%, the first reduction since April’s 0.85% drop three months ago.

By July, year-to-date lead times had risen by 0.51%. However, with August’s update, the year-to-date figure has now fallen to –0.59%. This stabilization will be viewed positively by many buyers, signaling that lead times may no longer be on an upward trajectory.

The biggest drivers in this decrease were Power (down 8.71% Month-to-Month), Standard Logic (down 7.60% Month-to-Month), Clock/Timer (down 7.30% Month-to-Month), and Thermal Management (down 6.61% Month-to-Month).

Those commodities pushing back on August’s trend included RF/MW (up 7.15% Month-to-Month), Magnetic (up 4.38% Month-to-Month), Frequency Control (up 4.04% Month-to-Month) and Relay & I/O Module (up 2.78% Month-to-Month), among others

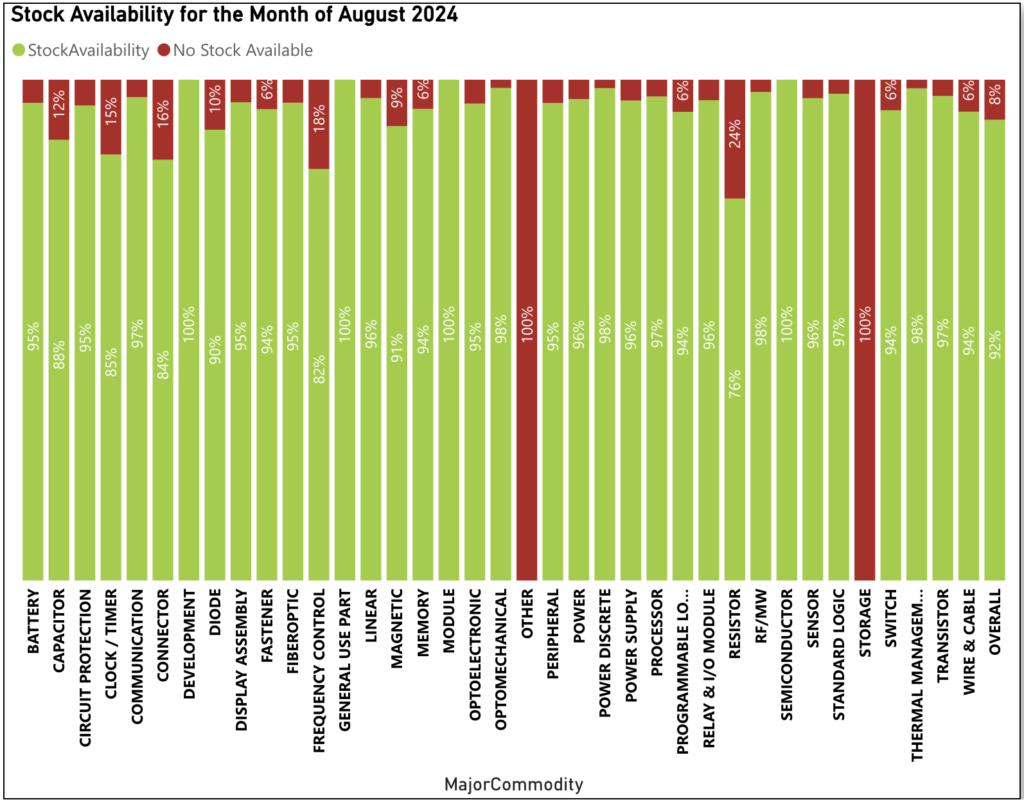

Electronic Component Availability at Highest Level All Year

With electronic component availability reaching 92% in August, this marks the highest level recorded all year, surpassing July’s previous high of 91%. This is encouraging news for buyers, as the overall trend remains positive, with availability consistently staying above the 87% threshold throughout 2024.

Those components leading the way from an availability perspective in August included Development, General Use Parts, Module and Semiconductor (all at 100% available with no change from July), and Optomechanical, Power Discrete, RF/MW, and Thermal Management (all at 98% available) among others.

Sign up for our newsletter for more on the electronic components market.