Electronics Market: 2024 Ends with Welcome News Across Pricing, Lead Times, and Availability

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $470 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

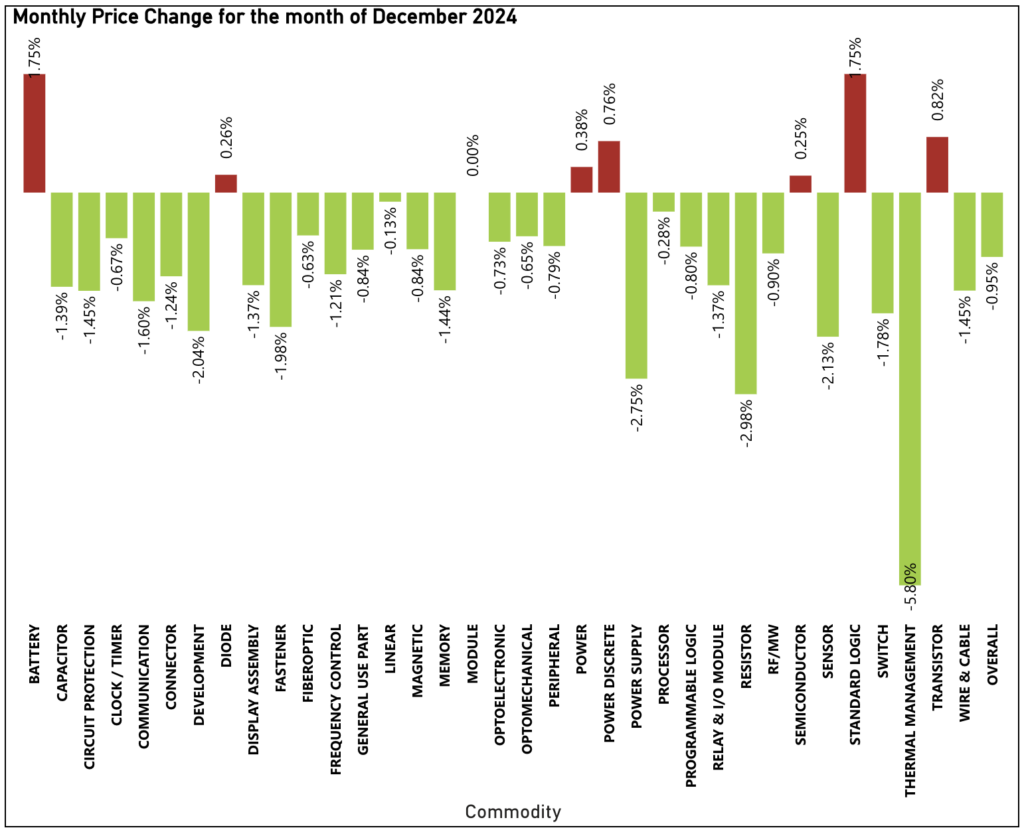

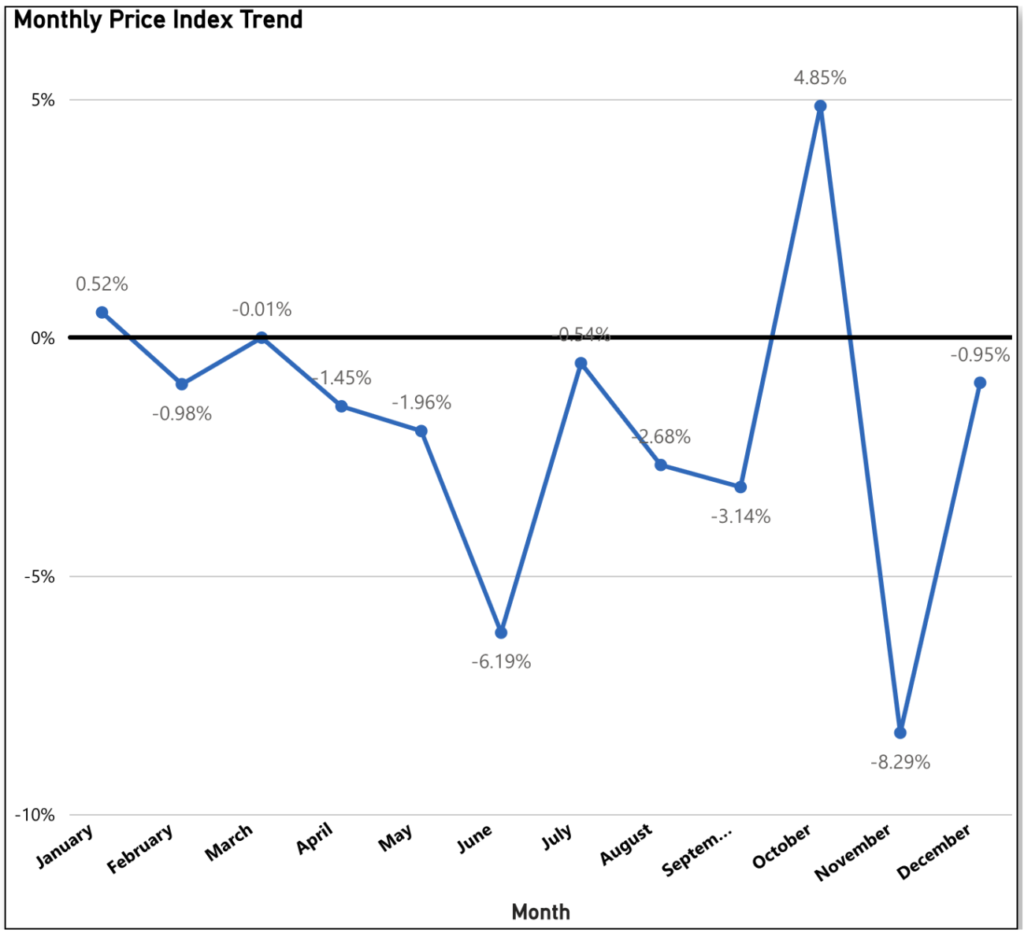

Prices End the Year Strong with Another Decrease in December

Building on November’s record-breaking price drop, December saw an additional 0.95% decline in electronics component prices. Year-to-date, prices have fallen by an impressive 19.62% compared to 2023, offering welcome news for buyers as we head into 2025. Of the 35 commodities tracked in December, all but eight experienced price decreases. Notably, Battery prices and Standard Logic, standing out as the largest increases countering this downward trend.

The biggest drivers in this pricing readout include Thermal Management (down 5.80% month-to-month), Resistor (down 2.98% month-to-month), Power Supply (down 2.75% month-to-month), Sensor (down 2.13% month-to-month), and Development (down 2.04% month-to-month).

The commodities pushing upward against this trend include Battery (up 1.75% month-to-month), Standard Logic (up 1.75% month-to-month), and Transistor (up 0.82% month-to-month).

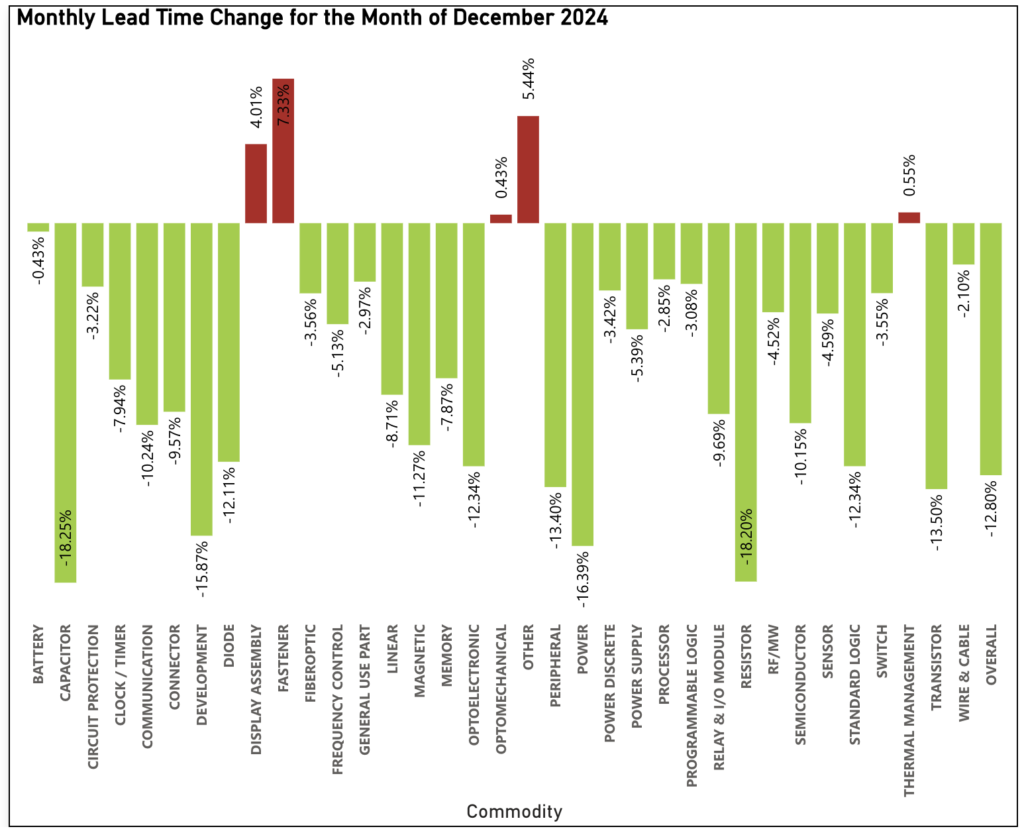

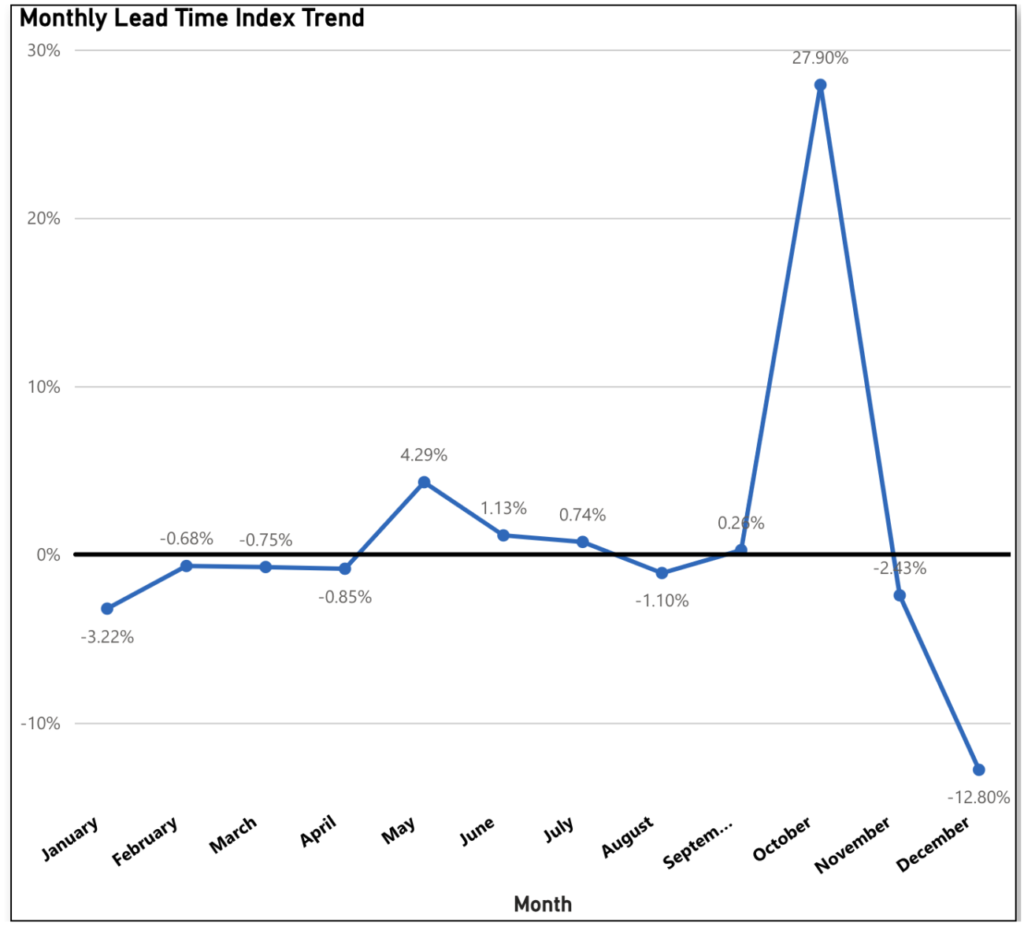

December Marks Significant Improvement in 2024 Lead Times

December delivered the most encouraging update of the year on lead times, achieving a record-breaking decrease of 12.80%. While year-to-date lead times remain elevated, December’s progress reduced the November YTD increase of 24.38% to just 8.46% by year’s end. October’s sharp spike in lead times, a major outlier for the year, had driven overall averages higher. However, December’s improvement offers hope that lead times in 2025 will fall below 2024 levels, signaling a positive trend for the year ahead.

The main contributors to this month’s decrease were Capacitor, (down 18.25% month-to-month), Resistor (down 18.20% month-to-month), Power (down 16.39% month-to-month) and Communication, Development, Diode, Magnetic, Optoelectronic, Peripheral, Semiconductor, Standard Logic, and Transistor each seeing decreases of at least 10% month-to-month in December.

The commodities pushing upward against this trend include Fastner (up 7.33% month-to-month), Other (up 5.44% month-to-month), and Display Assembly (up 4.01% month-to-month).

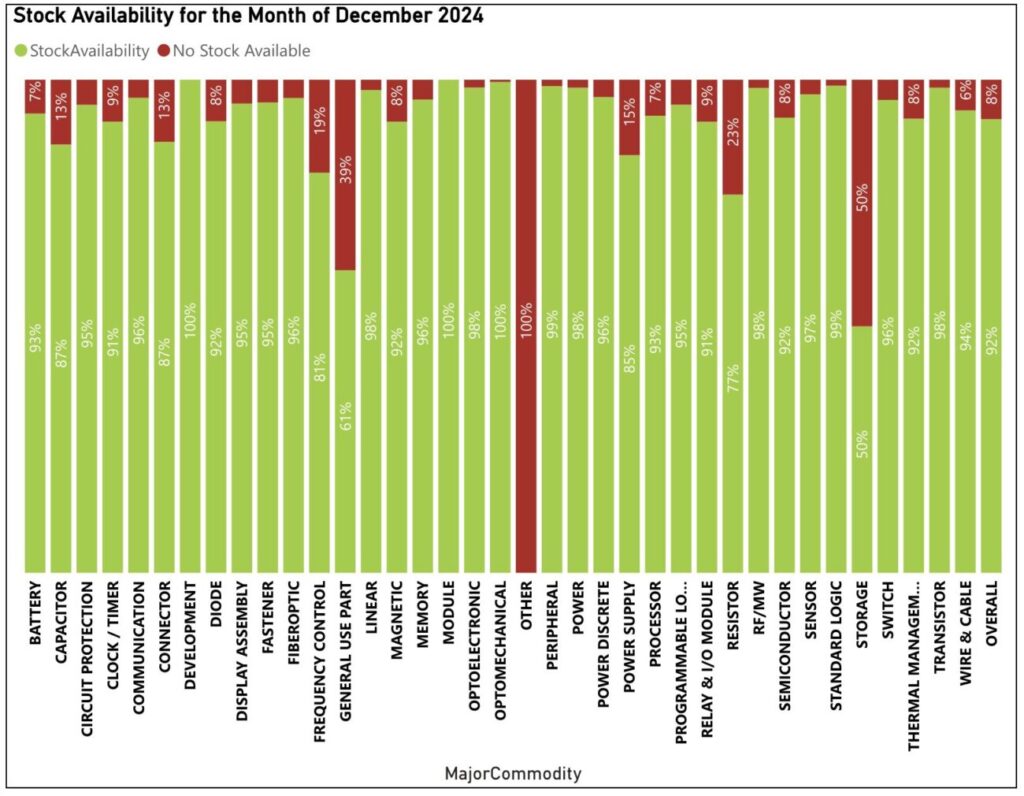

December Closes the Year with Peak Stock Availability

A standout highlight in December’s report is stock availability, which held steady at 92%—the highest level recorded in 2024. This marks a continuation of the positive trend, offering encouraging stability for the market. Those components leading the way from an availability perspective in December included Development, Module, and Optomechanical (all still at 100% available), and Peripheral and Standard Logic (both at 99% available). Those components pushing down on that trend included Other (with no parts available), Storage (at 50% available), and General Use Parts (at 61% available).

Sign up for our newsletter for more on the electronic components market.