State of the Electronic Components Market: December 2025

AI Demand and Input Costs Drive Selective Price Increases

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $550 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket comprises 165,000 electronic components across more than 30 categories, including the most popular devices used by our customers. These indices are intended to show market trends. Individual component and BOM analysis is offered by Lytica as a service to our customers.

December 2025 closed the year with continued month-over-month pricing momentum across select electronic component categories. Market conditions reflected targeted, demand- and cost-driven price increases rather than broad-based shortages. Month-over-month increases were concentrated in memory, battery-related components, and certain semiconductor categories, while most other segments remained stable with healthy availability.

A Year-End Shift Takes Hold Across Key Component Categories

December 2025 closed the year with continued month-over-month pricing momentum across select electronic component categories. Market conditions reflected targeted, demand- and cost-driven price increases rather than broad-based shortages. Month-over-month increases were concentrated in memory, battery-related components, and certain semiconductor categories, while most other segments remained stable with healthy availability.

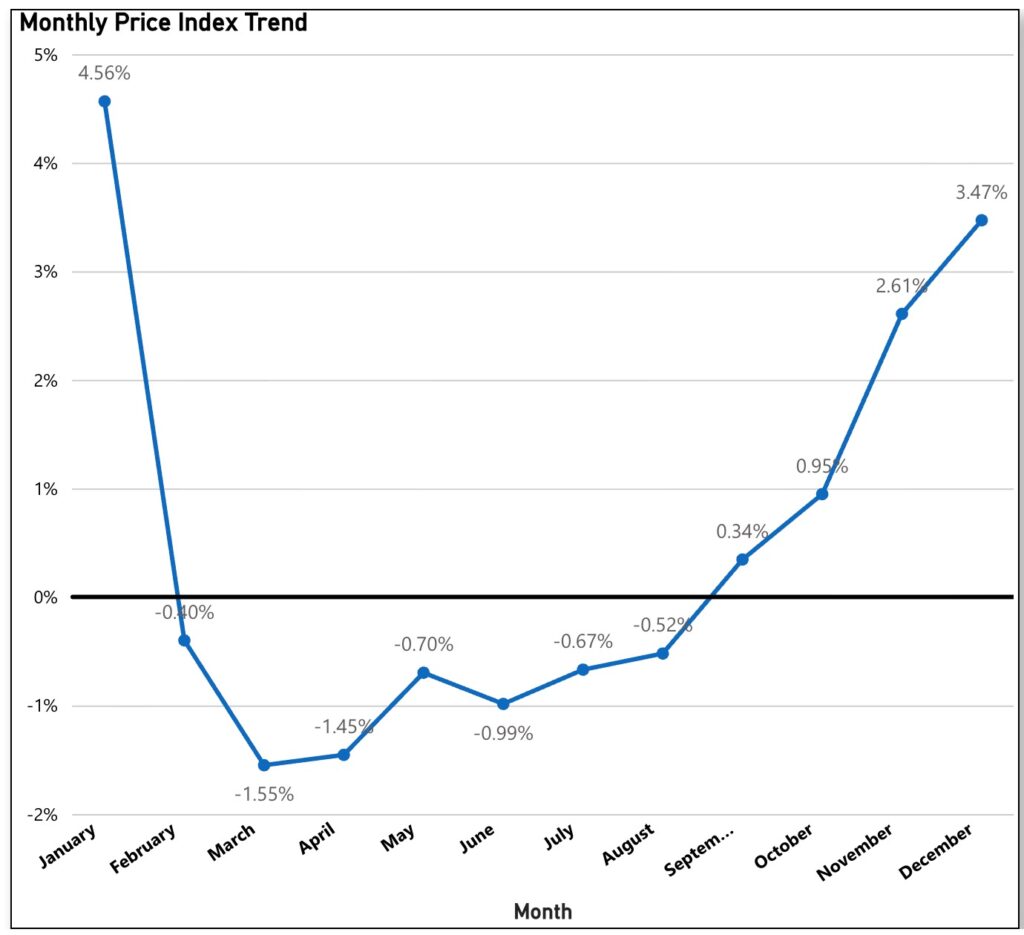

The monthly price index increased 3.47% month-over-month in December, extending the upward trajectory observed throughout the fourth quarter. Earlier softness gave way to a directional shift in recent months, with sustained increases leading into December. While price increases became more pronounced in specific categories, the broader market remained balanced, with movement driven by structural demand and upstream cost pressures rather than widespread supply disruption.

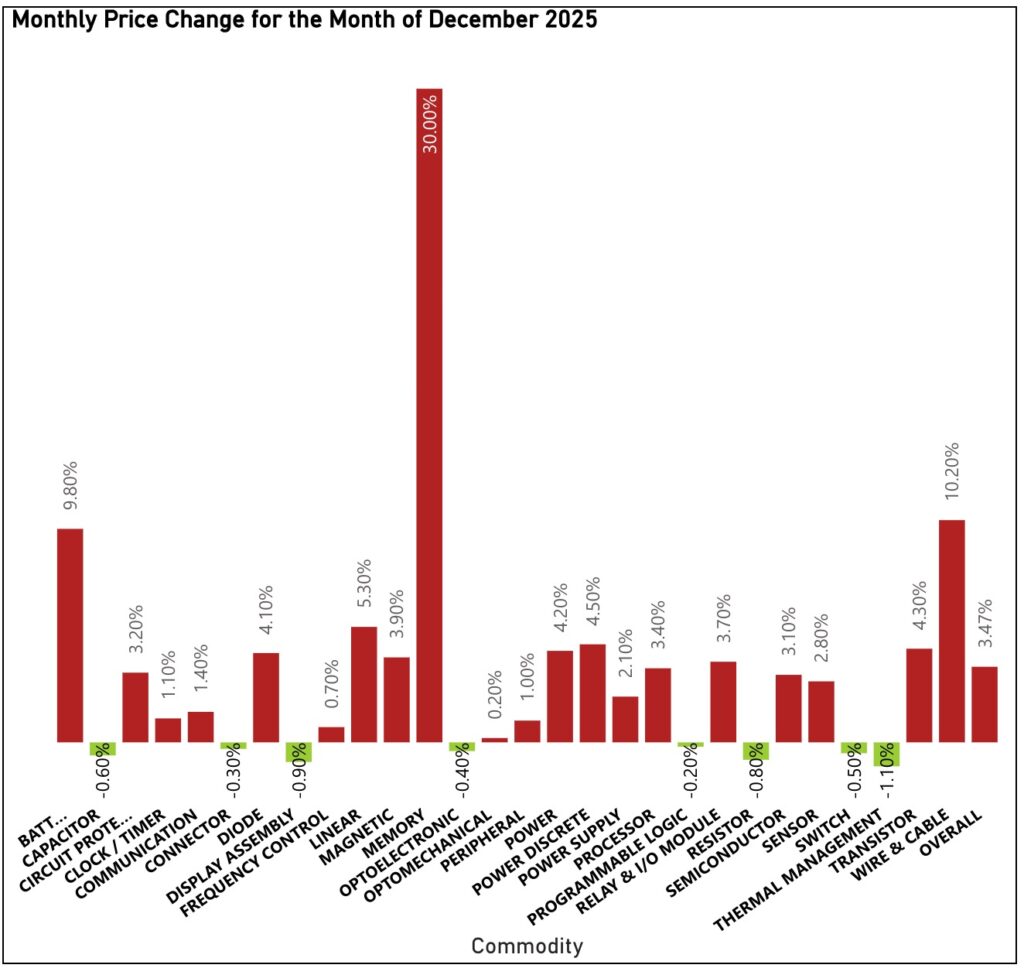

Pricing Trends by Component Category

Price increases became more pronounced across several major categories in December, led by memory, which had the greatest month-over-month increase at 30.0%. This sharp rise reflects the continuing demand for AI and data-center projects, which tightened the availability of DRAM (Dynamic Random Access Memory) and NAND (long-term storage memory) products as suppliers continued to prioritize enterprise supply commitments.

Battery pricing increased 9.8% month-over-month, while wire and cable components rose 10.2% month-over-month, reflecting sustained increases in key raw materials such as lithium and copper. Broader semiconductor-related categories posted moderate month-over-month gains, with standard semiconductors increasing 3.1% and power supply components rising 2.1%, driven by higher manufacturing costs and steady demand from automotive, industrial, and infrastructure markets.

Discrete components remained under upward pressure, with diodes increasing 4.1% month-over-month and transistors rising 4.3% month-over-month, reflecting tighter supply conditions in select product families. Display-related components showed more modest movement, with pricing increasing approximately 1–2% month-over-month, as flat panel and assembly pricing helped offset cost pressures elsewhere.

Lead Time Pressures Remain Elevated

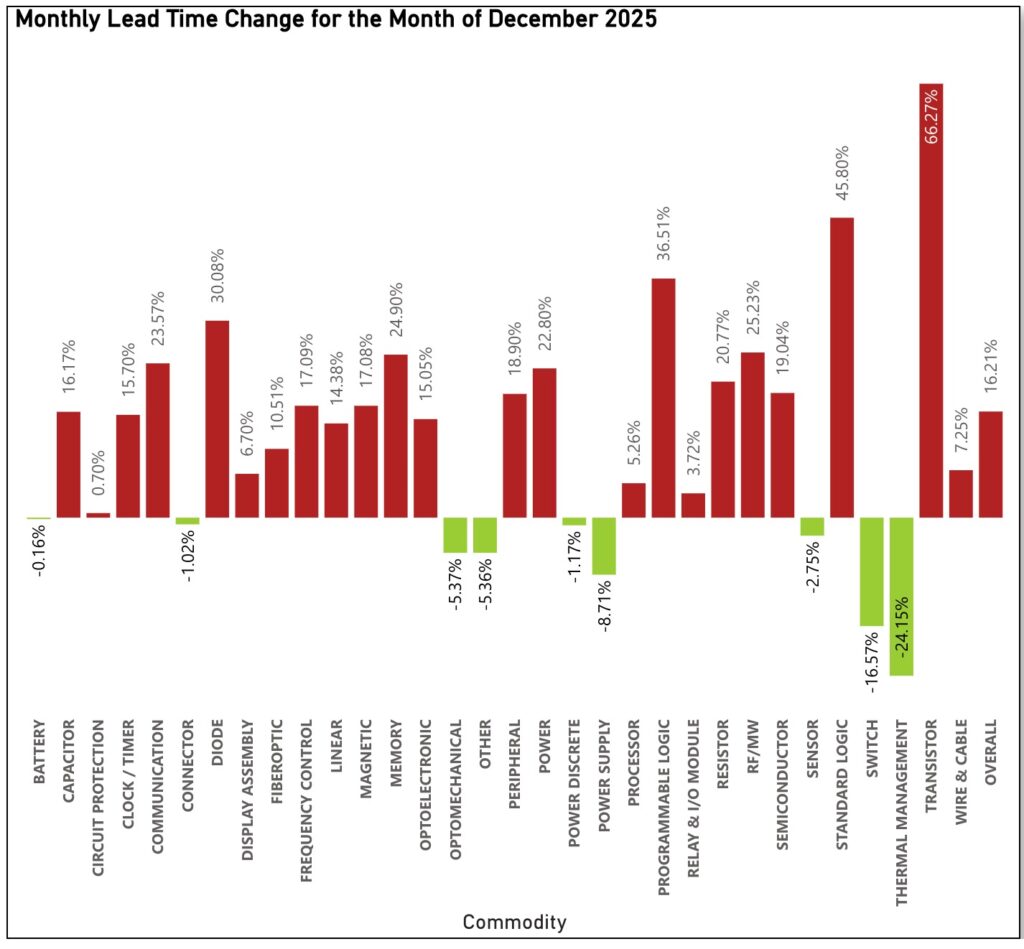

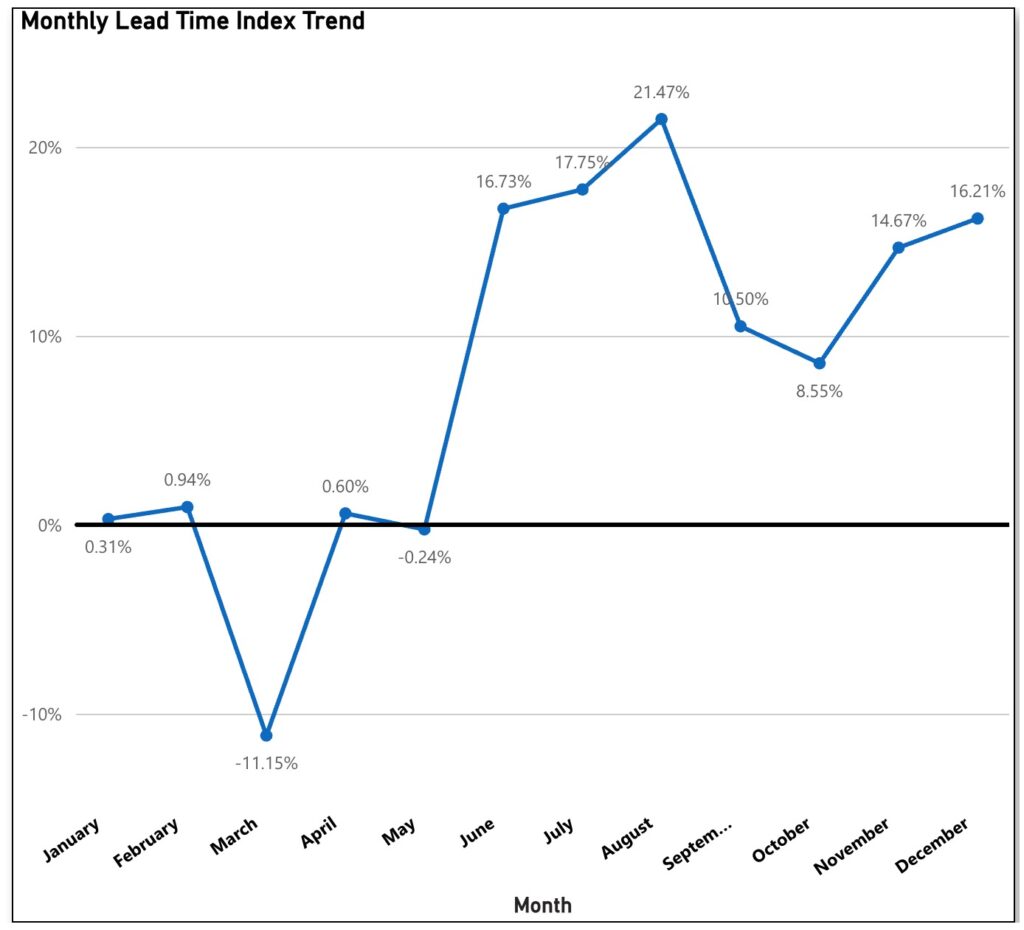

Lead times continued to increase in December, with the Monthly Lead Time Index rising 16.21% month-over-month. Lead time extensions were most pronounced in categories tied to AI infrastructure, Radio Frequency and semiconductor supply chains, while other segments experienced more modest changes. Although lead times remain elevated relative to historical norms, the rate of escalation is slower than what was seen during the mid-year (May to August) peaks of certain components.

Availability Holds Steady Across Most Categories

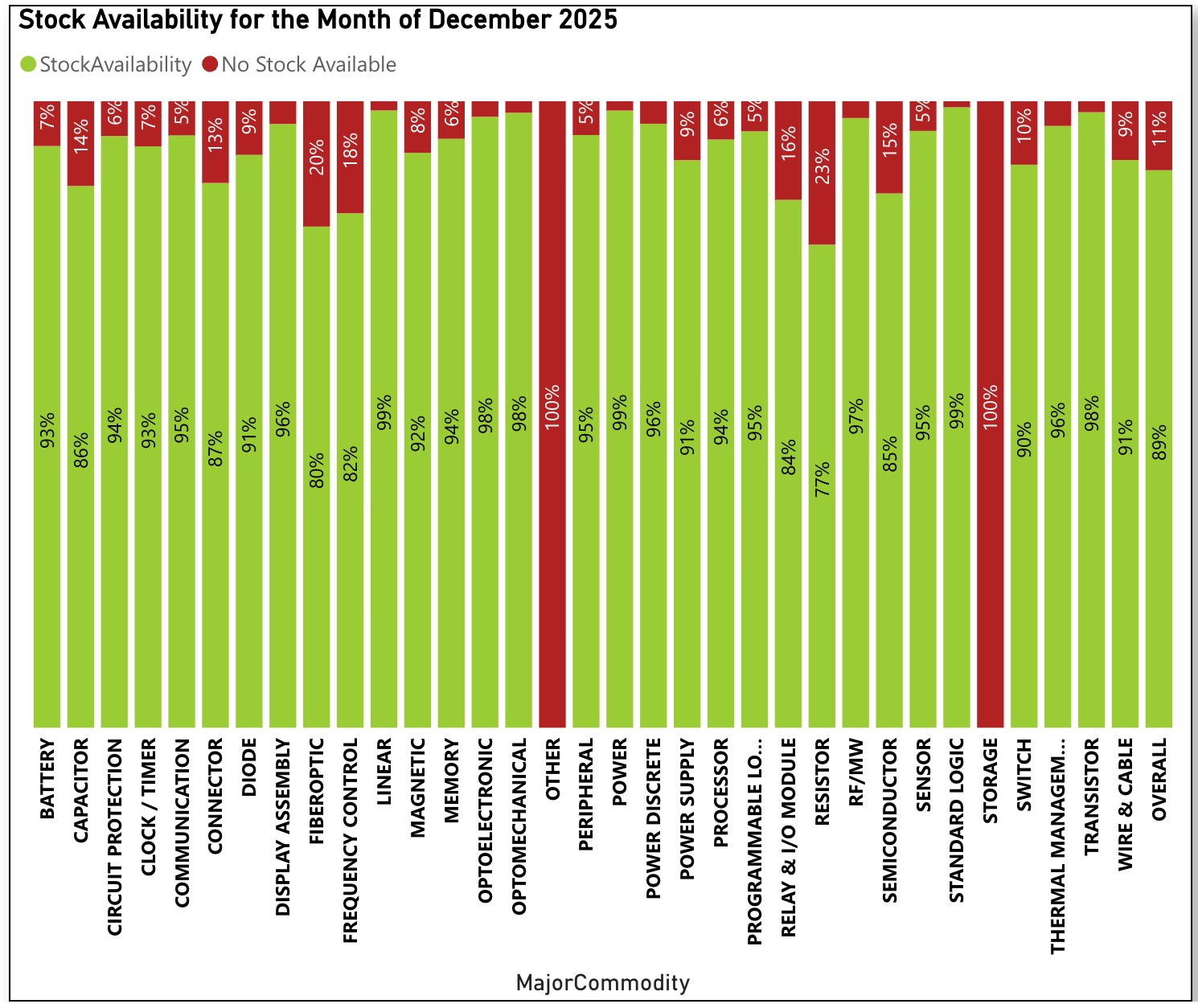

Stock availability remained strong and broadly stable across the market in December, with most component categories maintaining availability levels above 90%. Several categories that recorded price increases — including standard semiconductors (99%), power supply components (99%), connectors (99%), and memory (94%) — continued to exhibit high availability, indicating that the price increases were not driven by constrained supply.

Even discrete components such as diodes and transistors, both at approximately 97% availability, showed ample stock coverage despite month-over-month price increases. While a small number of categories, such as resistors (77%) and programmable logic (88%), displayed comparatively lower availability, these remained isolated cases rather than signals of broad disruption. Overall, December availability trends reinforce that price changes reflected selective demand and upstream cost dynamics, rather than widespread shortages across the electronic components market.

Market Outlook

Entering 2026, pricing conditions are expected to remain selectively pressured, particularly in memory and categories closely tied to AI infrastructure and raw-material-intensive components. While broad availability remains strong, buyers should continue monitoring targeted volatility across key inputs and maintain benchmarking practices grounded in real purchasing data. December’s trends reinforce the value of continuous market intelligence as organizations navigate an increasingly complex electronics supply landscape.

Sign up for our newsletter for more on the electronic components market.