Electronics Market: Threat of Tariffs, Increased Pricing and Lead Times to Start 2025

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $470 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

Special Note: Tariffs in 2025

In this edition of the State of the Electronics Component Market, we cannot overlook the potential impact of tariffs in 2025. Rather than attempt to predict or dwell on the uncertainty they may introduce into your procurement processes, we’ve developed a blog to help you navigate this evolving challenge.

The New Reality of Tariffs: Navigating Uncertainty in Electronics Procurement offers valuable insights and strategic considerations for managing both short- and long-term tariffs. As the world grapples with this issue, this blog will help shed some light on the complexities and provide actionable strategies to better manage this new challenge.

2025 Starts Off with Second Largest Price Increase in 13 Months

After a favorable pricing environment for buyers in 2024, 2025 begins with a notable price increase of 4.56%, marking one of the largest increases in the past 13 months, surpassed only by October 2024’s 4.85% jump. Of the 31 commodities tracked in January, 24 experienced price hikes. Combined with the looming threat of tariffs, this will likely be unwelcome news for electronic component procurement teams around the globe.

The biggest drivers in this pricing readout include Resistor (up 8.17% month-to-month), Capacitor (up 5.55% month-to-month) Standard Logic (up 5.37% month-to-month), Transistor (up 5.35% month-to-month) and Diode (up 5.21% month-to-month).

The commodities pushing downward against this trend include Power Discrete (down 3.80% month-to-month), Battery (down 3.18% month-to-month), and Wire & Cable (down 2.48% month-to-month).

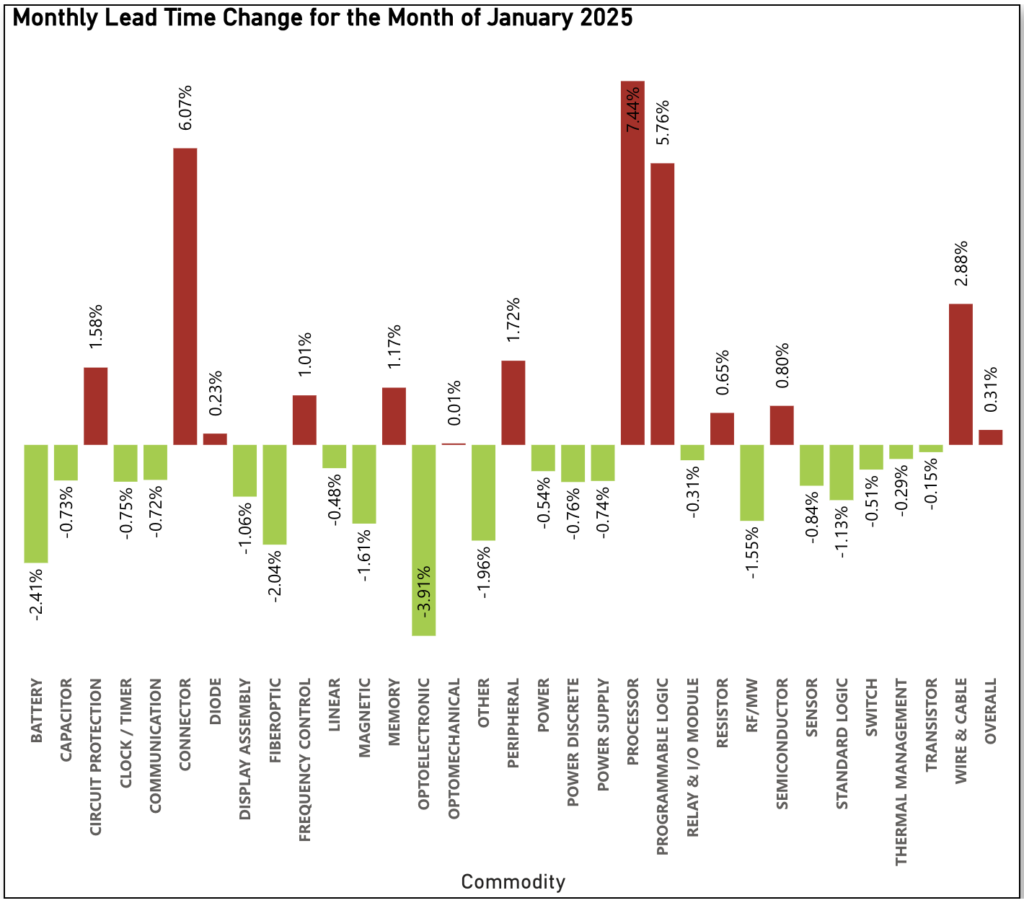

Lead Times Continue to Rise with Modest Increase in January

Following a challenging year of rising lead times in 2024, the trend continues into 2025, with January seeing a modest increase of 0.31%. This uptick appears to be primarily driven by three significant outliers: Processors, Programmable Logic, and Connectors. However, this may offer a glimmer of hope, suggesting that lead times could remain relatively stable or even decrease in 2025.

The main contributors to this month’s increase were Processor (up 7.44% month-to-month), Connector (up 6.07% month-to-month) and Programmable Logic (up 5.76% month-to-month).

The commodities pushing downward against this trend include Optoelectronic (down 3.91% month-to-month), Battery (down 2.41% month-to-month), and Fiberoptic (down 2.04% month-to-month).

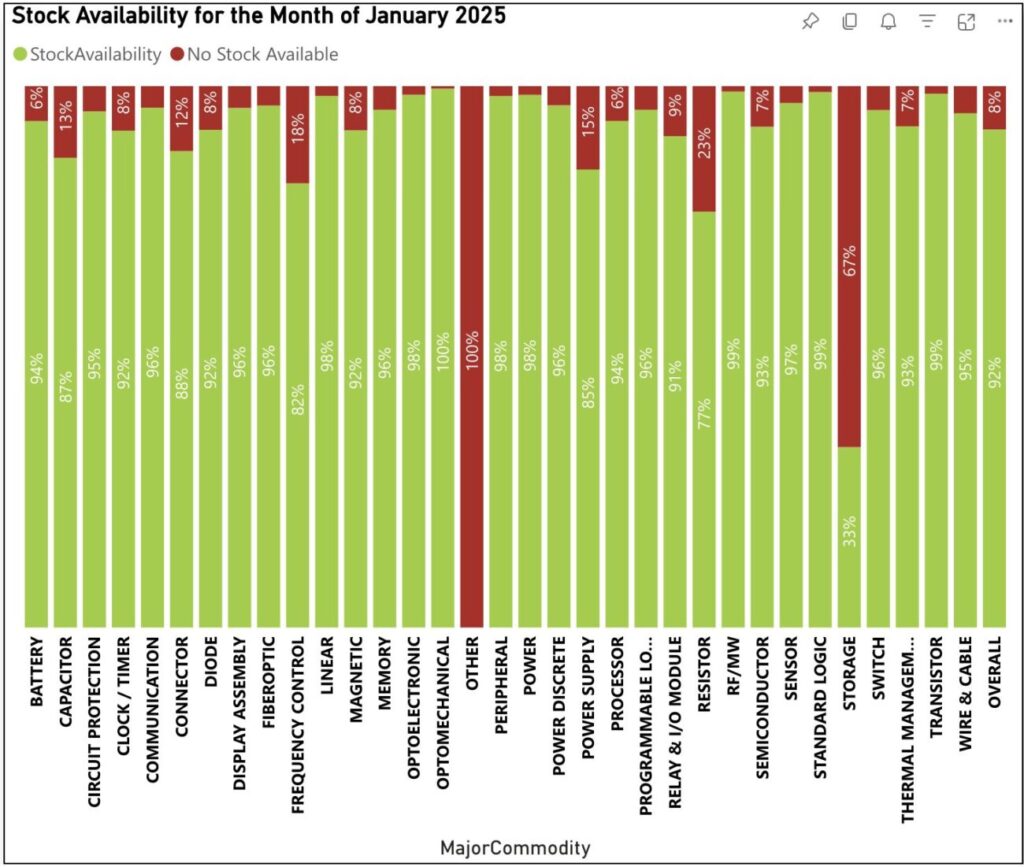

Stock Availability the Only Positive Trend to Kick Off 2025

Perhaps the only welcome news in the first report of 2025 is January’s stock availability, which held steady at 92%, the highest level recorded in 2024 and now 2025. Those components leading the way from an availability perspective include Optomechanical (at 100% available), and RF/MW, Standard Logic and Transistor (all at 99% available). Those components pushing down on that trend include Other (with no parts available), and Storage (at 31% available).

Sign up for our newsletter for more on the electronic components market.