Electronics Market: Prices See Record Decrease, but Lead Times Continue to Grow

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $450 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s basket of goods used in our analysis is comprised of 15,800 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

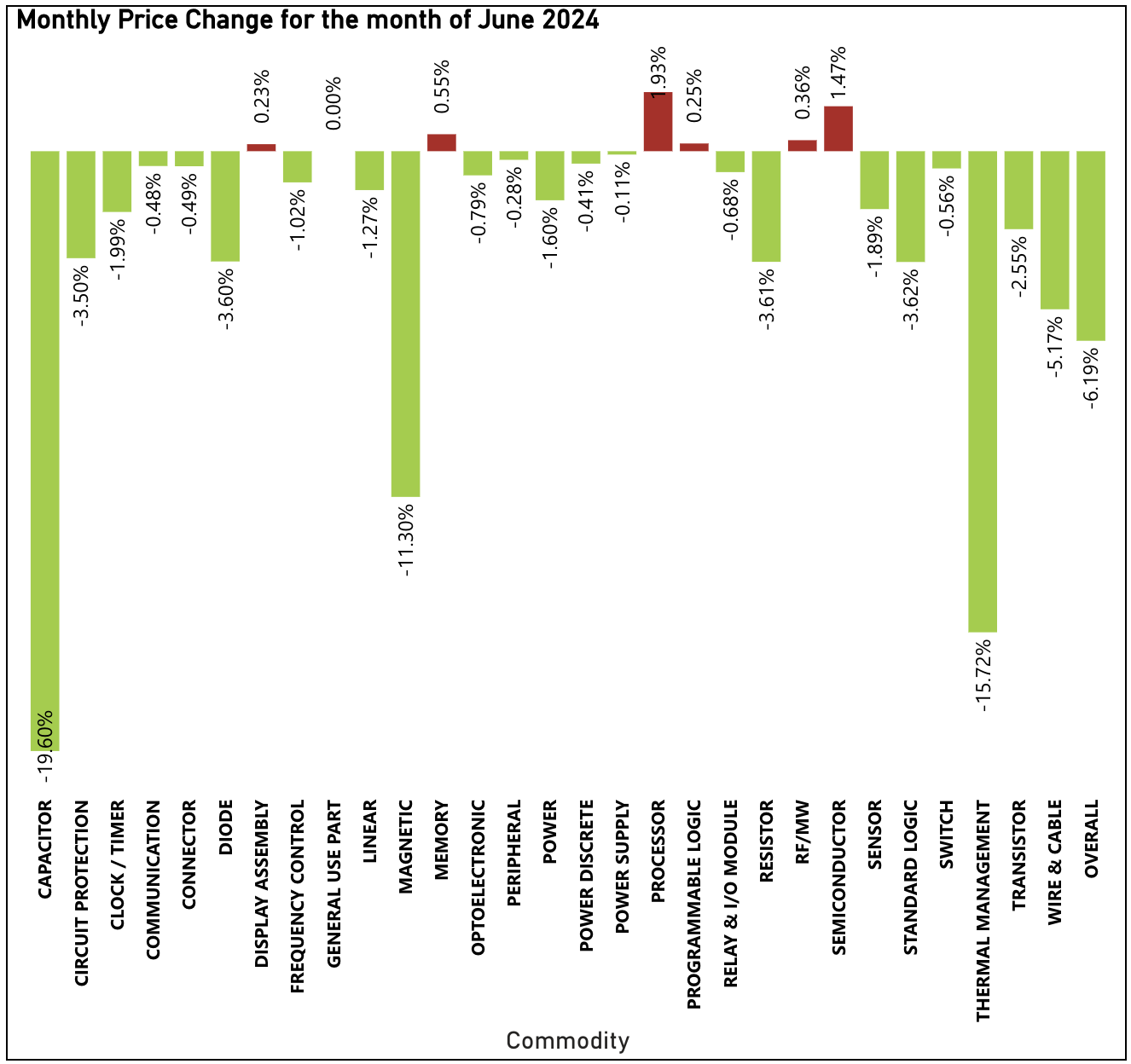

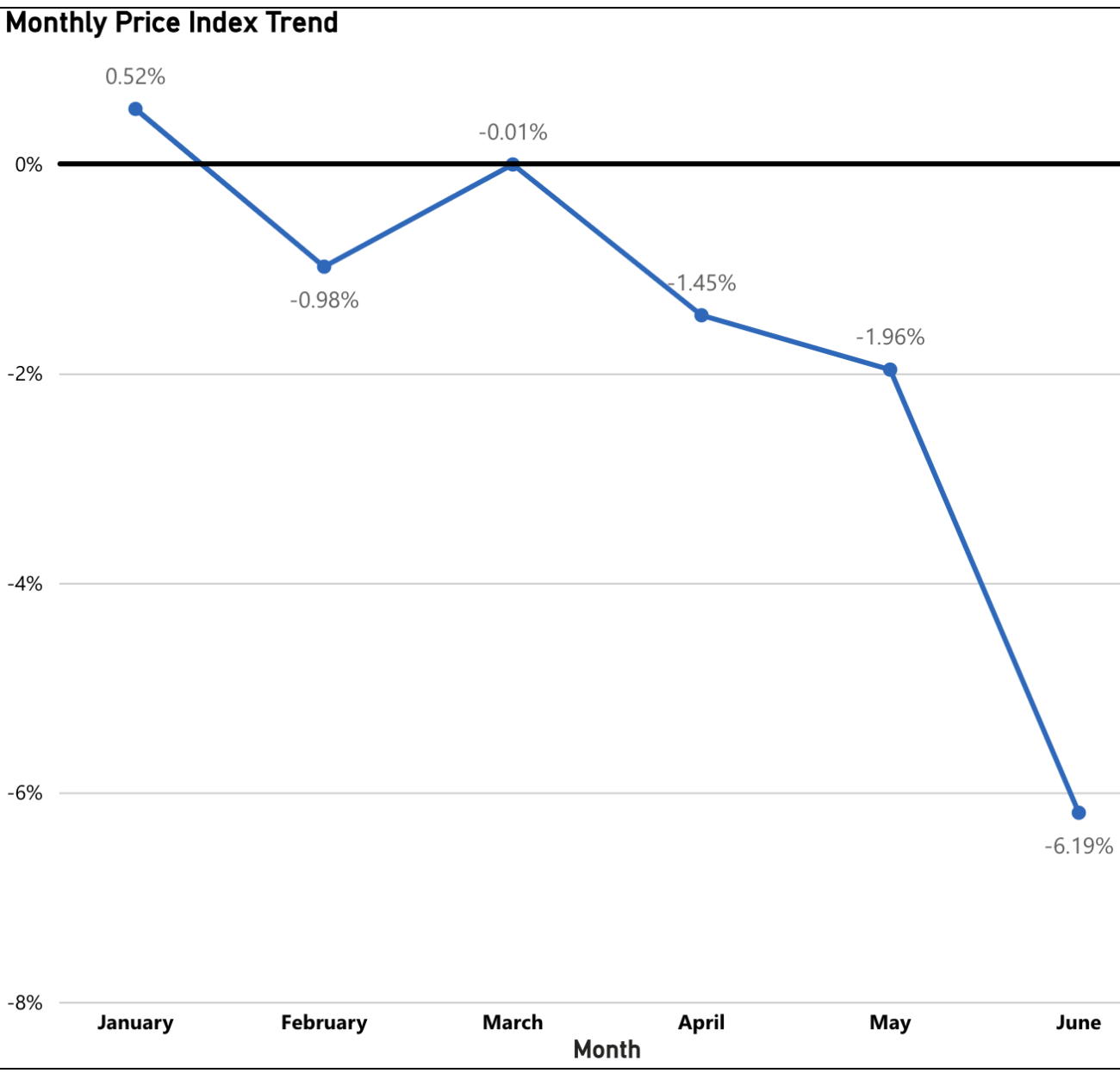

Electronic Component Prices Experience Record Decline in June

June marks the fifth consecutive month of price decreases in 2024 and sets a record with a significant 6.19% overall drop. This favorable trend for buyers challenges previous assertions that prices might stabilize in 2024, suggesting instead that the downward trend is continuing more strongly than anticipated. The ongoing decline in prices raises questions about the market’s trajectory and may be indicating a sustained period of buyer advantage.

The biggest drivers in this pricing readout include Capacitor (down 19.60% Month-to-Month, following a 5.46% decrease in May), Thermal Management (down 15.72% Month-to-Month), and Magnetic (down 11.30% Month-to-Month).

The commodities pushing upward against this trend include Processor (up 1.93% Month-to-Month), Semiconductor (up 1.47% Month-to-Month) and Memory (up 0.55% Month-to-Month).

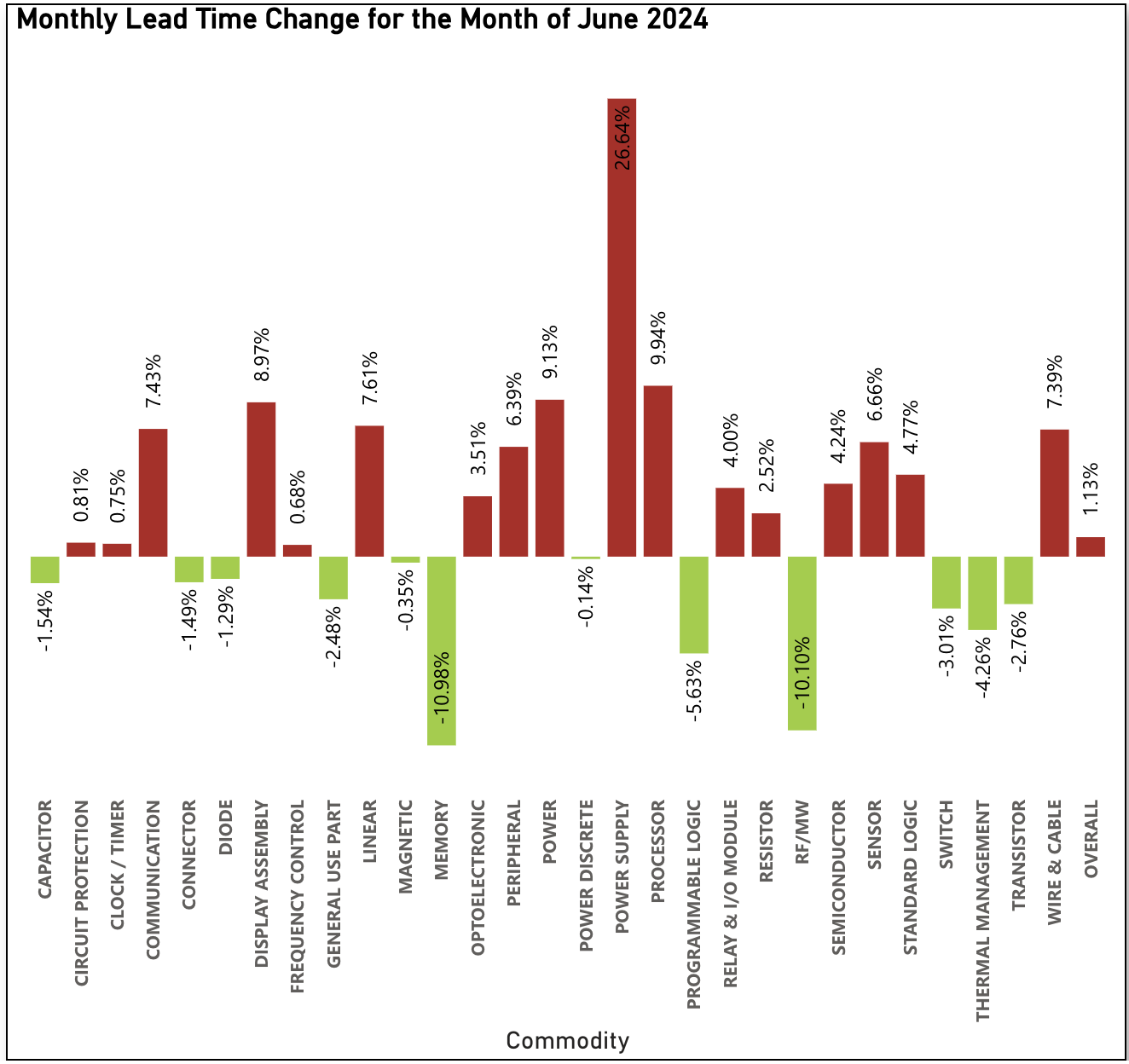

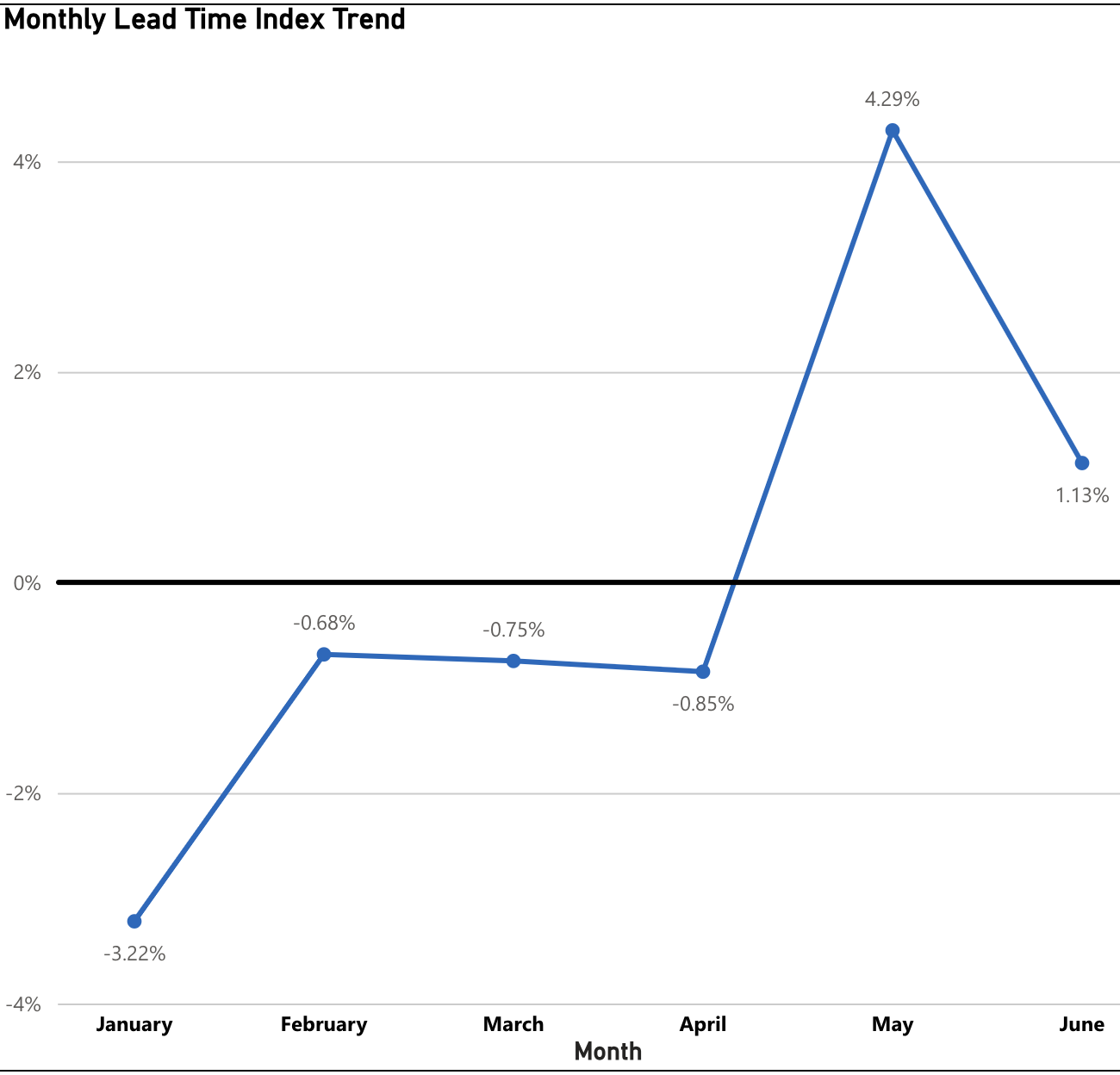

Lead Times Increase for the Second Consecutive Month in June

June marks the second consecutive month of rising lead times in 2024, with an average month-to-month increase of 1.13%. This is only the second rise since October 2023 and the third in the past 18 months. This trend supports last month’s report suggesting that increasing or stabilizing lead times could become the new norm in 2024. Could this be an indication that the reductions seen since the end of the pandemic may be ending?

The biggest drivers in this increase were Power Supply (up 26.64% Month-to-Month), Processor (up 9.94% Month-to-Month), Power (up 9.13% Month-to-Month), and Display Assembly (up 8.97% Month-to-Month) among others.

Those commodities pushing back on June’s trend included Memory (down 10.98% Month-to-Month), RF/MW (down 10.10% Month-to-Month), Programmable Logic (down 5.63% Month-to-Month) and Thermal Management (down 4.26% Month-to-Month), among others.

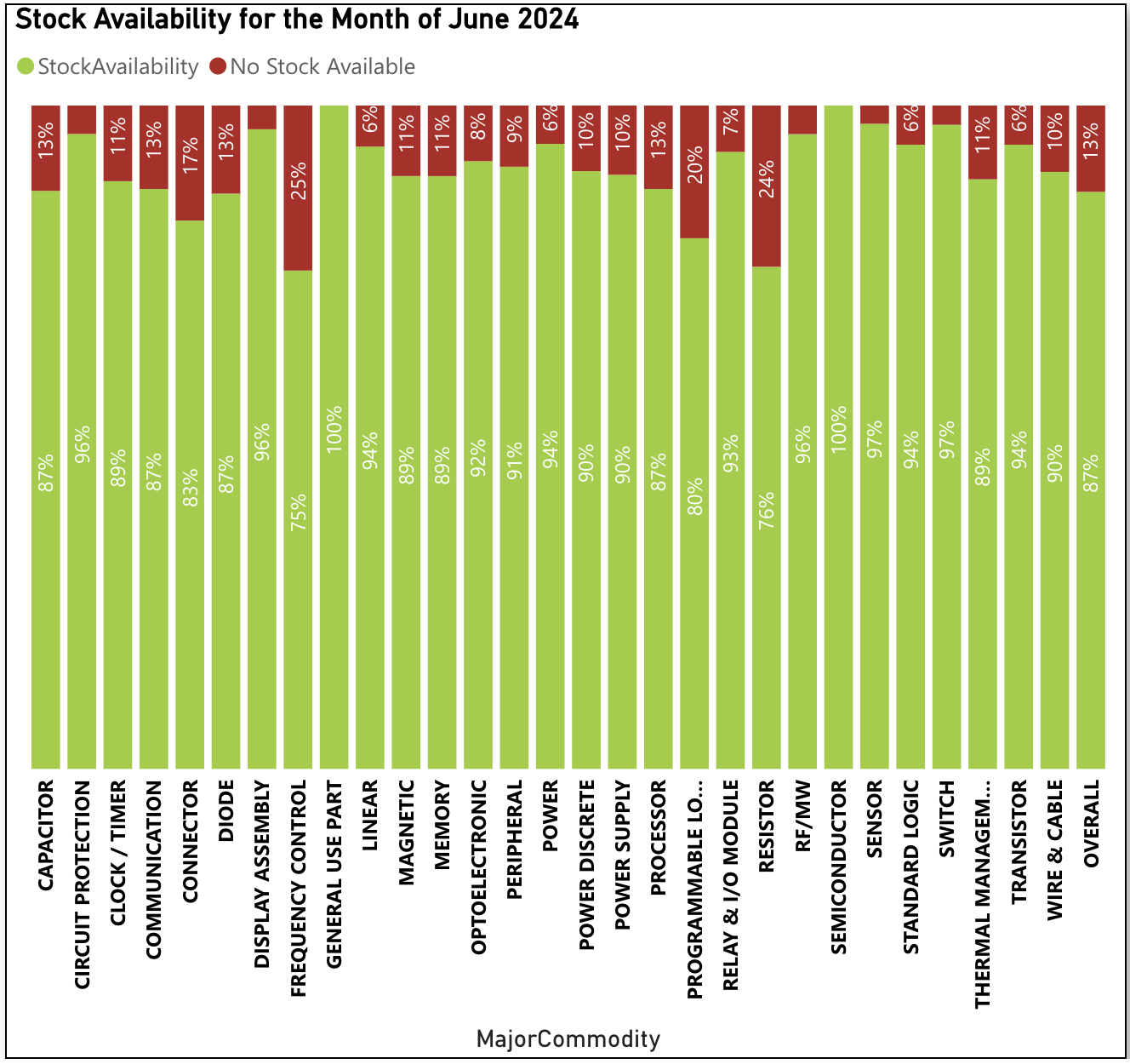

Electronic Component Availability Remains Consistent for June

In June, electronic component availability remained steady at 87%, showing little to no change from May. This consistency may be welcome news for buyers, following record-high availability levels throughout 2024, which only dipped below 90% in May. The overall trend remains positive, as availability in 2024 has consistently stayed above the 87% threshold.

Those components leading the way from an availability perspective in June included Semiconductor and General Use Parts (both still at 100% available), Sensor and Switch (both at 97% available) and Circuit Protection, Display Assembly, and RF/MW (all at 96% Available).

Sign up for our newsletter for more on the electronic components market.