Electronics Market: Buyer’s Market Emerges as Lead Times Ease and Suppliers Offer Potential Discounts Amid Q1 Softness

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $470 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

A Special Note on Q1 Pricing from Lytica’s VP of Business Transformation:

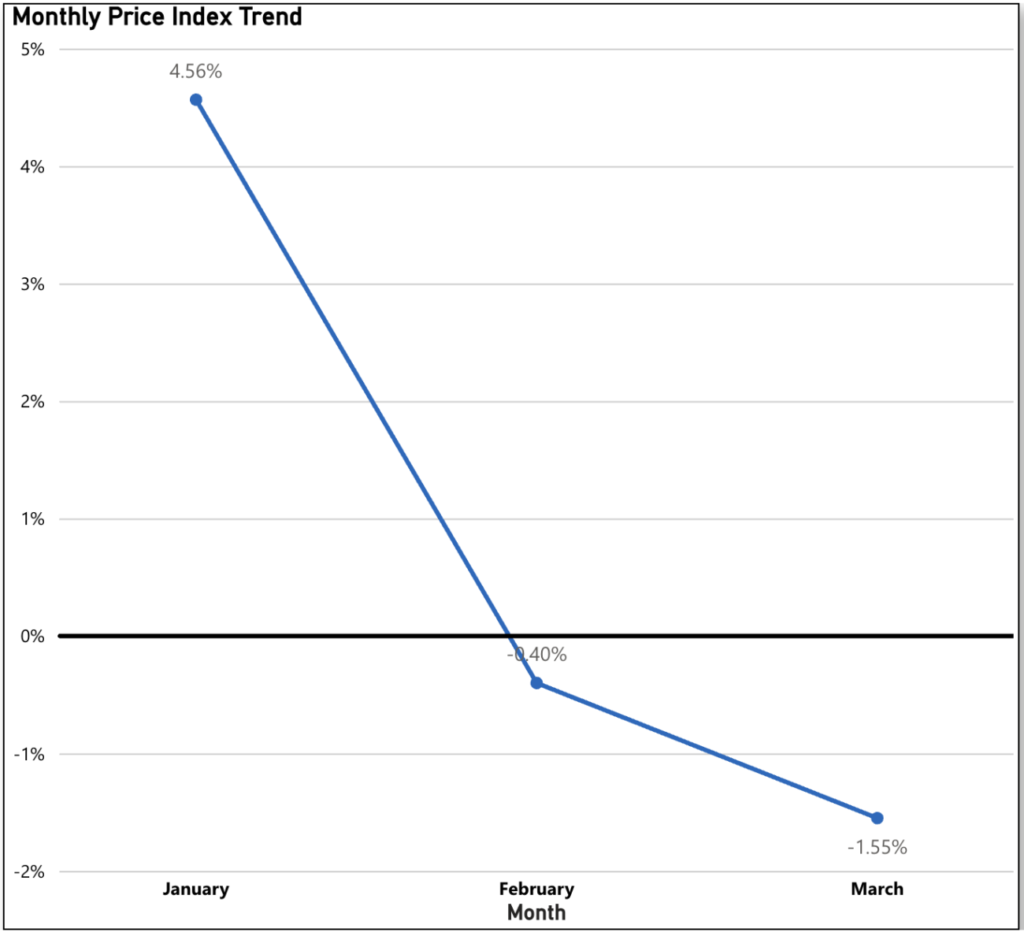

March marks the second consecutive month of price declines, with average component prices falling by 1.55%, accelerating from February’s 0.40% drop. Ongoing tariff uncertainties continue to cloud the global outlook, making trend identification more complex. To cut through the noise, this month’s report taps into the expertise of Varun Narayanan, Lytica’s VP of Business Transformation, for his take on the shifting component market, and what could be welcome news for buyers.

The current market, as viewed from the lens of lead time (softening month over month in 2025) and component availability across the broad set of technologies, remains solidly a buyers’ market. The last 6-7 quarters have largely been on inventory digestion, particularly in the automotive and industrial sectors. We are largely past that, with forward looking guidance still weak. The earnings call from Q1 2025 for many hybrid semiconductor manufacturers was clear evidence of this position. AI remains the exception and sole bright spot of growth.

With continued inventory digestion in place, more so for some manufacturers than others, and less urgency to secure parts, pricing pressure usually moves downward. Suppliers may reduce prices or offer more favorable terms to remain competitive and avoid excess stock. Distributors might also be willing to entertain volume discounts or special promotions to clear inventory. This behavior can be seen at quarter end months. However, pricing declines may vary depending on the specific technology or brand—commoditized parts tend to drop faster than niche or highly spec’d components. OEMs and contract manufacturers could use this window to renegotiate contracts or build buffer stock at lower costs. Overall, the trend is likely to be a softening in prices across many categories unless offset by external factors such as tariffs.

– Varun Narayanan, VP Business Transformation at Lytica

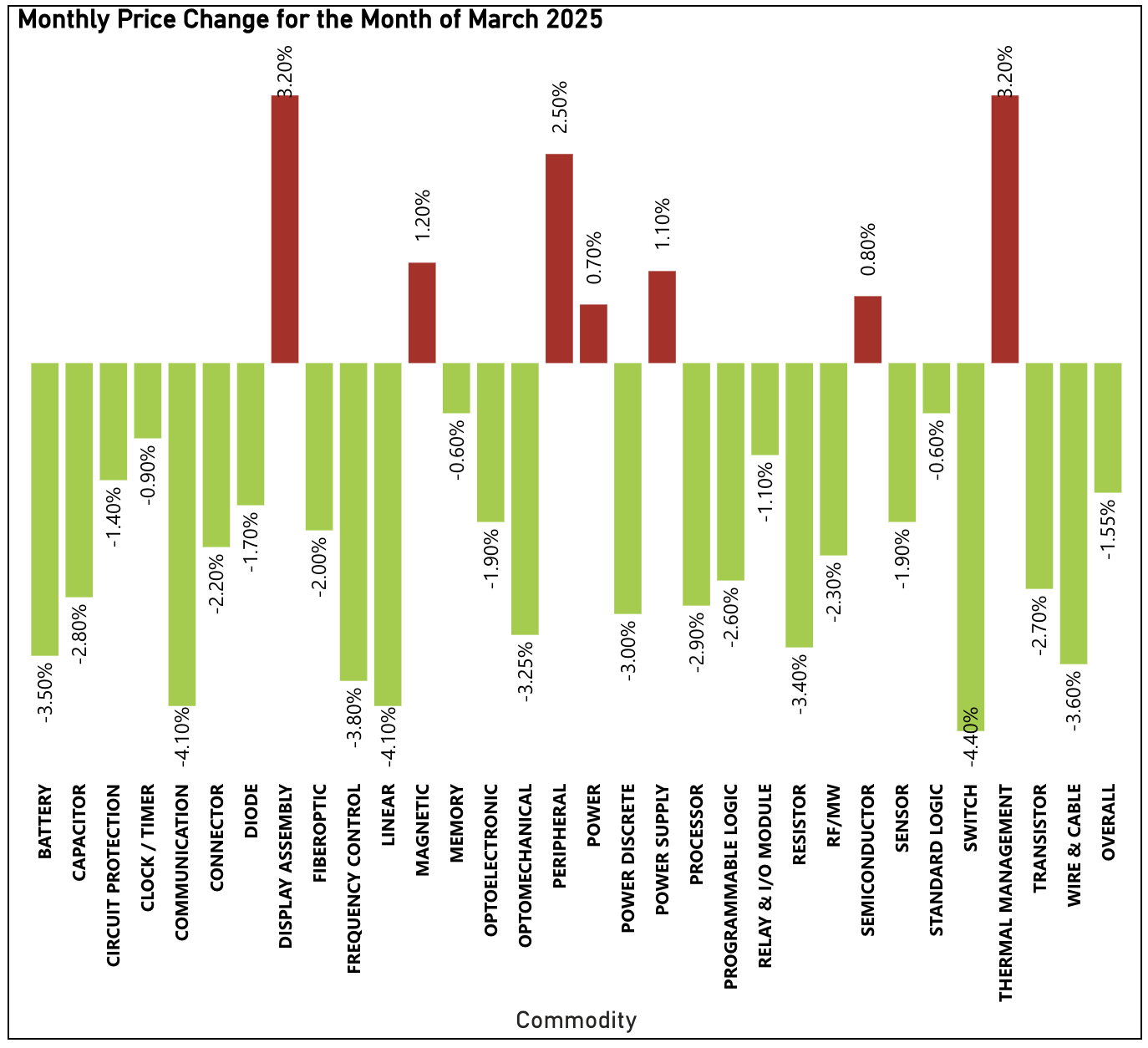

The biggest drivers in this pricing readout include Switch (down 4.40% month-to-month), Communication and Linear (both down 4.10% month-to-month), and Frequency Control (down 3.80% month-to-month). All but 7 commodities noted price decreases in the month of March.

The commodities pushing upward against this trend include Display Assembly and Thermal Management (both up 3.20% month-to-month), Peripheral (up 2.50% month-to-month), and Magnetic (up 1.20% month-to-month).

March Sees Largest Lead Time Decrease on Record Since Reporting Began

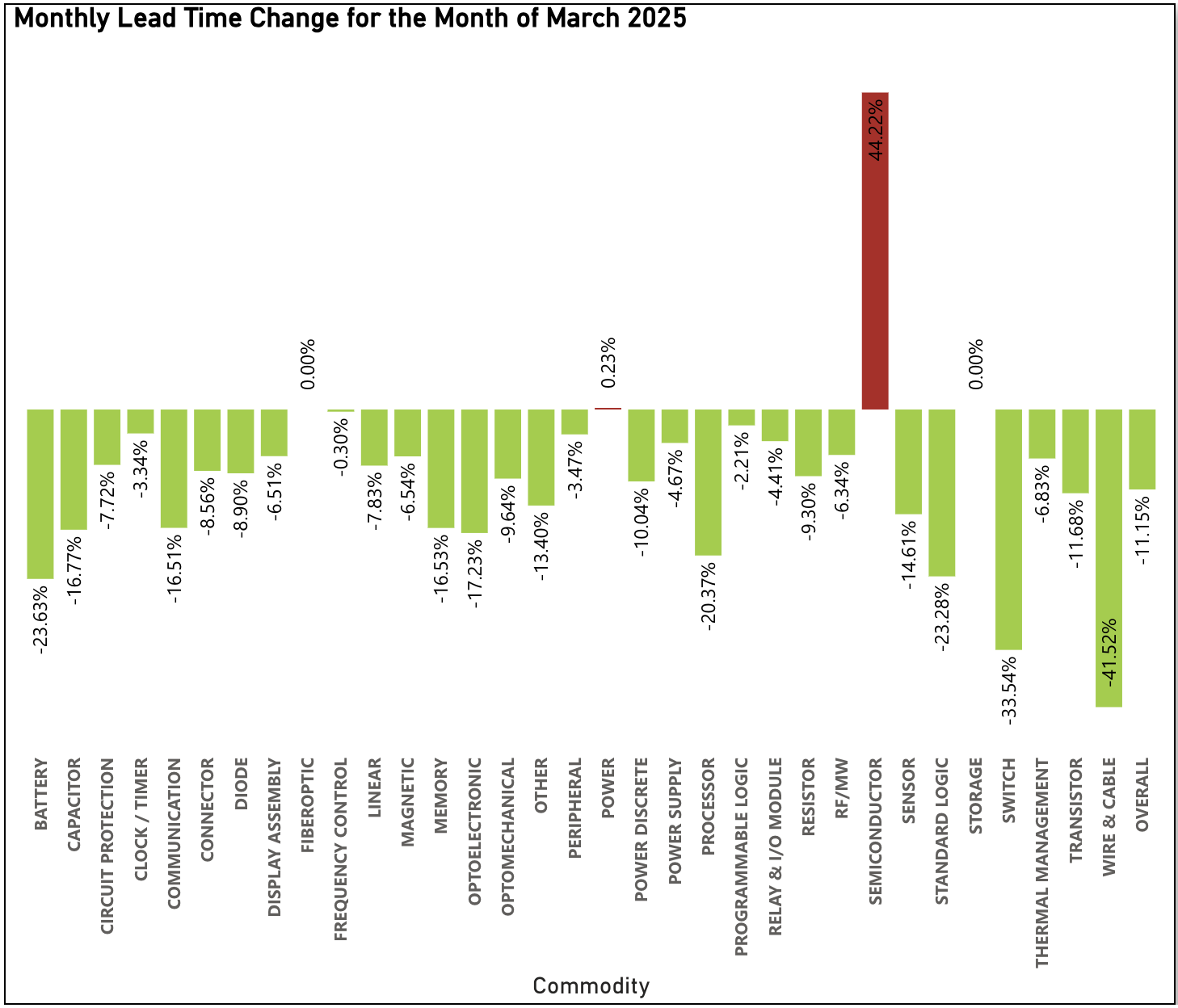

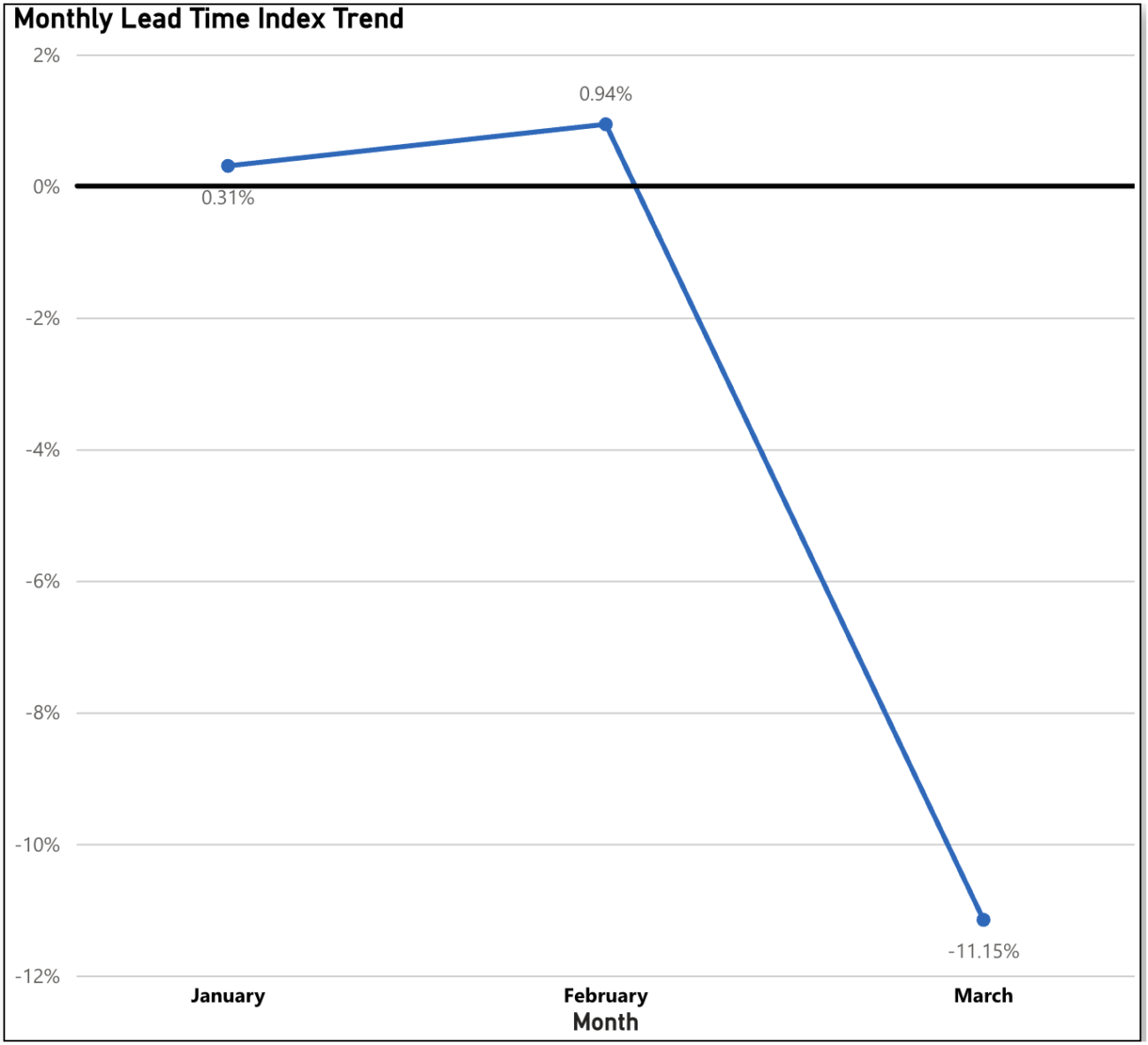

March saw a sharp reversal in lead time trends, breaking the upward momentum that began at the start of 2025. Lead times fell by a record 11.15%, the largest monthly decrease since this report began tracking data. Of the 32 commodities monitored, all but four reported a decline. This significant shift brings the year-to-date reduction to 10.05%, signaling a meaningful softening in supply dynamics.

The main contributors to this month’s record setting decrease were Wire & Cable (down 41.52% month-to-month), Switch (down 33.54% month-to-month) Battery (down 23.63% month-to-month), and Standard Logic (down 23.28% month-to-month) among many others.

The commodities pushing upward against this trend include Semiconductor (up 44.22% month-to-month), and Power (up 0.23% month-to-month).

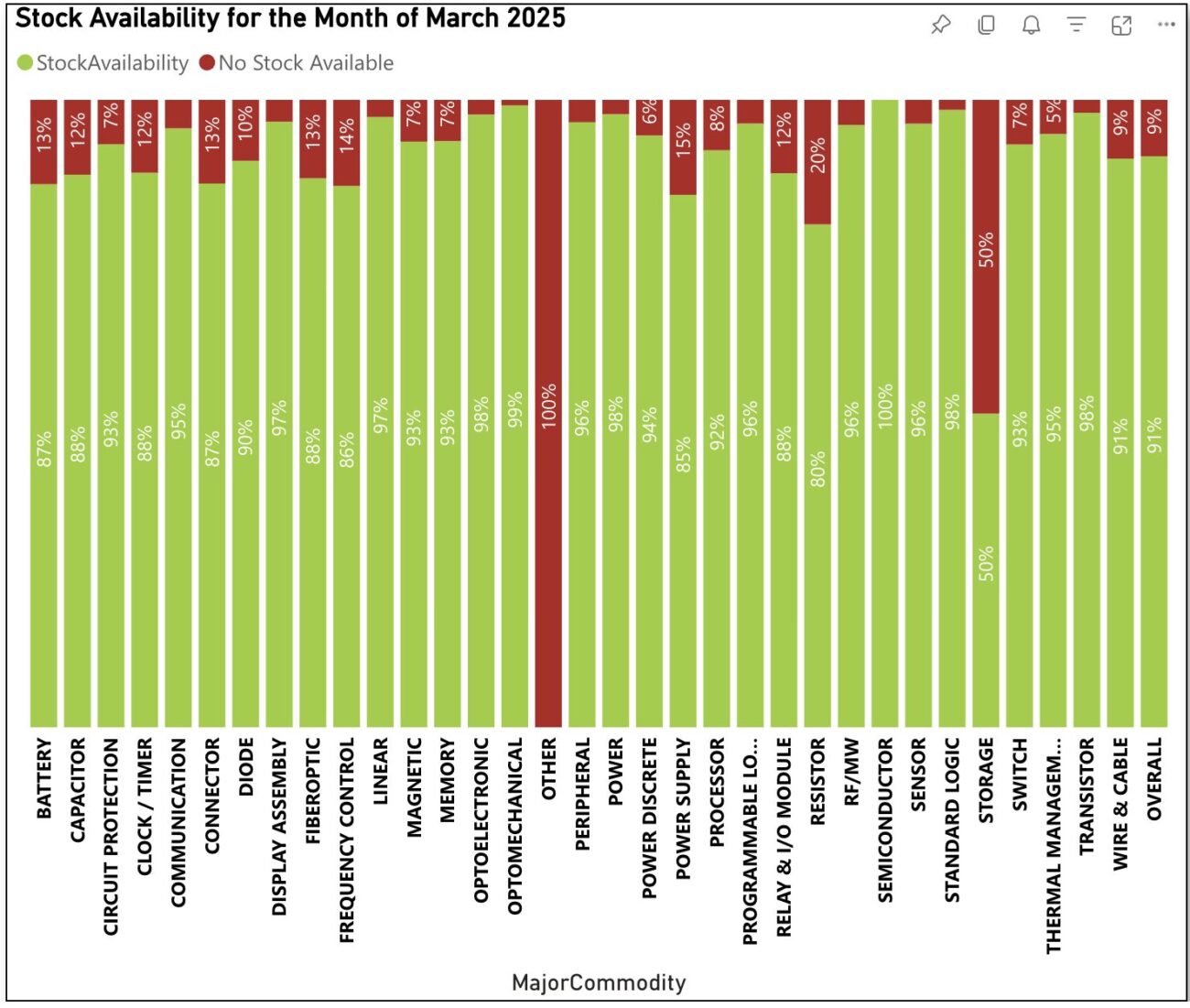

Stock Availability Climbs Back Up Slightly in March

After February marked the first dip in stock levels since late 2024, March saw a rebound to 91%, bringing inventory levels closer to the 2024 average of 92%. Those components leading the way from availability perspective include Optomechanical (at 99% available), and Optoelectronic, Power, Standard Logic, and Transistor (all at 98% available). Those components pushing downward on this trend include Other (at 0% available), and Storage (at 50% available).

Sign up for our newsletter for more on the electronic components market.