Electronics Market: Favourable Conditions Continue in May with Decreases Seen Across Prices and Lead Times

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $500 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

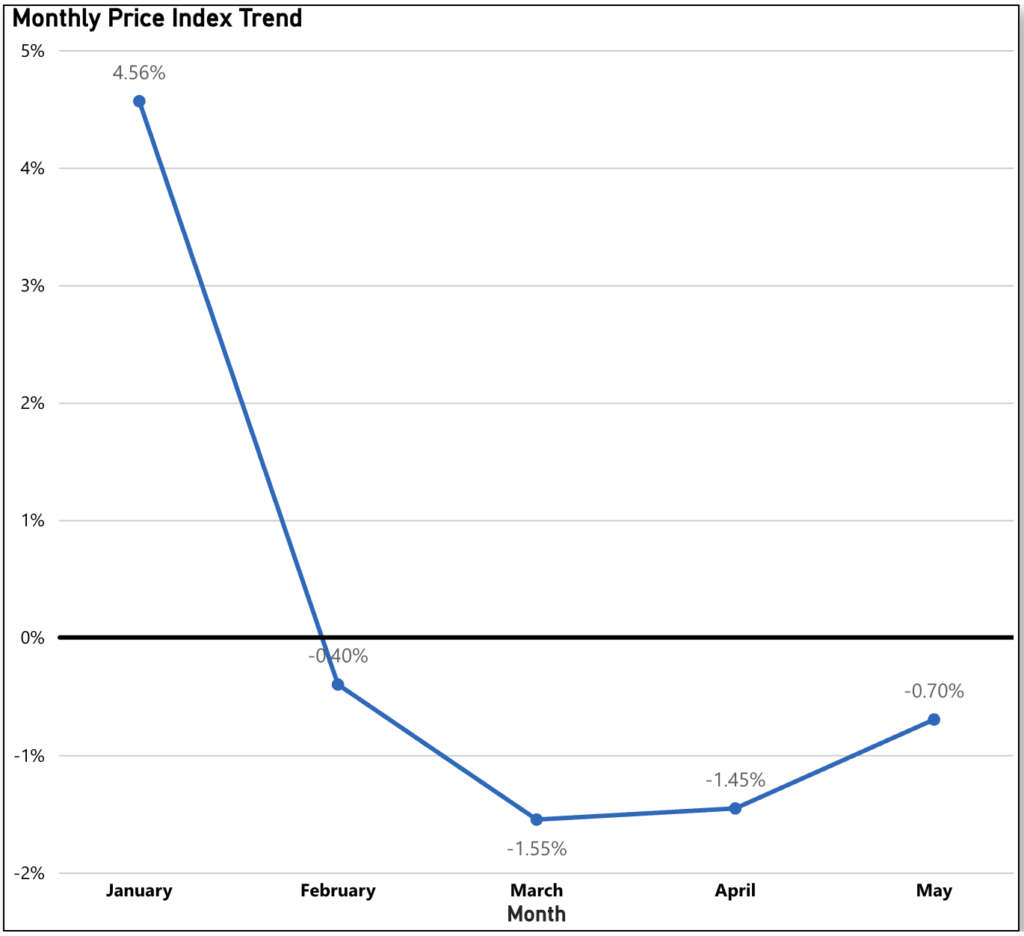

May Extends the Streak: Four Consecutive Months of Price Declines

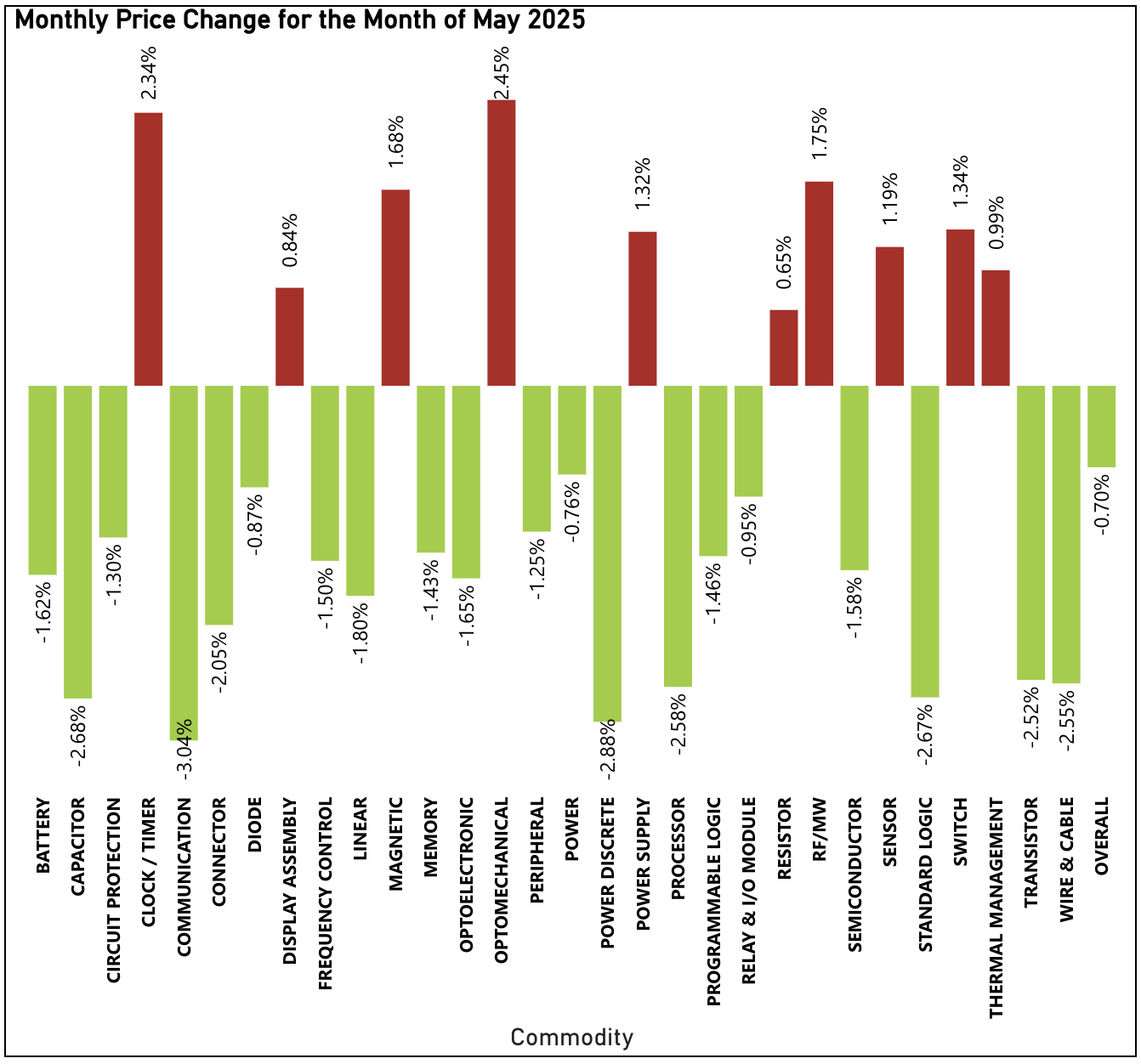

Component prices continued their downward trend in May, marking the fourth consecutive month of declines. The average price drop of 0.70%, while more modest than March (-1.55%) and April (-1.45%), still reinforces the steady shift toward a buyer’s market. Procurement teams are seeing sustained pricing leverage across multiple categories, adding momentum to the favourable conditions identified earlier in the year.

The biggest drivers in this pricing readout include Communication (down 3.04% month-to-month), Power Discrete (down 2.88% month-to-month), Capacitor (down 2.68% month-to-month) and Standard Logic (down 2.67% month-to-month). All but 10 commodities noted price decreases in the month of May.

The commodities pushing upward against this trend include Optomechanical (up 2.45% month-to-month), Clock/Timer (up 2.34% month-to-month), RF/MW (up 1.75% month-to-month) and Magnetic (up 1.68% month-to-month).

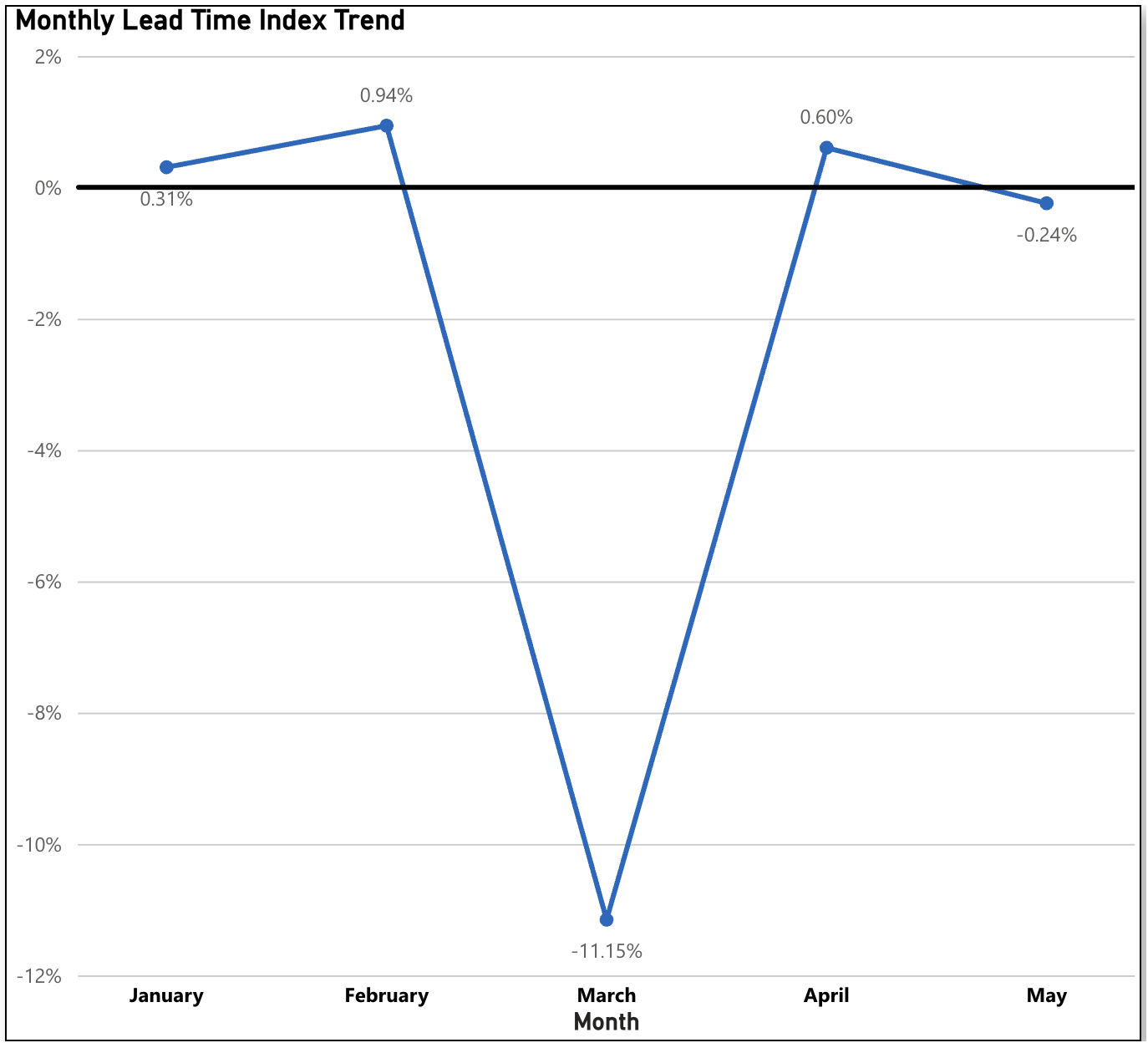

Lead Times Steadying: Slight Decrease Signals Continued Stability

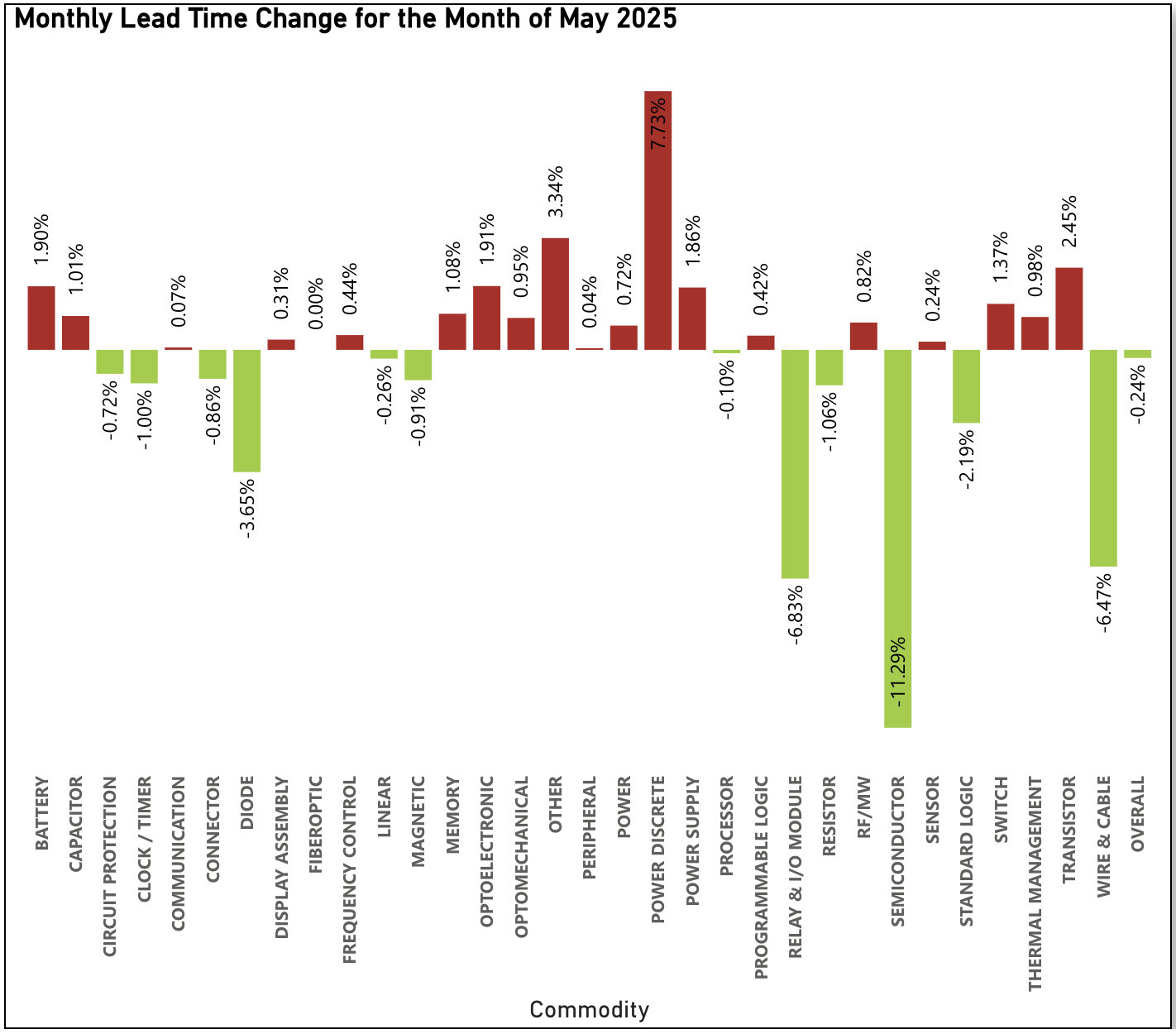

May saw a slight decrease in average lead times of 0.24%, aligning more closely with levels observed earlier in the year. While not as dramatic as March’s record-setting 11.45% drop, or April’s modest 0.60% rebound, this month’s shift suggests a stabilizing trend. With two consecutive months of relatively flat movement, the market may be settling into a more predictable rhythm on the lead time front.

The main contributors to this month’s lead time decrease were Semiconductor (down 11.29% month-to-month), Relay and I/O Module (down 6.83% month-to-month), Wire & Cable (down 6.47% month-to-month), and Diode (down 3.65% month-to-month).

The commodities pushing upward against this trend include Power Discrete (up 7.73% month-to-month), Other (up 3.34% month-to-month), Transistor (up 2.45% month-to-month) and Optoelectronic (up 1.91% month-to-month).

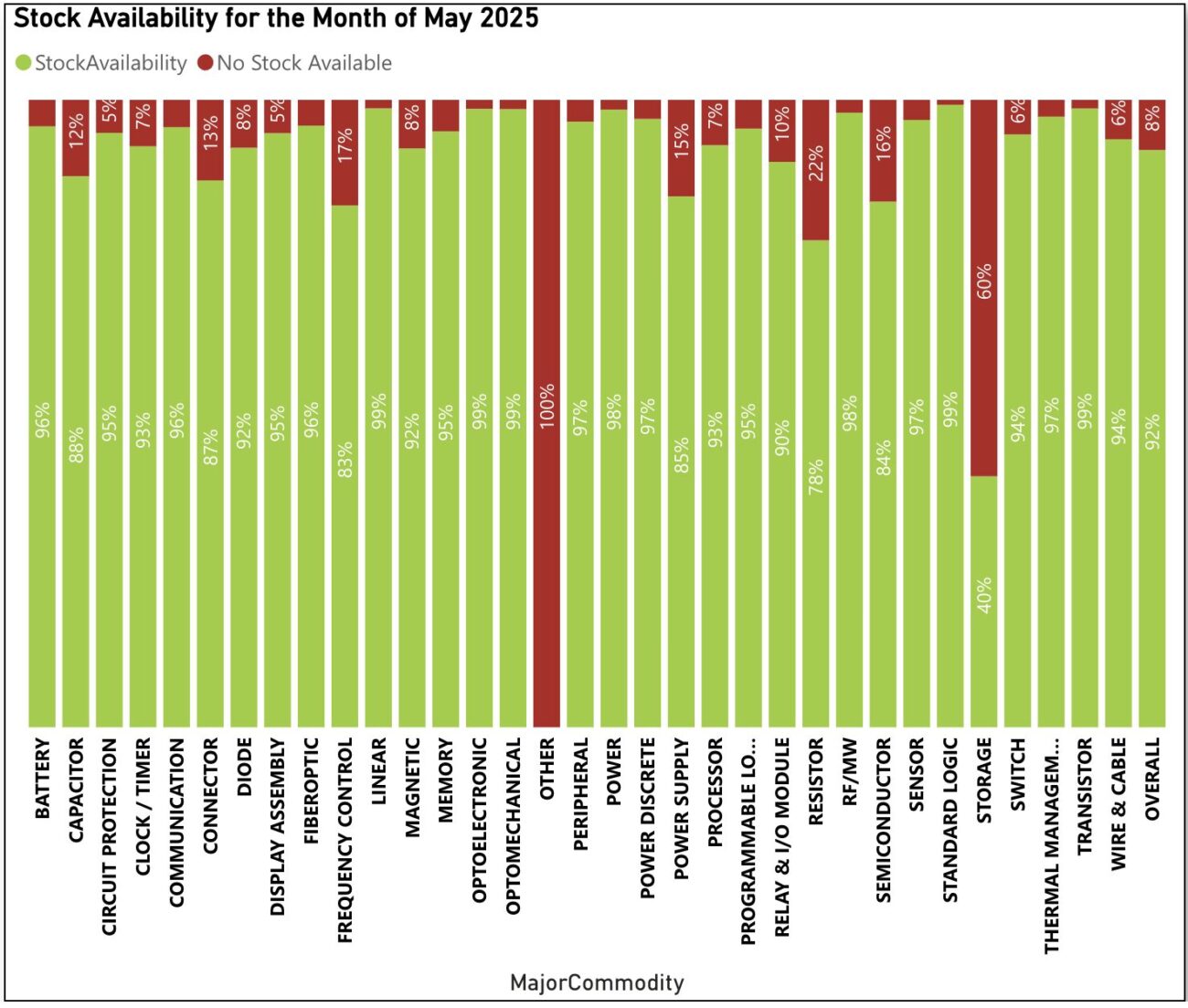

Stock Availability Remains Steady in May at 92%

Following three consecutive months of rising availability, stock levels stabilized in May at 92%. This consistency continues the broader 2024 trend, suggesting that inventory positions remain healthy for buyers. Minimal changes were observed across the commodity categories compared to April, further reinforcing a stable supply environment. Those components leading the way from an availability perspective include Linear, Optoelectronic, Optomechanical, Standard Logic, and Transistor (all at 99% available), RF/MW (at 98% available), and Peripheral, Sensor, and Thermal Management (all at 97% available). Those components pushing downward on this trend include Other (at 0% available), and Storage (at 40% available).

Sign up for our newsletter for more on the electronic components market.