Electronics Market May Be Starting to Heat Up

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using actual customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers across industries (including 20% of the Fortune 500) in analyzing over $425 billion in electronic component spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 15,800 electronic components across 22 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

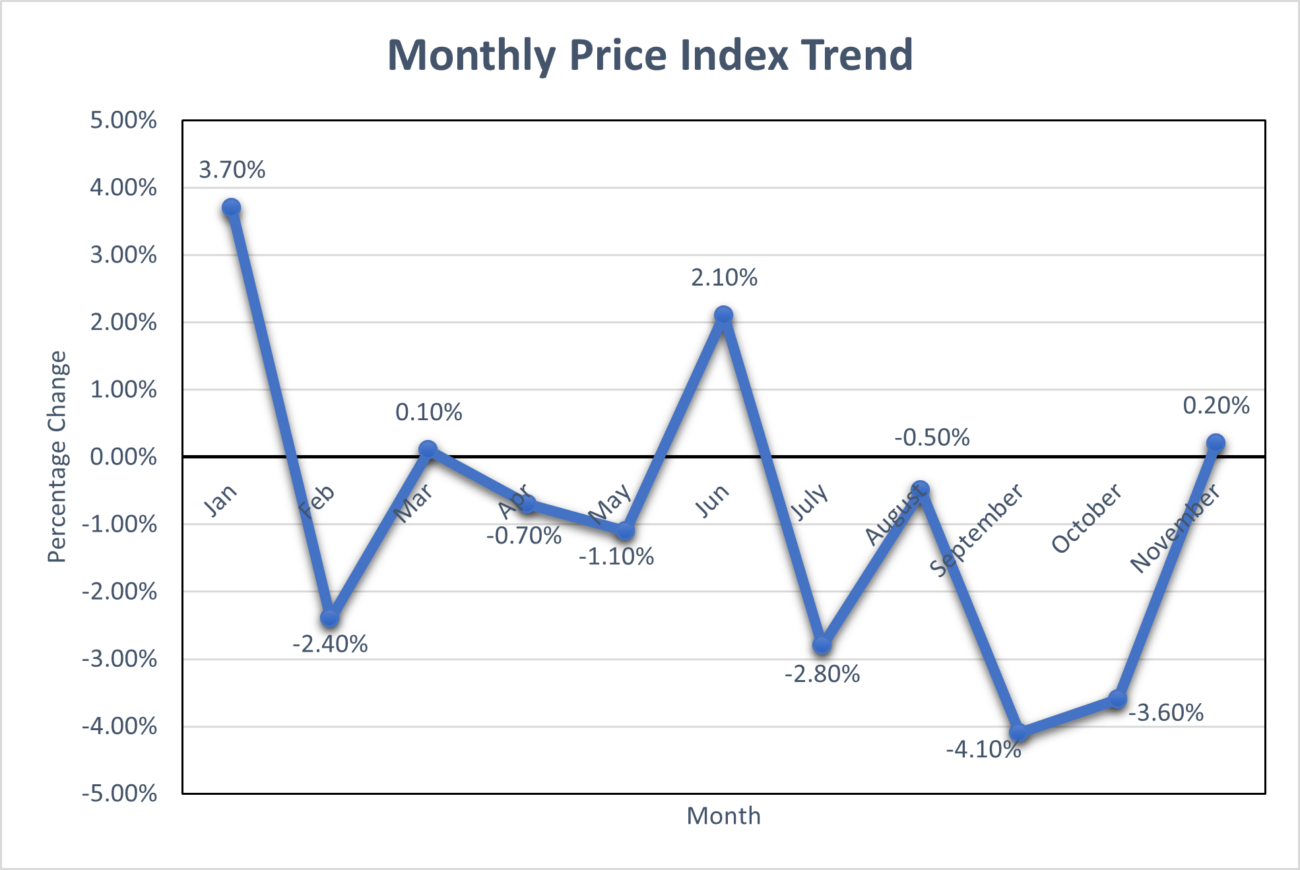

Electronic Component Pricing Increases Slightly Following Four Months of Drops

Electronic component pricing increased in November slightly by 0.2% on average, following a monthly decline in October of 3.6%. November’s readout of electronics pricing increase puts an end to the four consecutive months of drops and, for the year, represents only the 3rd month of pricing increases throughout 2023. Ultimately, electronic pricing remains compelling for procurement teams.

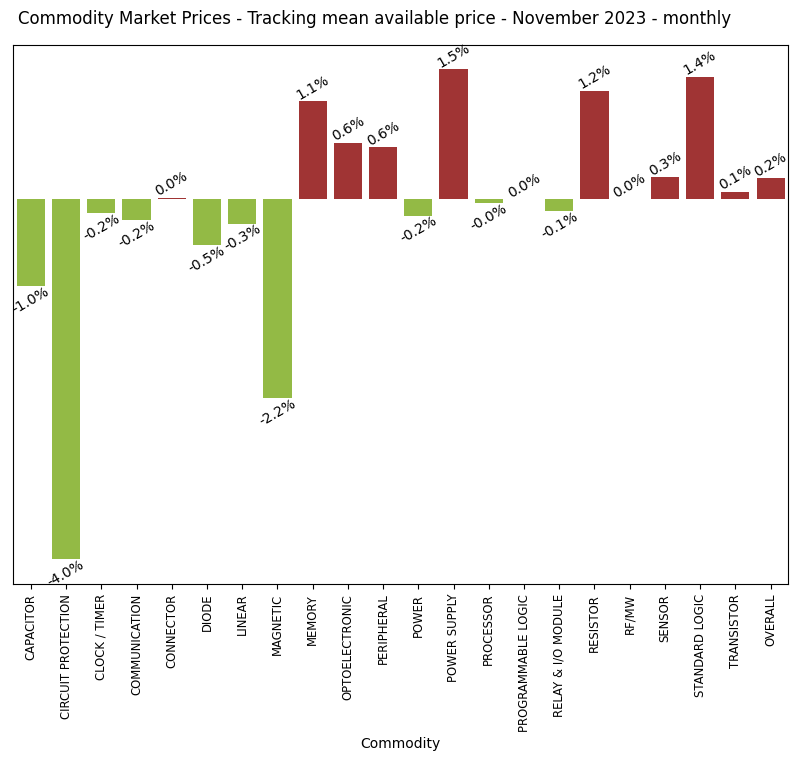

The biggest drivers in this pricing readout are Power Supply (up 1.5% Month-to-Month following a previous increase of 7.5% Month-to-Month), Resistor (up 1.2% Month-to-Month following a previous decrease of 10.5% Month-to-Month) and Standard Logic (up 1.4% Month-to-Month following a previous increase of 1.3% Month-to-Month).

In terms of commodities pushing against this trend, we saw prices decrease for Circuit Protection components (down 4.0% Month-to-Month), Capacitor (down 1.0% Month-to-Month following a previous decrease of 2.7% Month-to-Month), and Magnetic (down 2.2% Month-to-Month following a previous 2.3% increase Month-to-Month), among others.

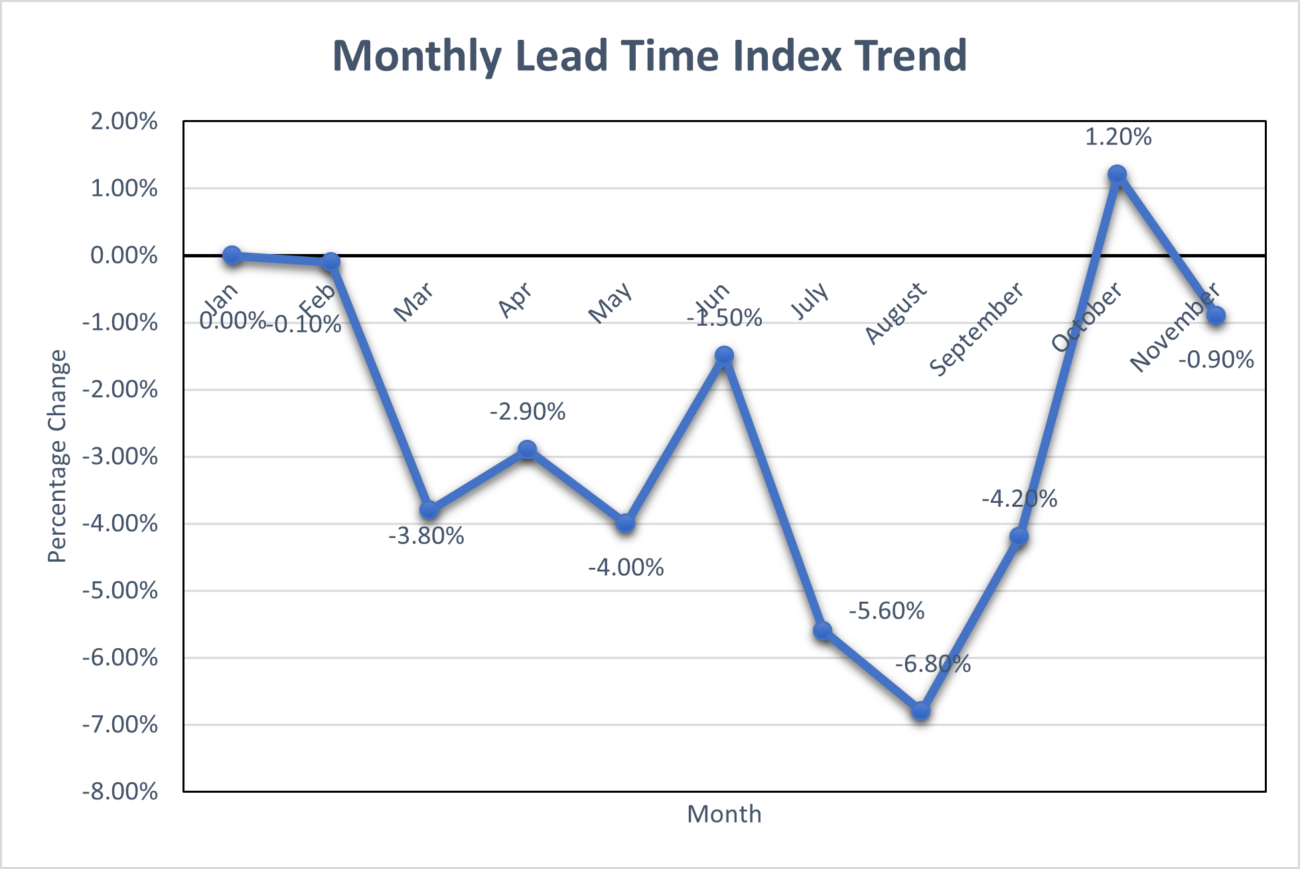

Electronic Component Lead Times Decreased In November Following Octobers Increase

In November, we saw average overall lead times for electronic components tracked decrease by 0.9%. This is a small reversal from the 1.2% increase that we saw in October. It is worth mentioning again this month that October was the only month in 2023 where lead times increased.

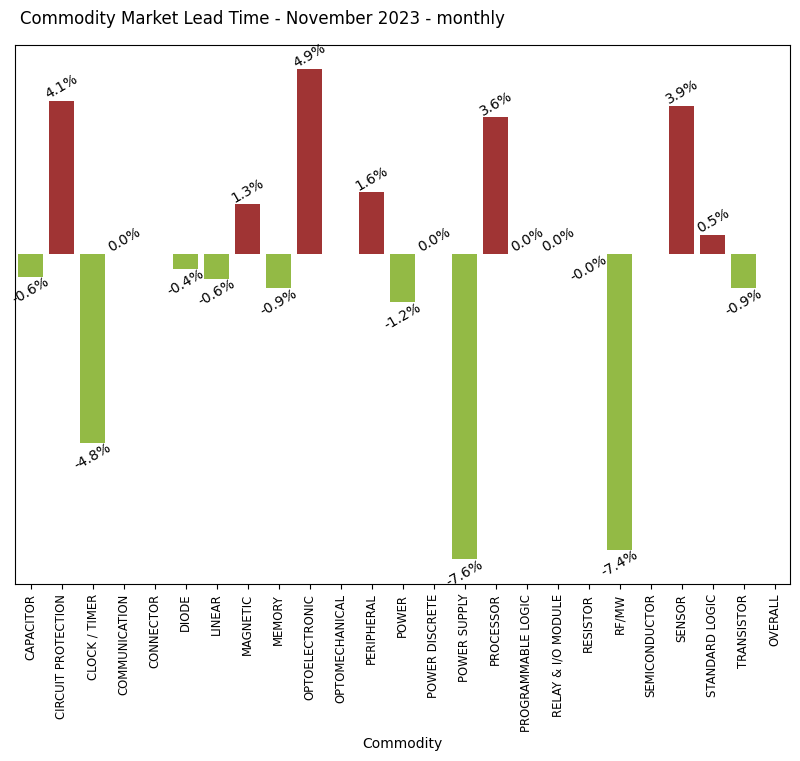

The decrease in lead times was driven largely by Power Supply (down 7.6% Month-to-Month), RF/MW components (down 7.4% Month-to-Month) and Clock/Timer (down 4.8% Month-to-Month). Those commodities pushing back on November’s trend included Optoelectronic components (up 4.9% Month-to-Month), Circuit Protection (up 4.1% Month-to-Month), and Sensor (up 3.9% Month-to-Month).

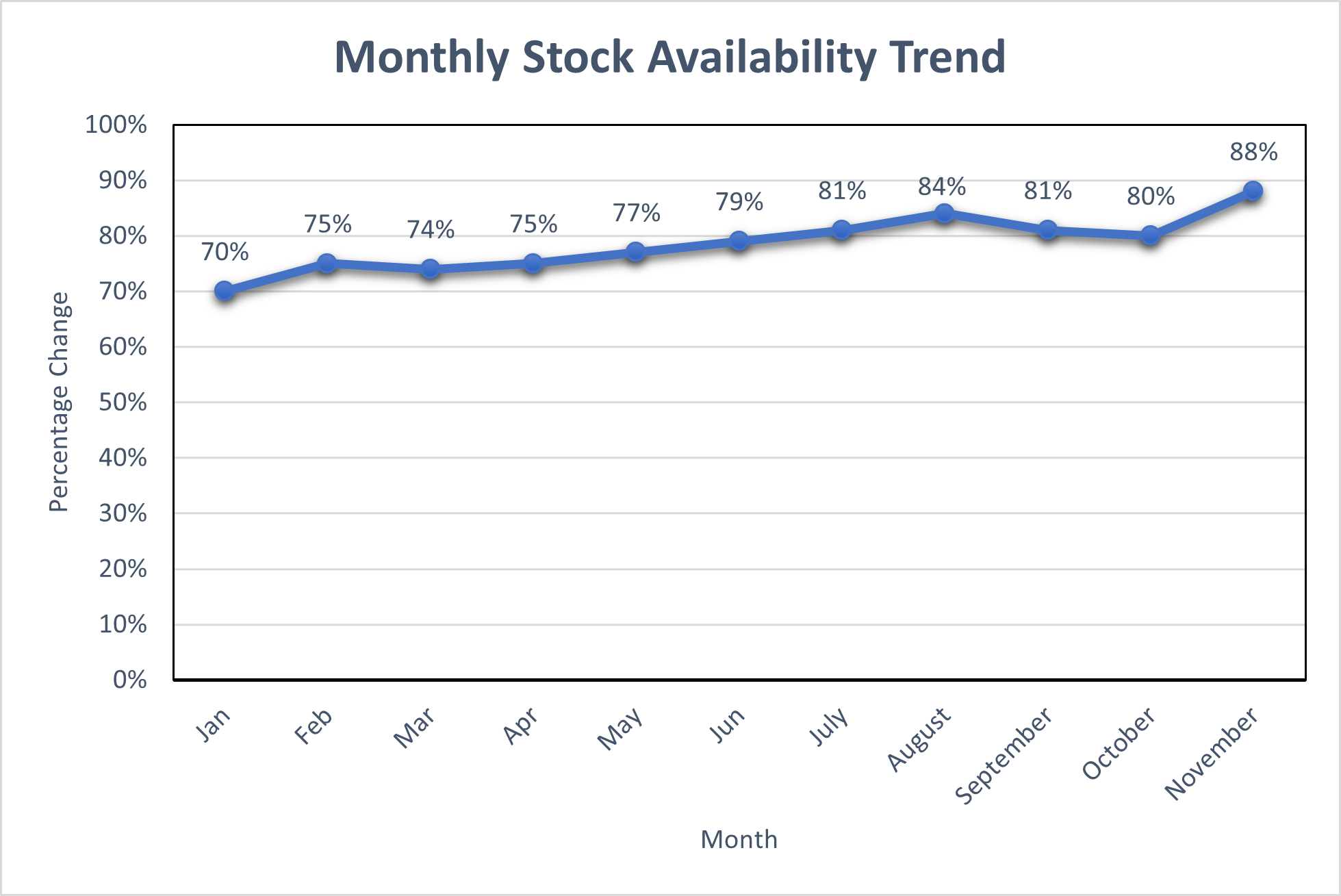

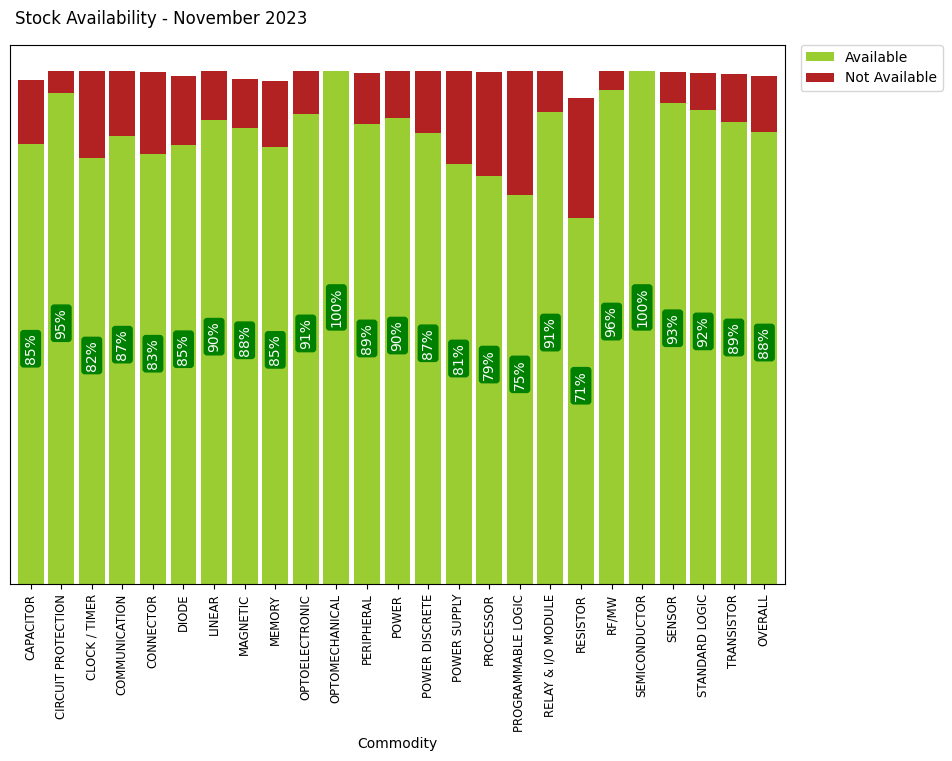

Electronic Component Availability Sees Highest Monthly Jump All Year In November

In November, electronic component availability increased to 88% of all tracked electronic components available, up from 80% in October. This jump marks the largest monthly increase of the whole year. Those components leading the way from an availability perspective in November included Optomechanical and Semiconductors (both 100% Available), RF/MW components (96% Available), and Circuit Protection (95% Available).

Sign up for our newsletter to get access to our next update for December 2023 – where we’ll see if the market continues to heat up.