Electronics Market: Significant Increases in Lead Times the Big Story for October

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $470 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

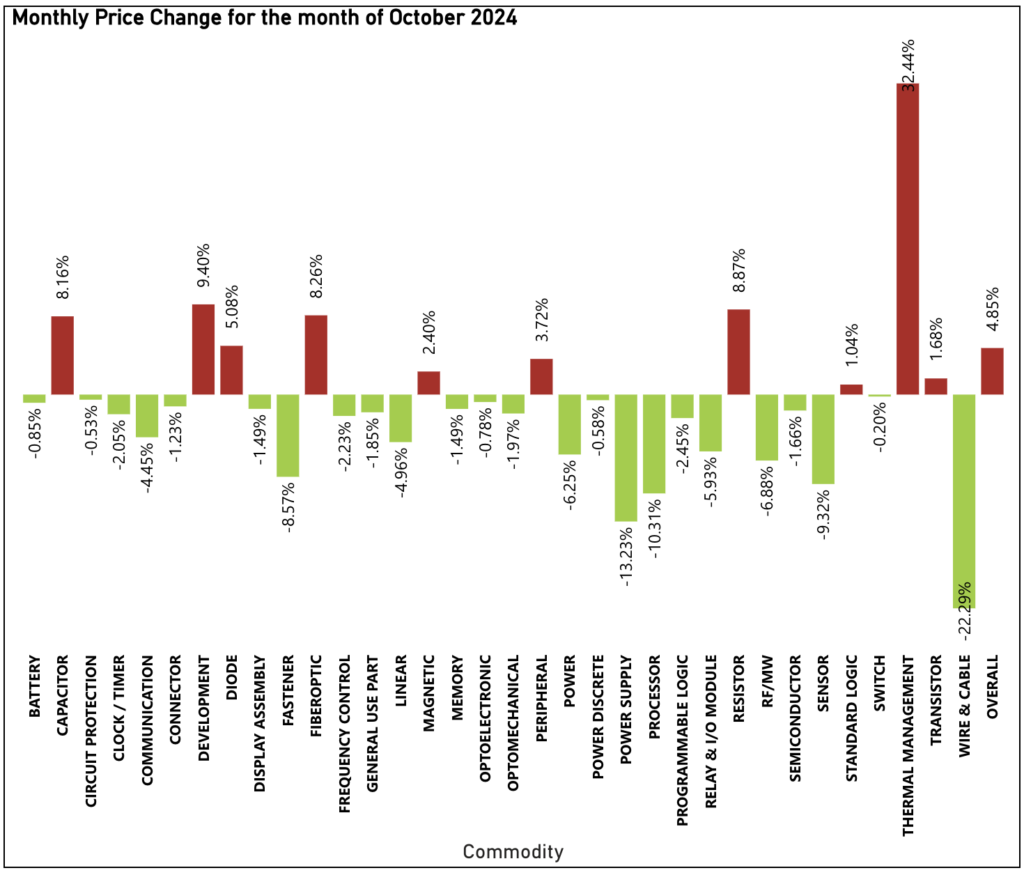

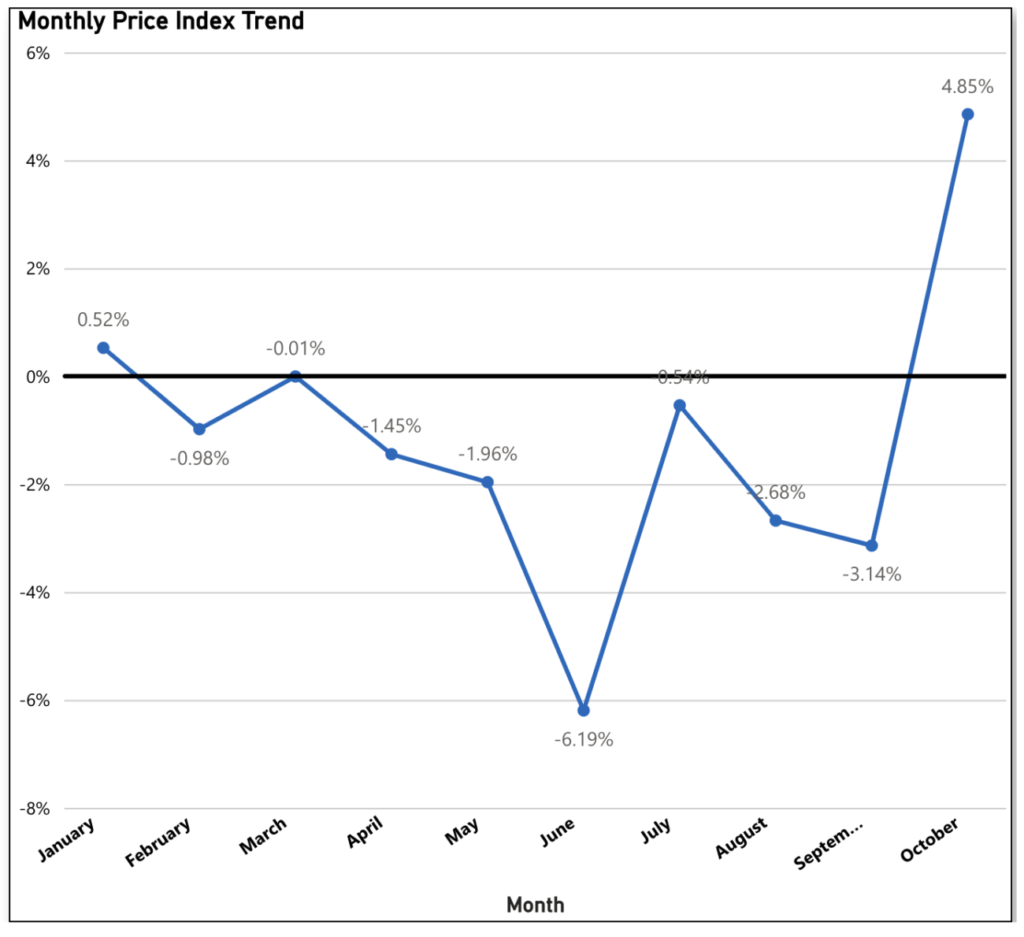

Prices Increase in October for the First Time Since January

October marks the end of an eight-month stretch of price decreases, with prices rising by 4.85%—the first increase since January’s modest 0.52% uptick. Despite this change, prices year-to-date are still down 8.44%, delivering savings to procurement teams compared to last year. The increase is largely driven by five key commodities, prompting buyers to watch November closely in hopes that this will not signal a trend for the rest of the year.

The biggest drivers in this pricing readout include Thermal Management (up 32.44% month-to-month), Development (up 9.40% month-to-month), Resistor (up 8.87% month-to-month), Fiberoptic (up 8.26% month-to-month), and Capacitor (up 8.16% month-to-month).

The commodities pushing downward against this trend include Wire and Cable (down 22.29% month-to-month), Power Supply (down 13.23% month-to-month), Processor (down 10.31% month-to-month), and Sensor (down 9.32% month-to-month).

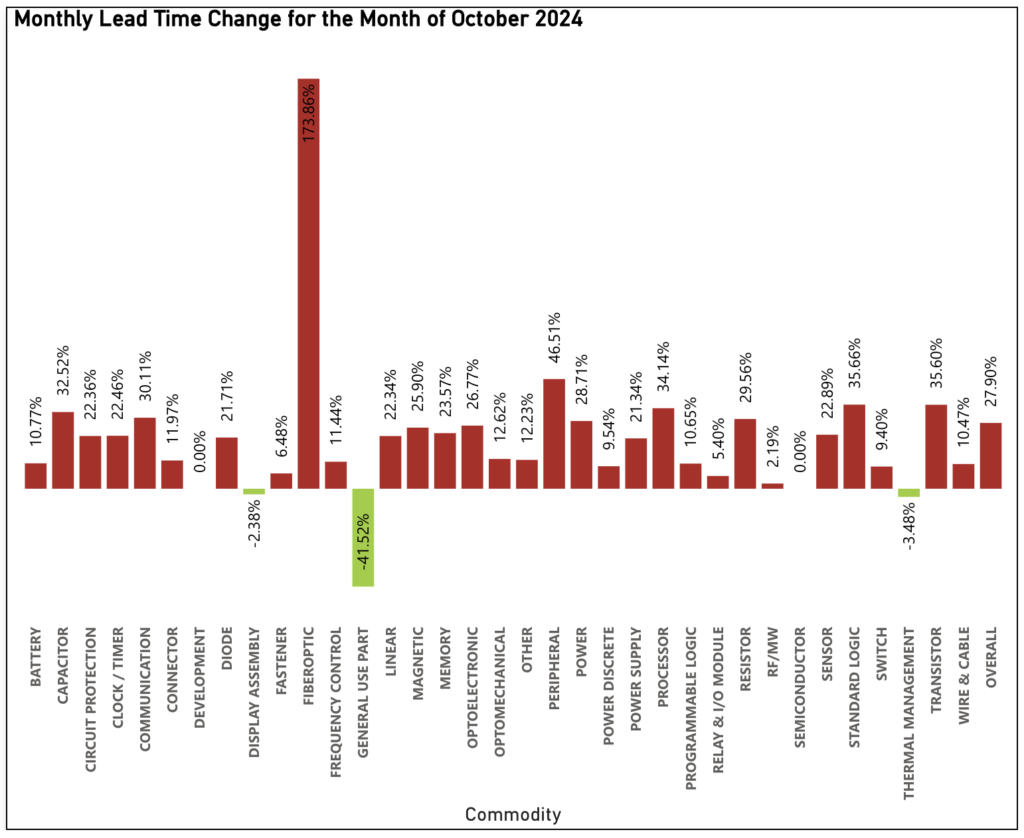

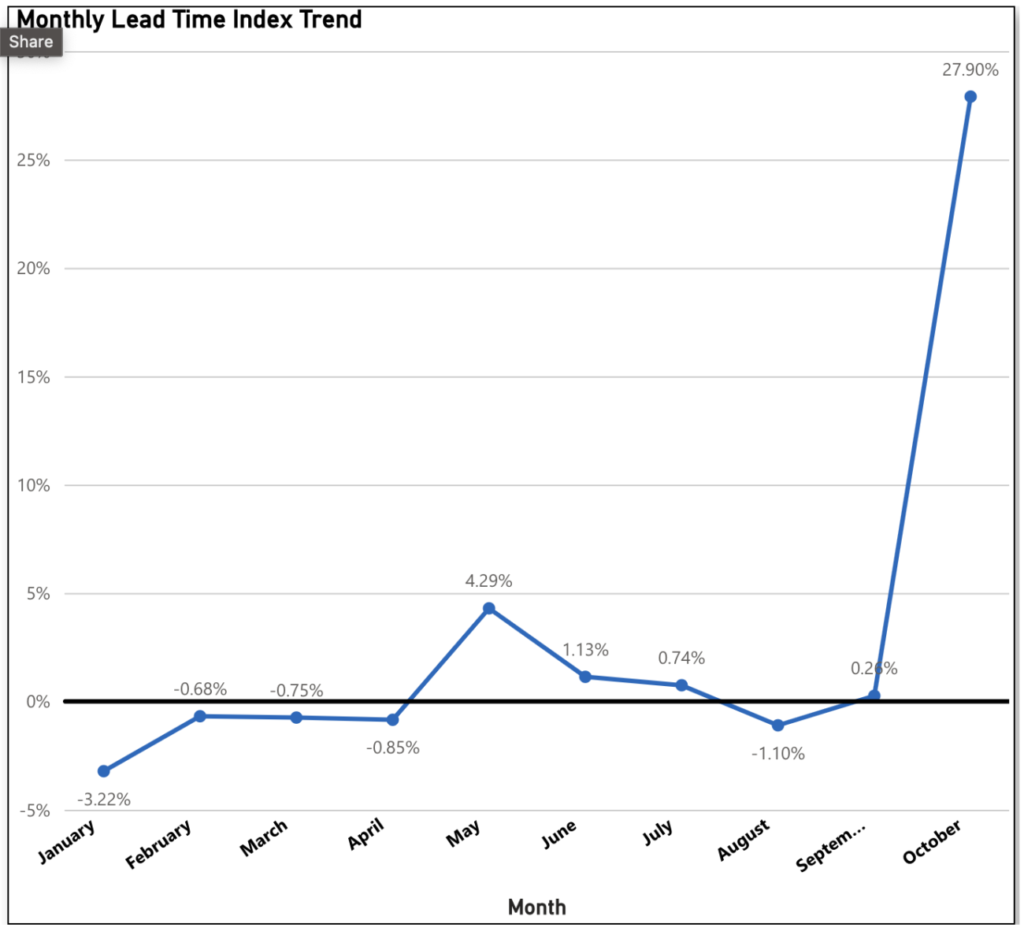

Significant Lead Time Increases Hit Across the Board in October

October’s biggest headline is the surge in lead times. Although the year has already been turbulent in this area, October saw an overall increase of 27.90%, pushing year-to-date lead times to an average rise of 27.14%. This isn’t welcome news for procurement teams, as all but three tracked commodities recorded substantial lead time increases. Much like recent price changes, teams will likely want to closely monitor lead times in November to determine if this trend could extend for the rest of the year.

The main contributors to this increase were Fiberoptic, (up a staggering 173.86% month-to-month), Peripheral (up 46.51% month-to-month), and 15 other tracked commodities, each seeing lead time increases of at least 20% month-to-month in October.

Those three commodities pushing back on October’s trend included General Use Parts (down 41.52% month-to-month), Thermal Management (down 3.48% month-to-month), and Display Assembly (down 2.38% month-to-month).

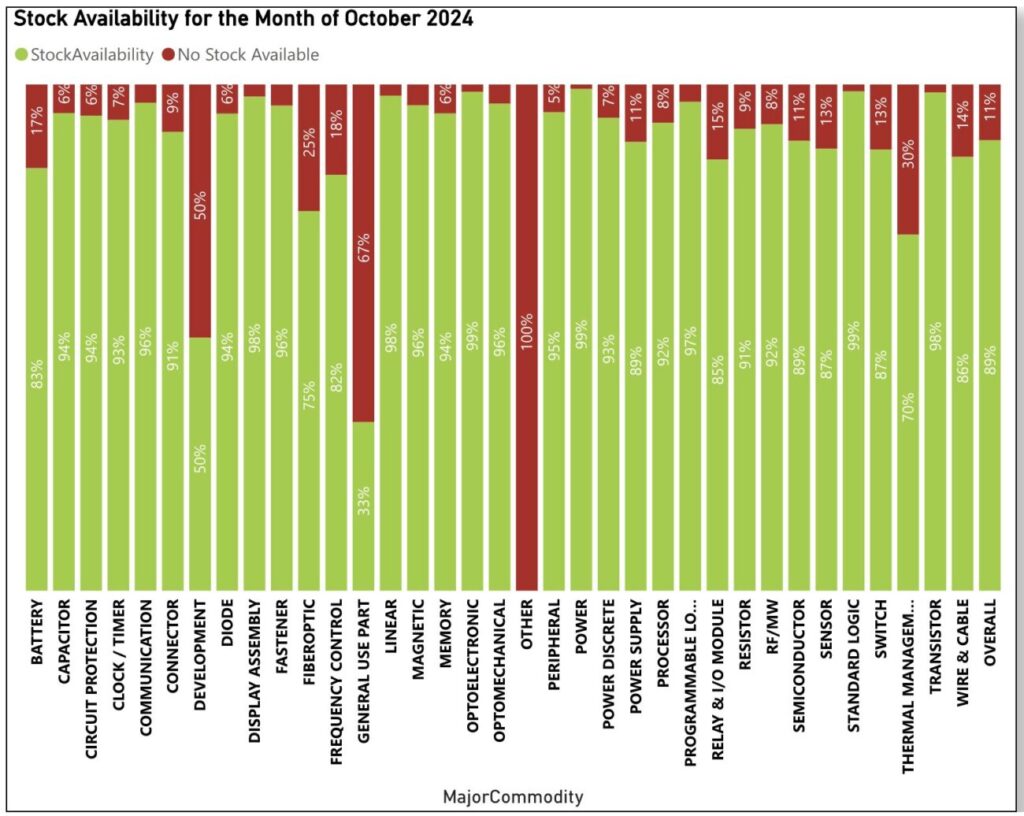

Electronic Component Availability Stays Strong at 89% in October

One bright spot in October’s report is stock availability, which remains high at 89%—a slight dip from September’s 90%. This aligns with the year-to-date average of 89%, with stock availability consistently holding above 87% throughout 2024.

Those components leading the way from an availability perspective in October included Optoelectronic, Power and Standard Logic (all at 99% available), and Display Assembly, Linear, and Transistor (all at 98% available). Those components pushing down on that trend included Other (with no parts available), General Use Parts (at 33% available) and Development (at 50% available).

Sign up for our newsletter for more on the electronic components market.