State of the Electronic Components Market: October 2025

Prices accelerate upward as supply tightens and lead times remain elevated

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $550 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

Price Increases Strengthen in October

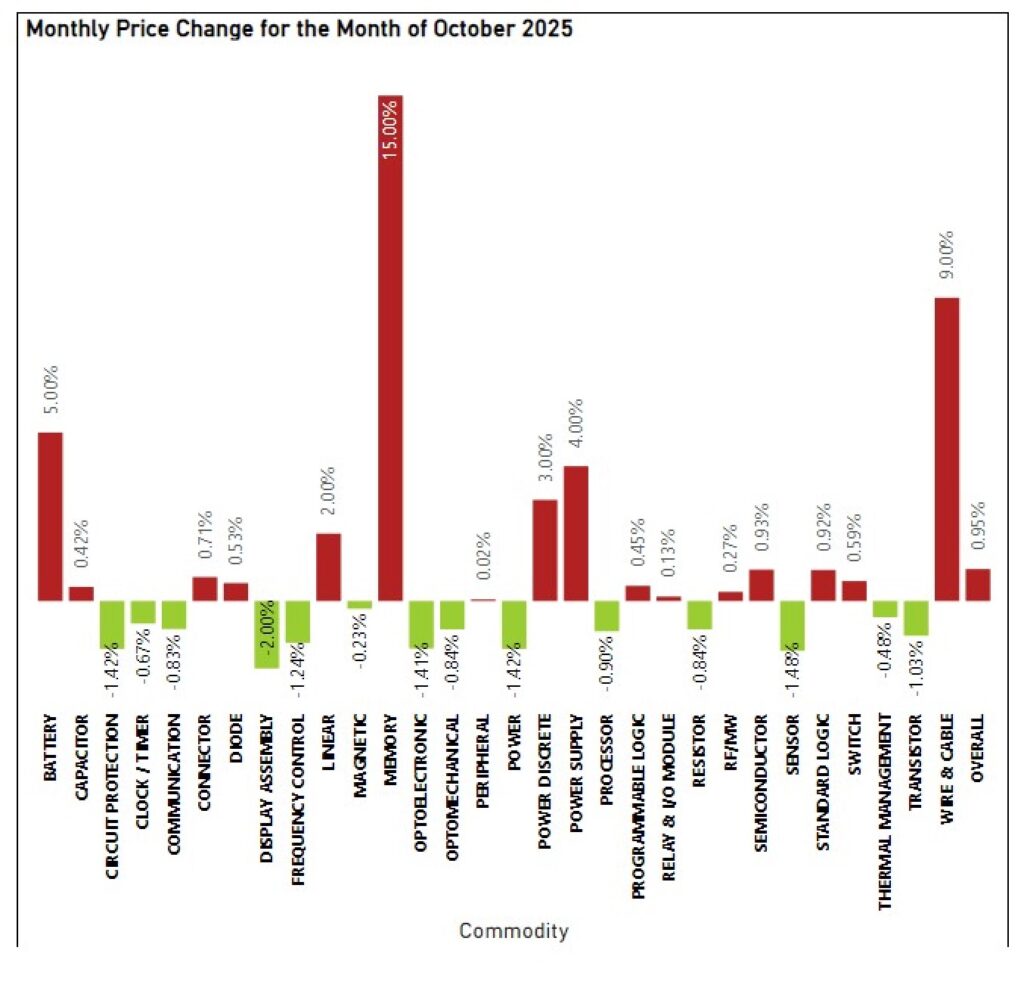

October showed a meaningful shift in pricing dynamics, with electronic component costs rising 0.95% month over month, nearly three times September’s increase. The most notable movement came from categories tied to AI, EVs, and energy systems. Memory led with a sharp 15% increase, driven by AI and data-center demand, while Battery prices rose 5% due to the EV sector’s pull and changes in China’s export policies. Power Discrete and Power Supply also moved higher (3% and 4%, respectively), reflecting increased electrification demand and upstream cost pass-throughs. Wire & Cable saw a 9% jump tied to surging copper prices.

A few categories — including Magnetic, Optoelectronic, Optomechanical, and Transistor — experienced modest declines, though these shifts were not large enough to counter the broader upward trend in the market.

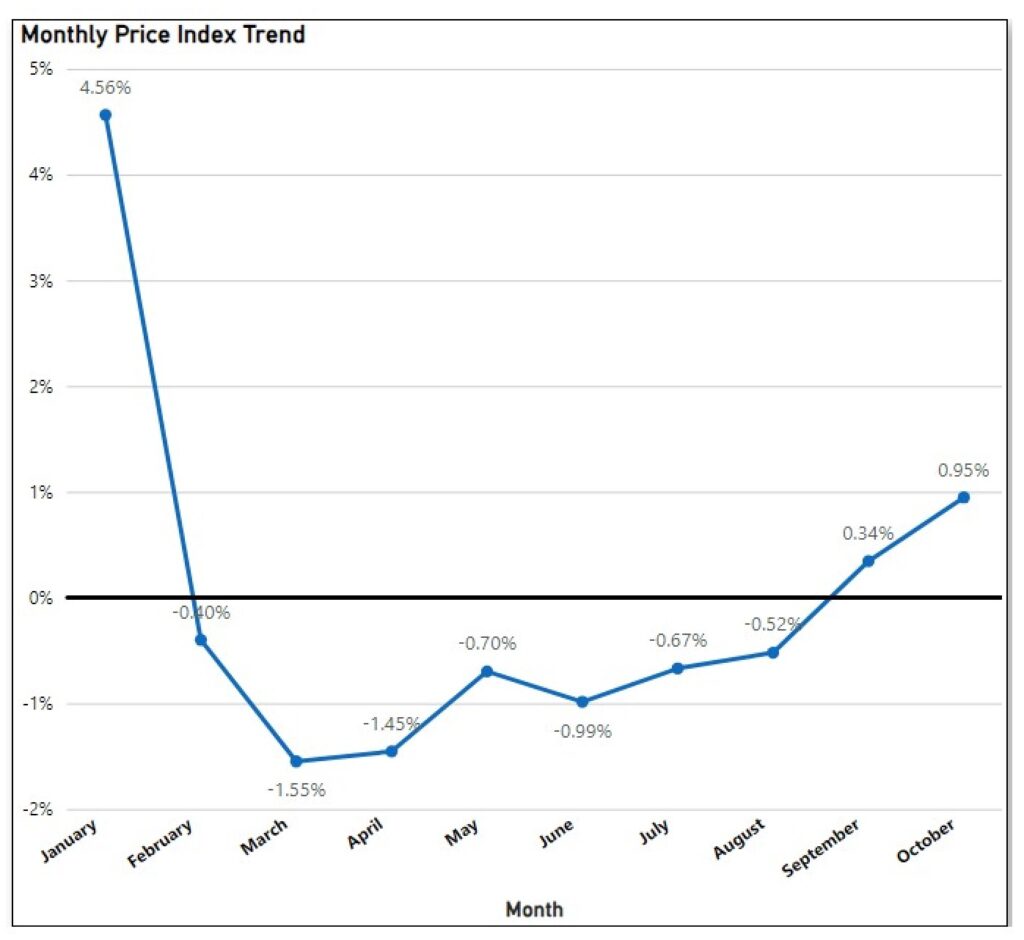

The Monthly Price Index Trend shows a clear inflection point in September 2025, when the index moved into positive territory (+0.34%) after eight consecutive months of decline from February through August. This shift strengthened in October, when the index rose further to +0.95%, confirming the start of a new upward trend. Together, these consecutive increases signal the early stages of selective inflation driven by structural demand in EV and AI markets, rising material costs, and tightening supply in specialized semiconductor categories.

The pricing index confirms that October represents a real, not incidental, turning point. The nearly 1% rise reflects meaningful upward pressure from EV, AI, and copper-exposed categories, positioning the market for continued volatility heading into Q1 2026.

Lead Time Pressures Persist Across Most Component Categories

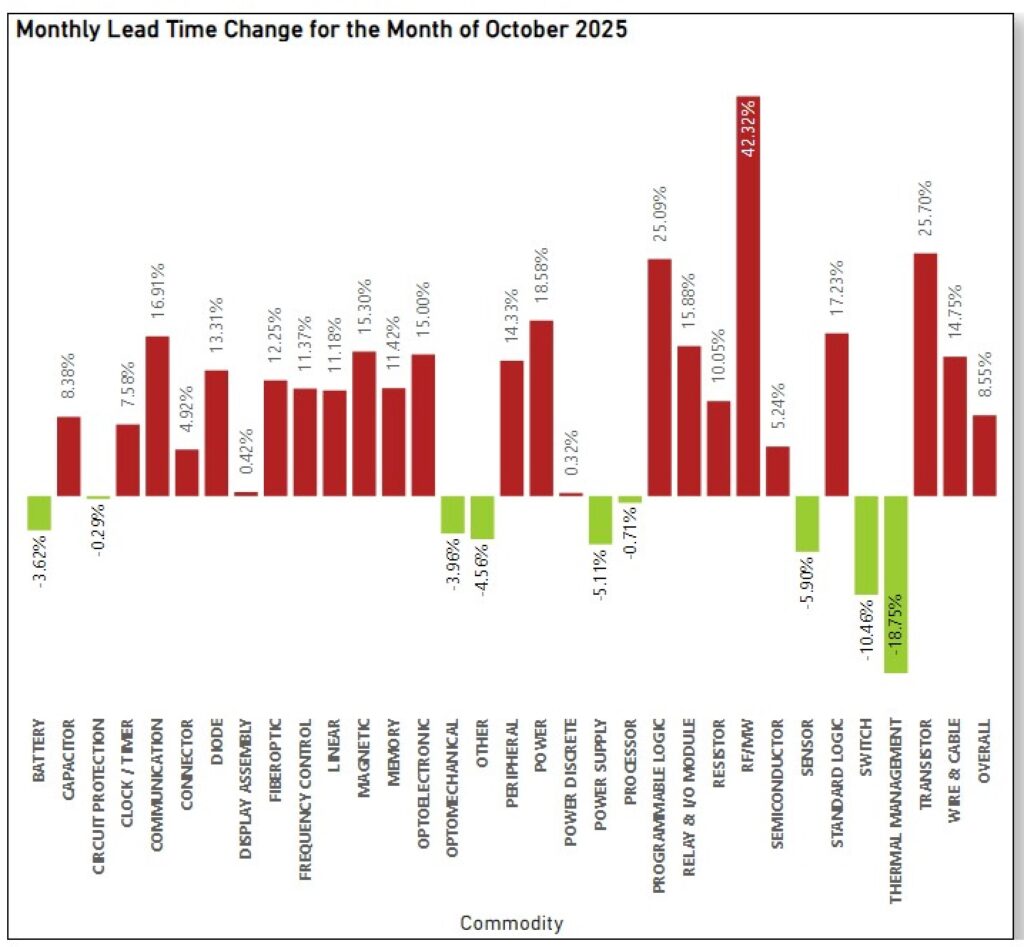

Lead times remained elevated in October, extending the upward trend that began earlier in the year. While the overall increase was smaller than in previous months, the Monthly Lead Time Change chart shows that most component categories continued to experience upward pressure. Several categories — particularly communications, sensors, power components, and RF-related technologies — showed notable increases. Only a few areas, such as Battery, Frequency Control, Optomechanical, Switch, and Thermal Management, saw modest improvements, though these declines were not enough to shift the broader trend.

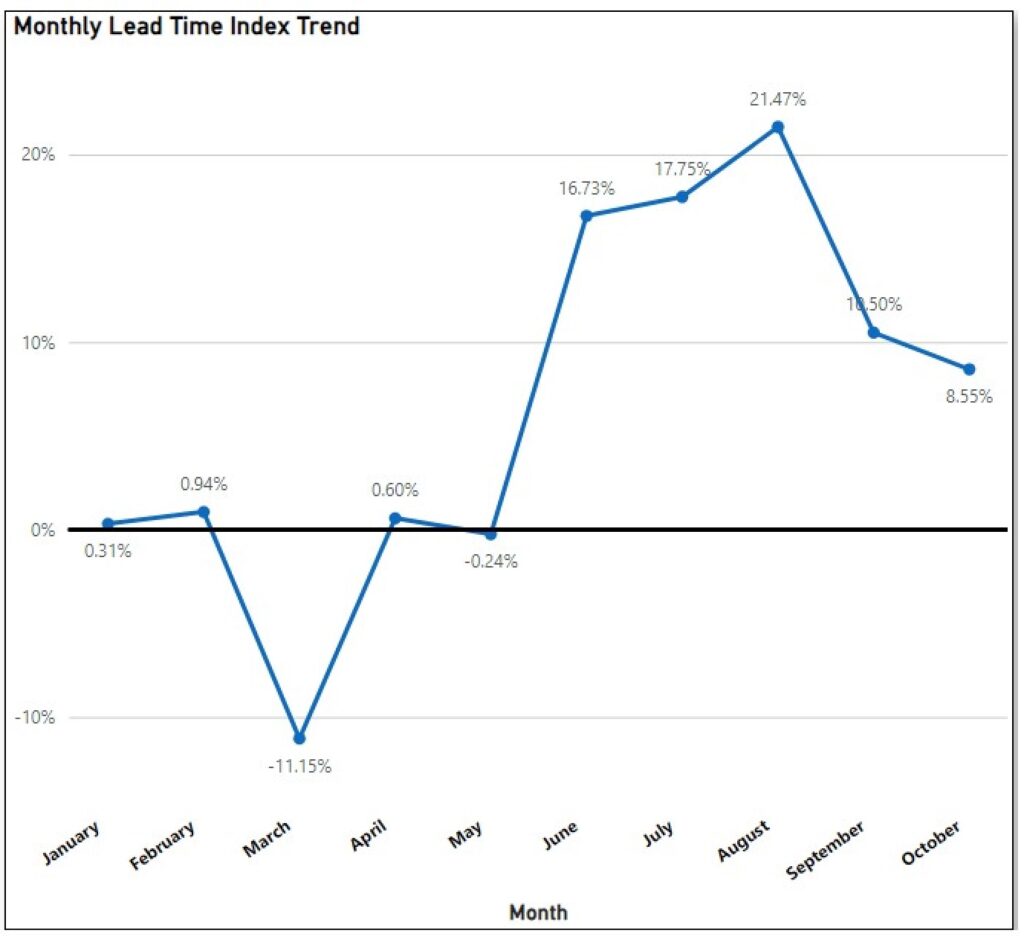

The Monthly Lead Time Index Trend highlights how 2025 has been defined by a sharp rise in lead times beginning in June, accelerating through the summer and peaking in August. September and October show some easing from those highs, but both months remain well above the levels seen earlier in the year. Together, the charts indicate that although the pace of increase has moderated, lead times remain elevated across much of the market heading into the final quarter of 2025.

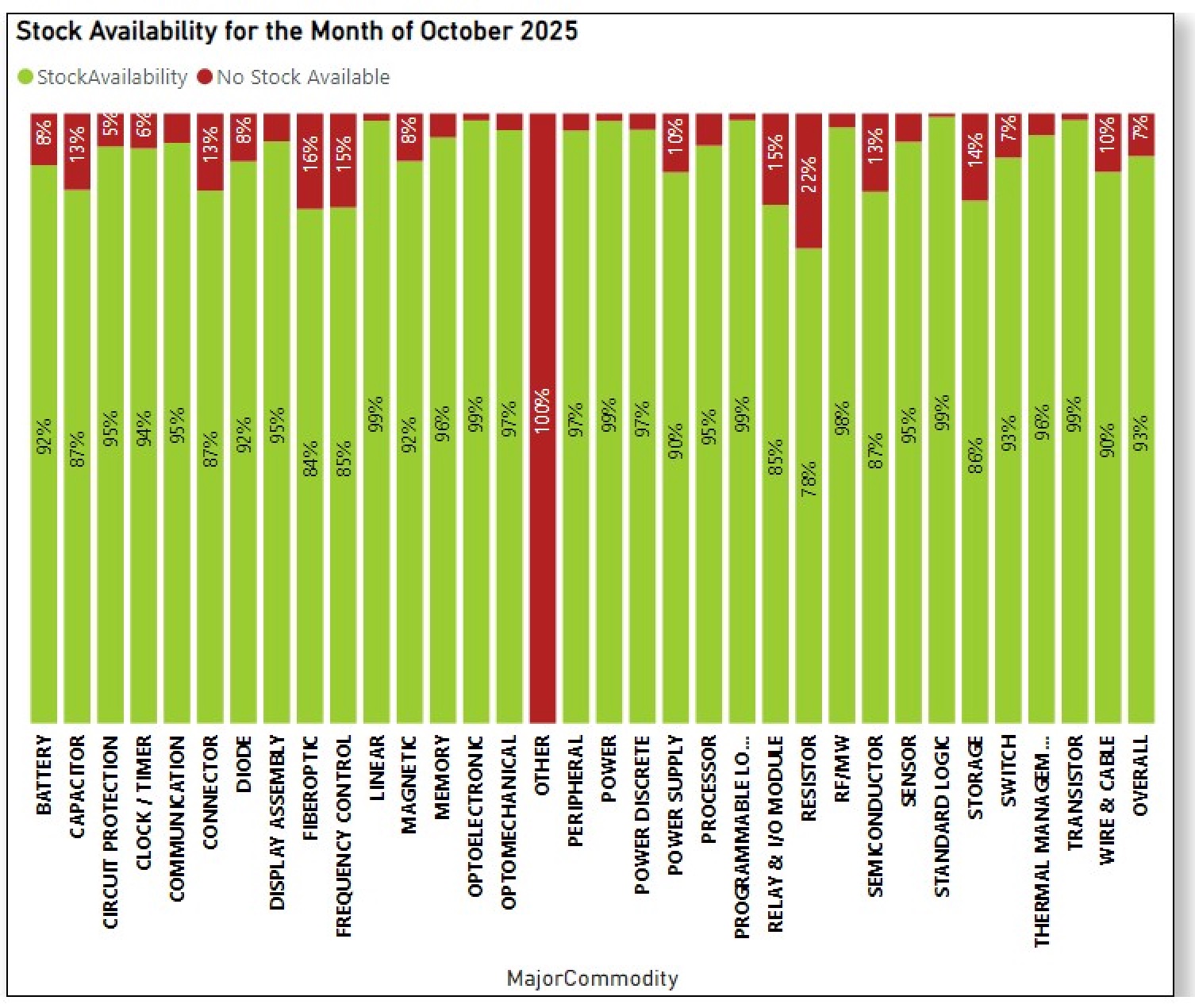

Stock Availability Holds Strong at 93% in October

In October, stock availability held steady at 93%, reflecting a stable supply environment across most component categories. This level aligns closely with the generally high availability seen throughout the year. Leading categories this month include Standard Logic (99% available), Power Discrete (97–99% range), Transistor (98% available), Optoelectronic (98% available), and Linear (97–98% available).

A few categories, however, showed tighter conditions — most notably Optomechanical, which registered no available stock. Despite these isolated shortages, overall market availability remains high.

Sign up for our newsletter for more on the electronic components market.