Electronics Market: Price Declines and Steady Supply Define Septembers Landscape

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $470 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 15,800 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

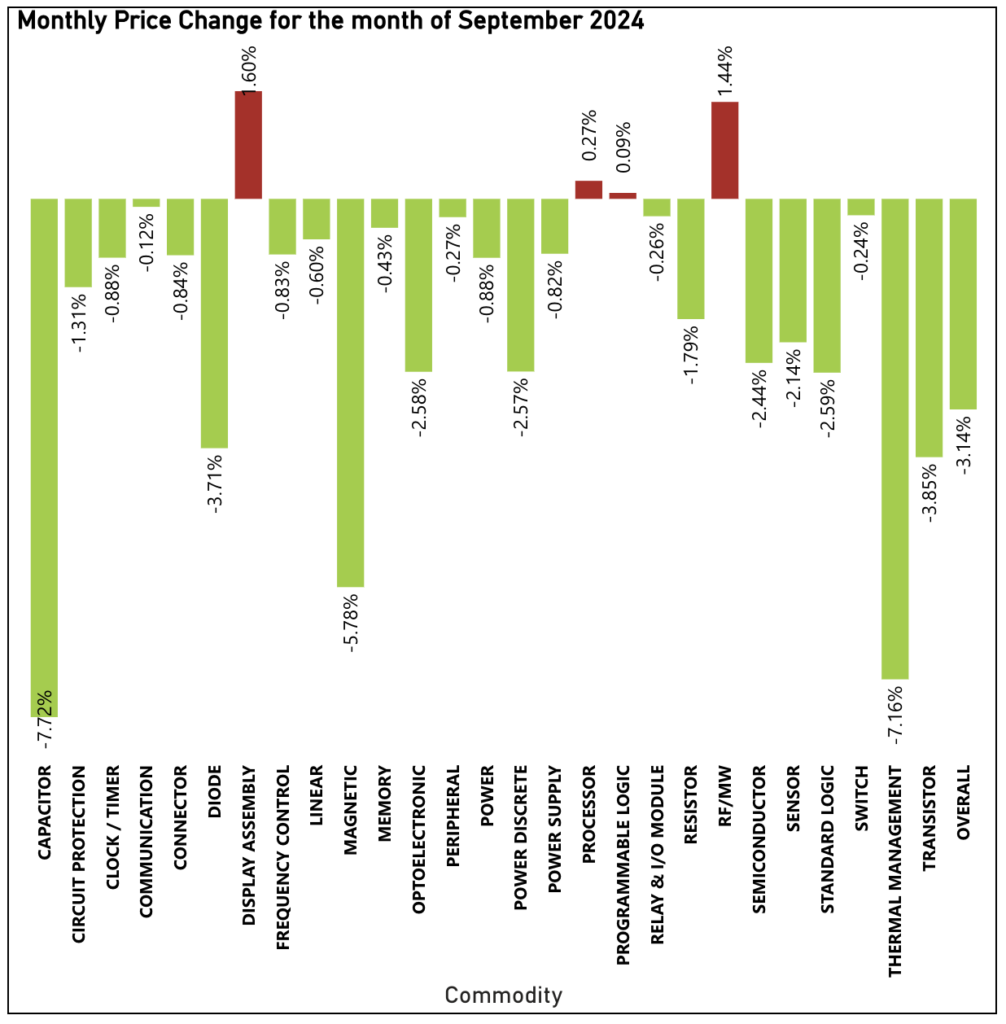

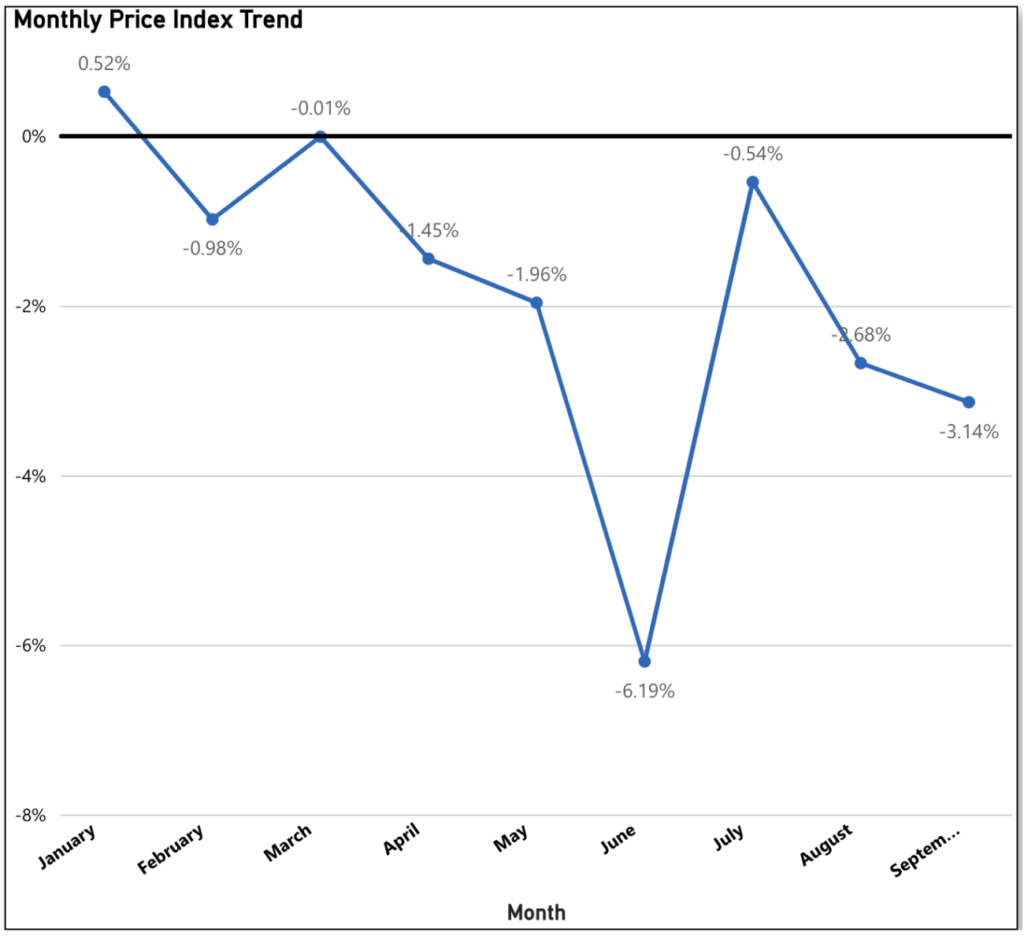

September Continues With Strong Price Declines, Surpassing August’s Decrease

September extends 2024’s streak of price reductions, marking the eighth consecutive month of declines with a 3.14% drop—exceeding August’s 2.68% decrease for the second largest dip this year. Of the 27 commodities monitored, 23 saw price drops, further highlighting the buyer-friendly market dynamics. This sustained downward trend reinforces a year-long narrative of favorable pricing conditions for buyers, underscoring the competitive advantage available throughout 2024.

The biggest drivers in this pricing readout include Capacitor (down 7.72% Month-to-Month), Thermal Management (down 7.16% Month-to-Month), and Magnetic (down 5.78% Month-to-Month).

The commodities pushing upward against this trend include Display Assembly (up 1.60% Month-to-Month), RF/MW (up 1.44% Month-to-Month), Processor (up 0.27% Month-to-Month), and Programmable Logic (up 0.09% Month-to-Month).

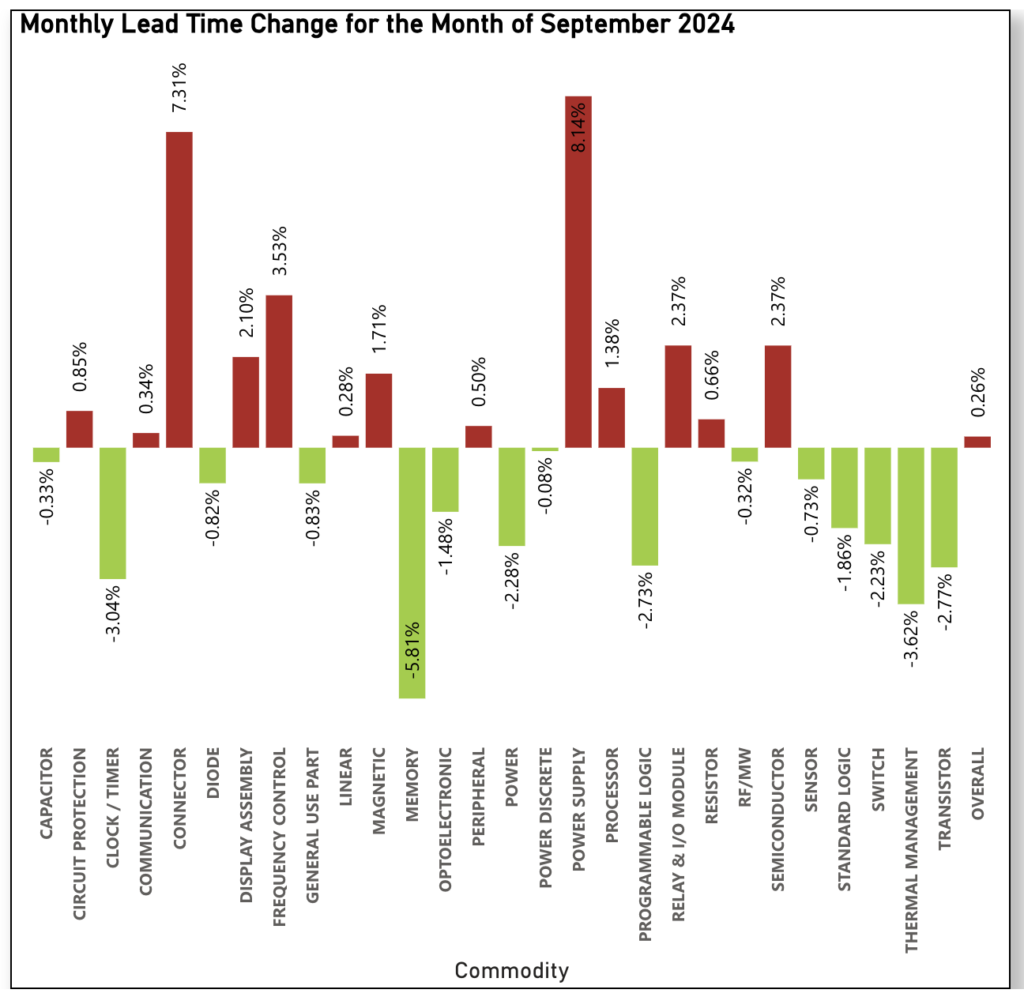

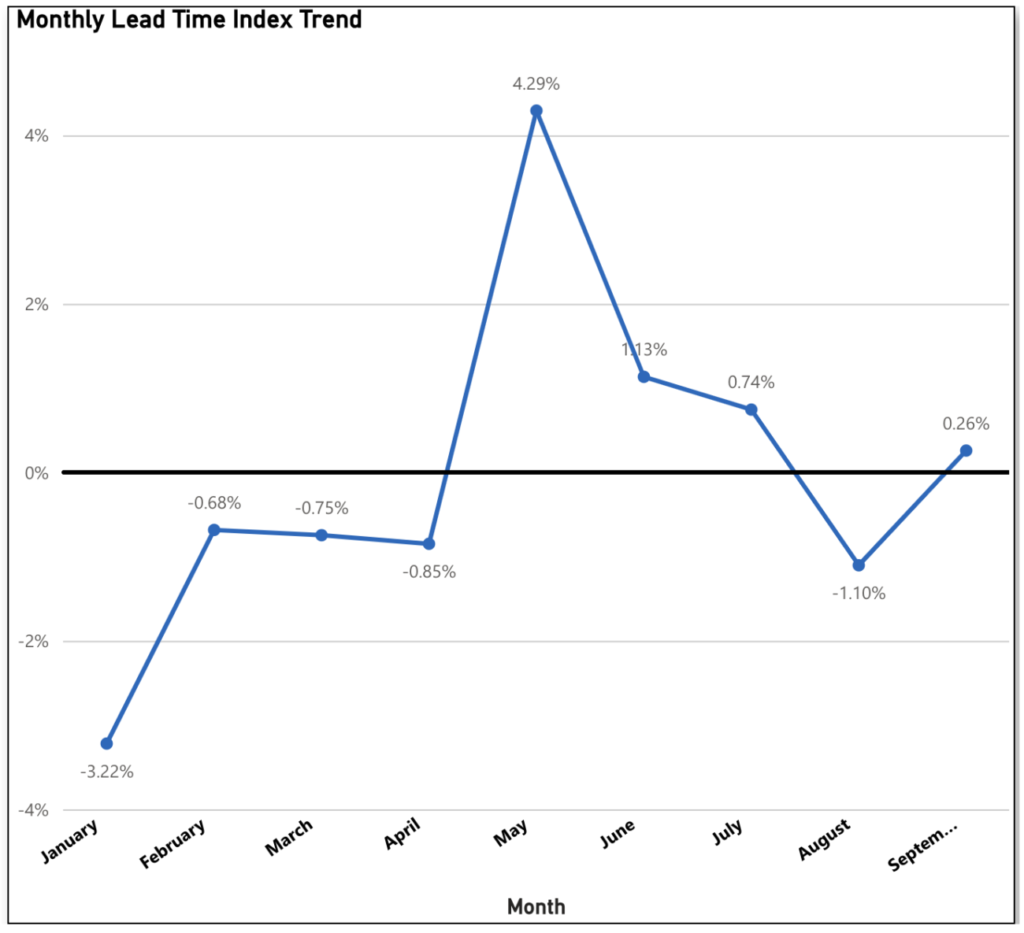

Lead Times Edge Up Again in September After August’s Improvement

Following a favorable 1.10% reduction in August, lead times saw a slight increase of 0.26% in September. While August’s decline had offered optimism that lead times were stabilizing, this recent uptick brings year-to-date lead times back to -0.34%. Despite this small rise, lead times remain lower than earlier in the year, though buyers should continue to monitor the trend closely as further increases could signal potential supply chain constraints.

The biggest drivers in this increase were Power Supply (up 8.14% Month-to-Month), Connector (up 7.31% Month-to-Month), Frequency Control (up 3.53% Month-to-Month), and Relay & I/O Module and Semiconductor (both up 2.37% Month-to-Month).

Those commodities pushing back on September’s trend included Memory (down 5.81% Month-to-Month), Thermal Management (down 3.62% Month-to-Month), Clock/Timer (down 3.04% Month-to-Month), and Transistor (down 2.77% Month-to-Month) among others.

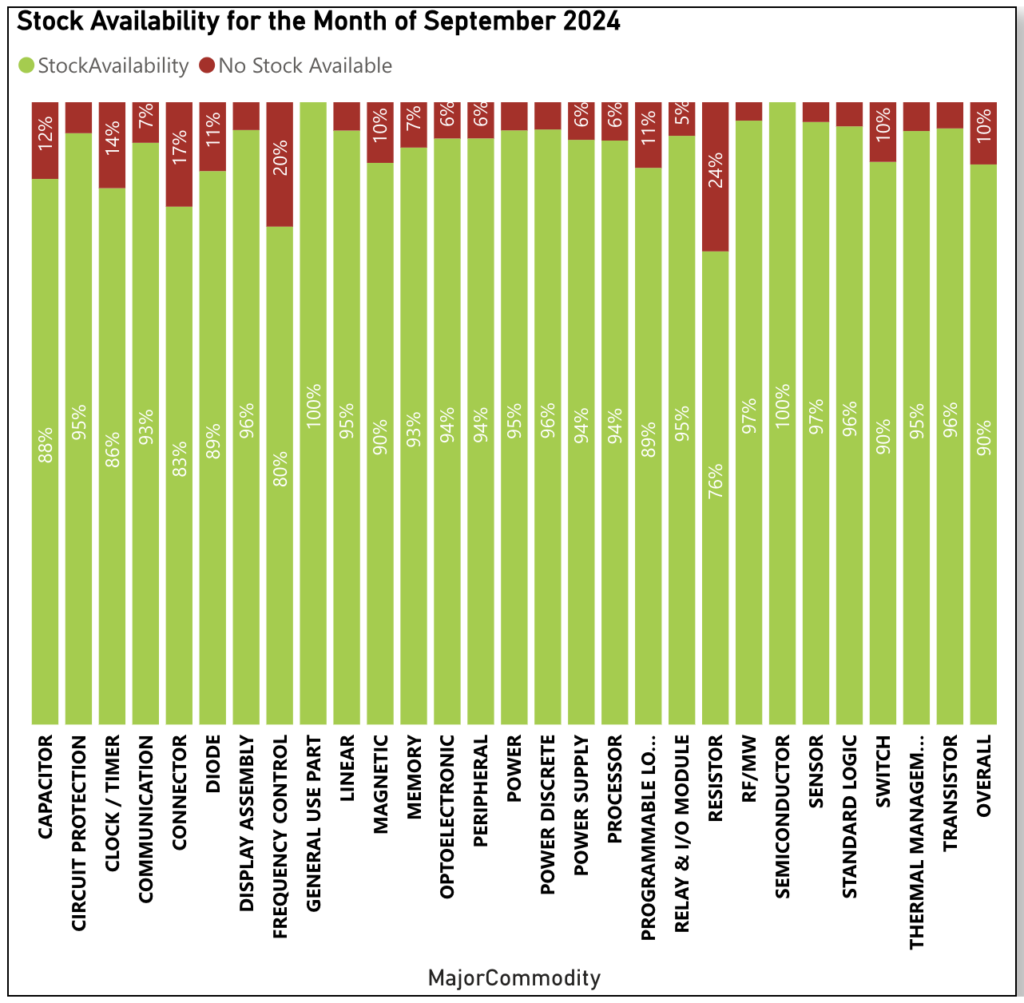

Electronic Component Availability at 90% in September, Maintaining Strong Supply Levels

In September, electronic component availability remained robust at 90%, slightly down from August’s peak of 92% but still among the highest levels recorded this year. This consistency offers reassurance to buyers, as availability has remained above 87% throughout 2024. The strong stock levels continue to provide a favorable environment for procurement efforts.

Those components leading the way from an availability perspective in September included General Use Parts and Semiconductor (both at 100% available with no change from August), RF/MW and Sensor (both at 97% available), and Display Assembly, Power Discrete, Standard Logic, and Transistor (all at 96% available).

Sign up for our newsletter for more on the electronic components market.