State of the Electronic Components Market: September 2025

Prices starting to crawl upwards with Availability starting to dwindle

Lytica is the world’s only provider of electronic component spend analytics and risk intelligence using real customer data. As a result of our unique position in the marketplace, we’ve been able to work with 100+ customers in analyzing over $500 billion in electronics spend. We’ve curated up-to-date insights on the state of the electronic component market and will be sharing them with you each month.

Lytica’s component basket of goods used in our analysis is comprised of 165,000 electronic components across more than 30 categories, consisting of the most popular devices used by our customers. These indices are intended to show trends in the market. Individual component and BoM analysis is offered by Lytica as a service to our customers.

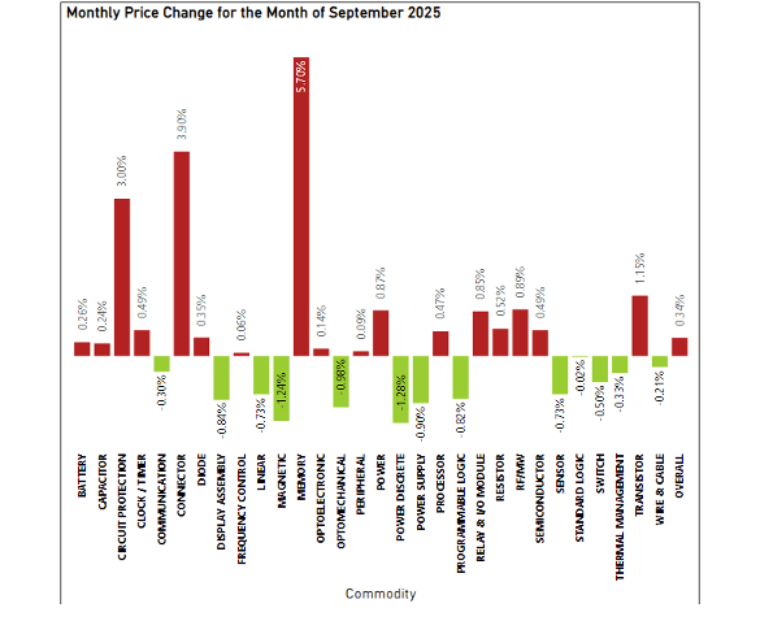

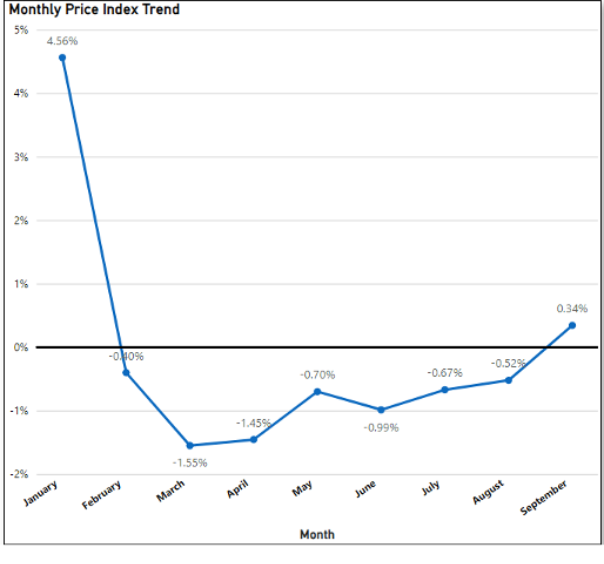

Price Decreases Snapped Their Streak In September

After seven straight months of declines, average pricing on electronic commodities rose by 0.34%. This was an expected outcome given the slowing rate of price decreases over the past two months. It’s unclear if this single data point is a turning point or if procurement teams will quickly get back to seeing sustained pricing leverage across a range of categories.

The biggest drivers in this pricing readout include Memory (up 5.70% month-to-month), Connectors (up 3.90% month-to-month), and Circuit Protectors (up 3.00% month-to-month).

The commodities pushing downward against this trend include Power Discrete (down 1.28% month-to-month), Magnetic (down 1.24% month-to-month) and Optomechanical (down 0.98%).

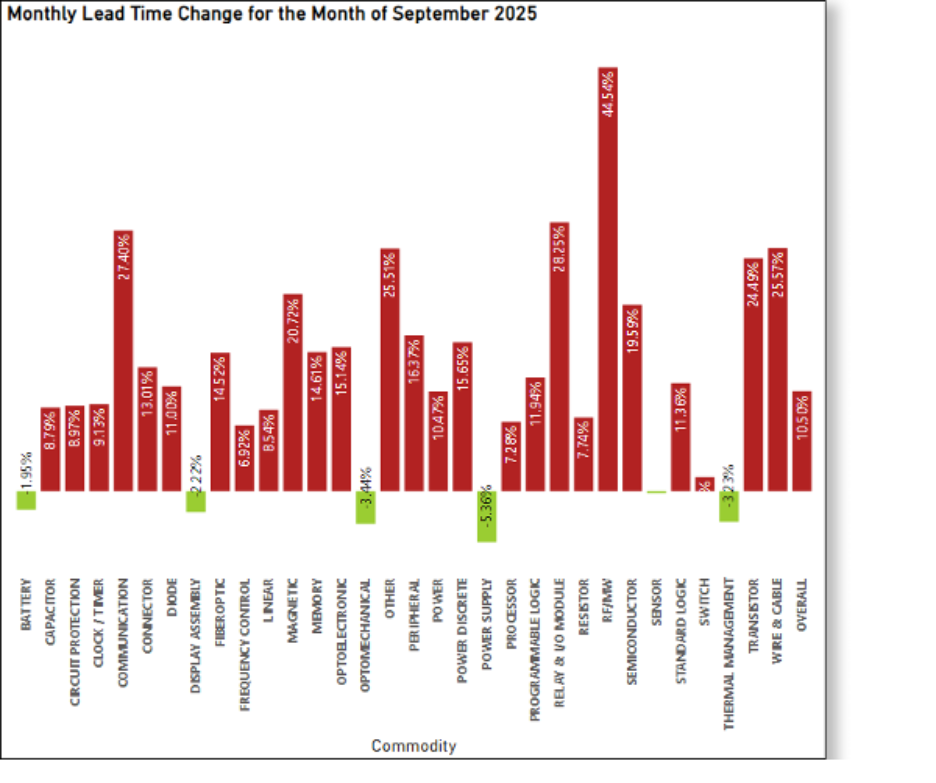

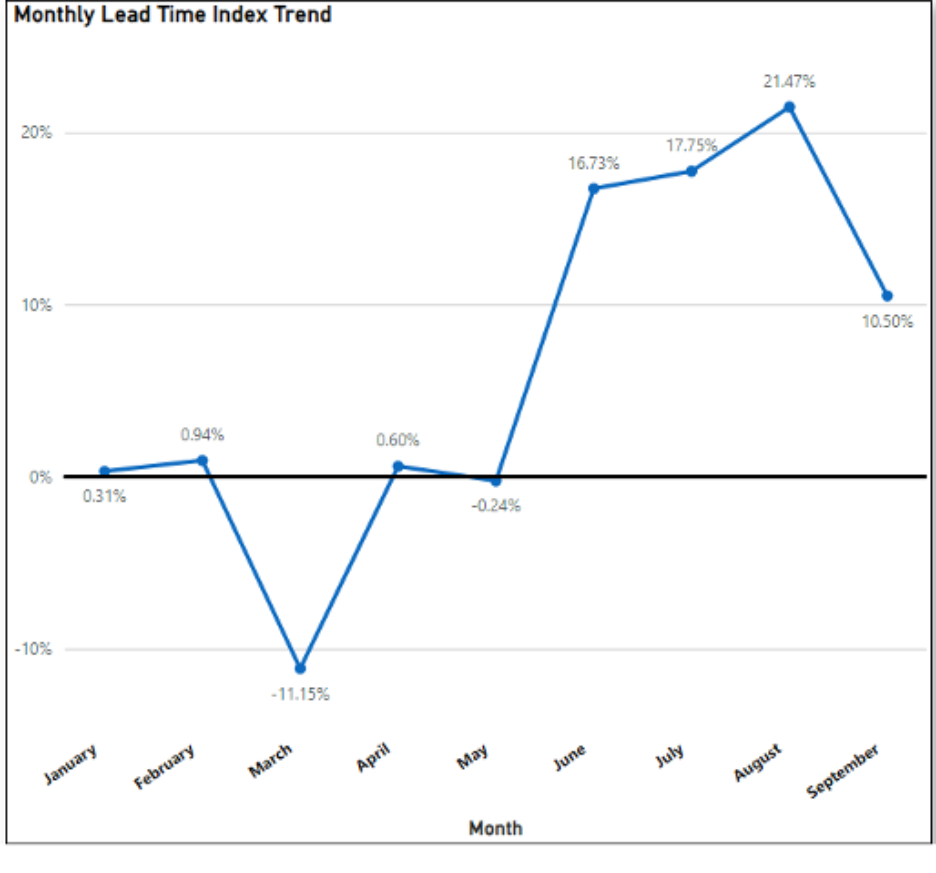

Lead Time Growth Slows In September

September recorded another month of lead time increases, but the rate itself slowed to 10.50% in September from 21.47% in August. This was the fourth straight month of lead time growth and the seventh for the year.

Much like last month’s State of the Electronic Components Market report, virtually all commodities tracked saw an increase in lead times with Power Supply, Optomechanical, Thermal Management, Display Assembly, and Battery being the only exceptions. The main contributors to this month’s large increase were RF/MW (up 44.54%), Relay & I/O Module (up 28.25%), and Communication (up 27.40%).

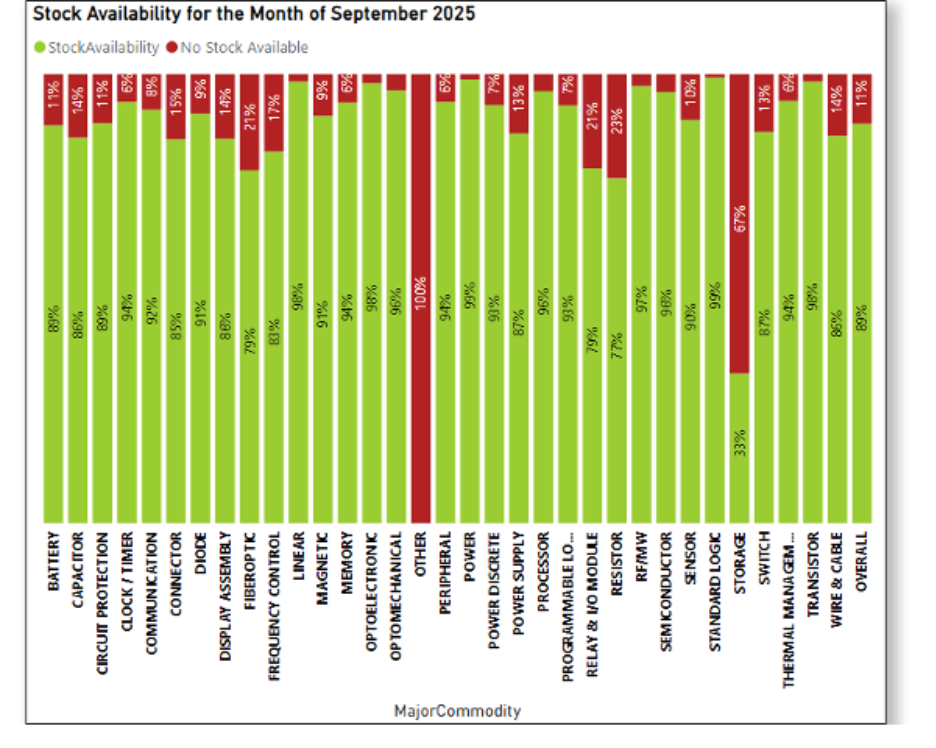

Stock Availability Dips In September to 89%

For the month of September, stock availability has dipped to 89% available. This represents a single data point dip from an otherwise consistent trend of 92% availability over the past 5 months. Those components leading the way from an availability perspective include Standard Logic (99% available), Power (99% available), and Transistor (98% available), Optoelectronic (98% available), and Linear (98% available).

Sign up for our newsletter for more on the electronic components market.