As chief procurement officer for Nortel Networks Ltd. during the downturn in the optical business in 2000, I had to preside over the management of billions of dollars of excess material. This is not something I ever want to have to do again, and I am sure none of you want to do it, either. Nevertheless, this experience flashed through my mind when I was asked by EBN editors to participate in a forthcoming Webinar on inventory management and how companies can develop plans to avoid piling up excess inventory. (See: Highwire Act: Inventory Balancing Between OEMs/EMS Providers & Suppliers.)

As you know, by the time you find yourself with significant excess inventory, it is too late to do much that is elegant. It really comes down to pain-sharing among you, your customers, and your suppliers. If you are in pain-sharing mode, try to balance the pain. You could easily put a weak supplier out of business if you force it to take back inventory — with threats of no future business — when it can’t afford this. I would hate to see you with good inventory turns and a failing sole-source vendor.

The best way to avoid excess inventory is not to get it in the first place. Lean techniques, improved systems, and closer customer relations all work in favor of better inventory management. But even when these things are available, some companies get things horribly out of sync.

I see some amazing things from my vantage point at Freebenchmarking.com. Since inventory is the sum of all the units times their prices, there are only two things you need to get right to get inventory right. One is the quantity, and the other is the price. It’s bewildering why good companies often fail at both. Also, most people don’t think of price as a big factor in inventory until they are conducting revaluations.

When companies submit their data for analysis to use, they provide information on both pricing and quantity. We see the vast majority of companies having quality problems in their data and no one having the best price all the time. Data quality impacts quantity in a number of ways. One way, which is not very obvious, is coding duplication — where customers buy parts under two different client part numbers. They can easily be buying unnecessarily when they already have an excess in the same components by another name. This is very common when company growth has been achieved through acquisitions.

Other problems stem from missing data or incorrect entries. These problems usually can be traced to non-integrated systems or a lack of attention to detail. Poor detail management can be within a company or in the way a company manages contract manufacturers. In any case, get the number of units wrong, and you have shortages or excess.

It’s a little different with price. With units, systems integration and eliminating coding duplication are tough challenges requiring management, coordination, and often significant investment. I can understand these constraints allowing only a limited response. But price inaction, as near as I can see, is beliefs-based, and until someone sees that the pricing is not competitive, it will remain unaddressed. Too many believe they are getting the best prices, and they all can’t be right. I will share a secret with you: Many companies with revenue of more than $1 billion per year think they have the best pricing when they don’t, and most companies with revenue of less than $1 billion think they have an excuse (volume) for not getting better pricing, but they don’t.

Let’s assume that you have $10 million in inventory, and your pricing is 50 percent too high for the size of your company. If so, you really have only $6.6 million of inventory. You have wasted about $3.4 million of cash, lowered profits, and understated turns. How realistic is it that you could be paying 50 percent too much for electronic components?

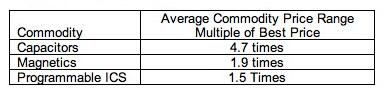

Within Freebenchmarking.com, we have price distributions on all components in our database. I have analyzed the price range for each component in the database and expressed the price range as a percentage of the best price in the database for each component. I have summarized some of these calculations in the table below by showing the average for each component commodity group.

Let me know if my thinking is realistic.

Note: The EBN Webinar will take place at 2:00 p.m. ET on November 2. Speakers include Ken Bradley, president of Lytica Inc., Charlie Barnhart, founder and principal of Charlie Barnhart & Associates LLC, and Bolaji Ojo, EBN editor in chief. The Webinar will discuss issues facing manufacturers as they struggle to balance demand and supply without crossing the line into excess territory when ordering components. Click here to register.

By Ken Bradley – Lytica Inc. Founder/Chairman/CTO