How Lytica became a unique analytics company: Part 23

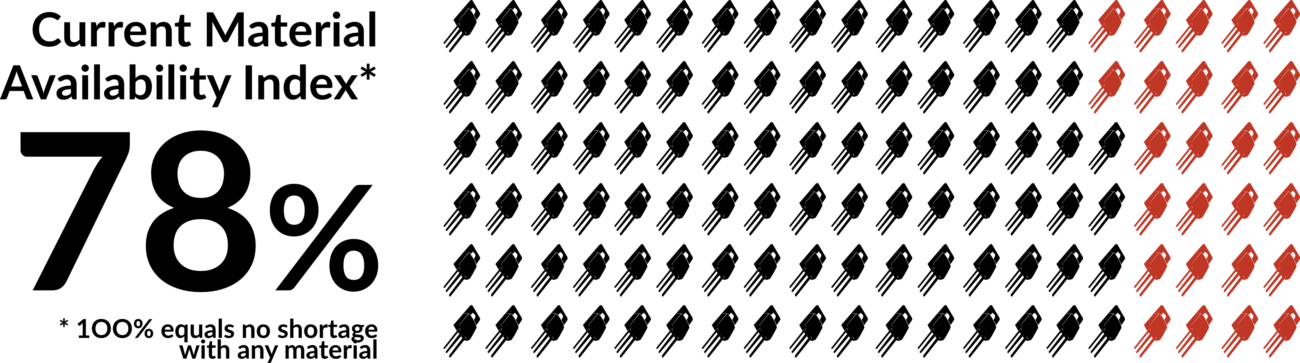

Lytica’s analysis of industry wide e-component availability determined that the Materials Availability Index (MAI) stands today at 78%, ranging from a low of 33% to a high approaching 100% across commodities. It’s no wonder that Supply Chain managers now have only one goal in life: FIND PARTS. Lytica conceived of the index as an early warning signal for changes in materials availability. In good times, our index is typically at 90%+ with a range of less than half the size it is today. Our MAI complements the traditional book-to-bill ratio with some added advantages. In times of shortages, the book-to-bill ratio often contains inaccuracies due to significant double ordering from customers who are scrambling to get parts; this results in the reporting of favourable ratio values even as the demand is decreasing. We believe the MAI is more sensitive to supply availability and, when combined with our in-development Price Trend Index (PTI), provides a more accurate view of the market dynamic.

While higher MAI values mean greater material availability, a MAI too close to 100% indicates over supply driven by factors such as order cancellations and management of excess inventory. These problems are followed by staff reductions and all of the other fun supply management activities associated with recessions. This is just one example of new insights being uncovered because of our Advanced Technology Center (ATC) data program.

We have also been observing companies – particularly EMS providers – to see how they are performing during the second longest period of growth in recorded history. The results are a bit unsettling. At a time when everything is reported as being great, 75% of the top 50 public EMS companies are showing poorer financials than two years ago. This is visible when their financials are converted to a risk metric. Increasing debt is one contributor and, yes, I can see a link to working capital – but it’s still strange. Another concern is that many of these top companies have not had record annual revenue results in many years; few are showing true revenue growth at all. Shouldn’t revenue growth accompany economic expansion? How can this be when these are the companies making most of the electronics products in the world during one of the best economic periods in history?

I don’t know the answer yet, but I will be watching our indices to see if a downturn is approaching. This would be extra hard on many EMS companies

The technology developed in Lytica’s Advanced Technology Center (ATC) has enabled me to create this index as well as to quickly assess these EMS companies. The idea for an index was nowhere on the horizon when we adopted an AI technology path to improve our products and offerings. Another example that materialized and quickly came to fruition is our Extreme Shortage Mitigation (ESM) report which was developed inside of two weeks and is helping clients get some shortage relief. We are working on other early warning tools, including a Price Trend Index (PTI) that we will reveal in a few weeks.

An interesting observation is that, as we create new technical capabilities, our technology is becoming as valuable as our products. Customers are seeing uses for our capabilities to solve chronic material and overhead problems. We have about half a dozen major corporations rethinking their work processes using our technologies as enablers. Many recognise that when the shortage problem abates and the downturn occurs, they are going to need significant productivity enhancement to ride out recession pain. Others are repositioning themselves to outperform their peers. These companies seek an integrated solution that brings our technology and unique knowledge together within their organization’s practices. This tailored approach delivers more than our standard products and services by bringing real time information on risk, compliance and cost information into their sourcing and supply base decisions. We are accumulating lots of information about manufacturers and components which allows us to explore offerings that benefit our customers; in some cases, our technology even shows potential for non-supply chain applications.

We are excited by this new ATC enabled thrust but recognize that many opportunities will arise and acknowledge that we can only act on those that fit with our company’s strategic direction and align with our roadmap. That said, small variations in our proven technology are providing our customers the opportunity to dramatically reduce their overhead and save time – sounds like a win-win to me.

Contact us today to discuss your company’s chronic or labor-intensive issues and discover how we can create transformative solutions from within.

Ken Bradley is the Chairman/CTO & founder of Lytica Inc., a provider of supply chain analytics tools and Silecta Inc., a SCM Operations consultancy.