Is the current distribution model sustainable in the future? To answer this question, let us re-examine whether the three prerequisites mentioned in WILL ELECTRONIC COMPONENT DISTRIBUTORS DISAPPEAR? (PART 1) will continue to exist for the distribution businesses.

Re-cap of the prerequisites:

- They keep inventory to provide materials to buyers faster than manufacturers do.

- It is costly for manufacturers to manage many small customers.

- Information asymmetry provides a profitable earnings opportunity through the gap between selling and purchasing price.

Re-examination of these prerequisites:

- Fast access to material and a more responsive supply chain weaken the dependence on inventory. Inventory was never a must have, it was a solution to the problem of access to materials and inaccurate demand prediction. Driven by cutting-edge technologies and innovations such as RFID, IoT and predictive analytics, a digitalized supply chain is just around the corner; it will be more connected and optimized for speed and agility. With streamlined systems and logistics services like those from Amazon and Alibaba the value of inventory provisioning diminishes. We will not be as heavily dependent on the stock in distribution warehouses for shorter lead time and unexpected demand fluctuation as we once were.

- Managing multiple relationships will become easier and cost much less. Better CRM and enterprise software greatly simplify the task of managing many customers. As mentioned above, distributors help boost the revenue of manufacturers because, for manufacturers, the benefit-to-cost between dealing with small customers vs. big customers varies significantly. In future, equipped with powerful CRM and automatic order fulfillment systems, manufacturers will be able to minimize benefit-to-cost variances among different customers allowing them to increase their revenue without increasing cost and without help from distributors. Where does this leave the distributor?

- Price transparency to buyers is increasing as continued consolidation in this industry intensifies competition and actions such as the aggressive market penetrating strategy of WPG holdings (lowest margins among all players) intensify pricing wars. Downstream customers also continuously drive improvement in price transparency; nobody wants to be overcharged. Additionally, customers can minimize extra cost resulting from information asymmetry by turning to 3rd party companies such as Lytica to determine the purchasing price in the market and leverage that information to negotiate a better price for themselves. As the degree of information asymmetry decreases, it becomes more difficult to sustain a distribution business model. Eventually same component/same service will be sold for the same amount to every purchaser.

Technology and customer needs will drive supply chain visibility in terms of the flow of goods and price, squeezing the market where electronic component distributors play. So, will they disappear or will they transform their business model to adapt to the new world?

In my opinion, distributors will not disappear but they must change their business strategy and strengthen their capability in marketing and design to create more value for manufacturers and buyers of electronic components. Some recommendations for achieving this change can be found below.

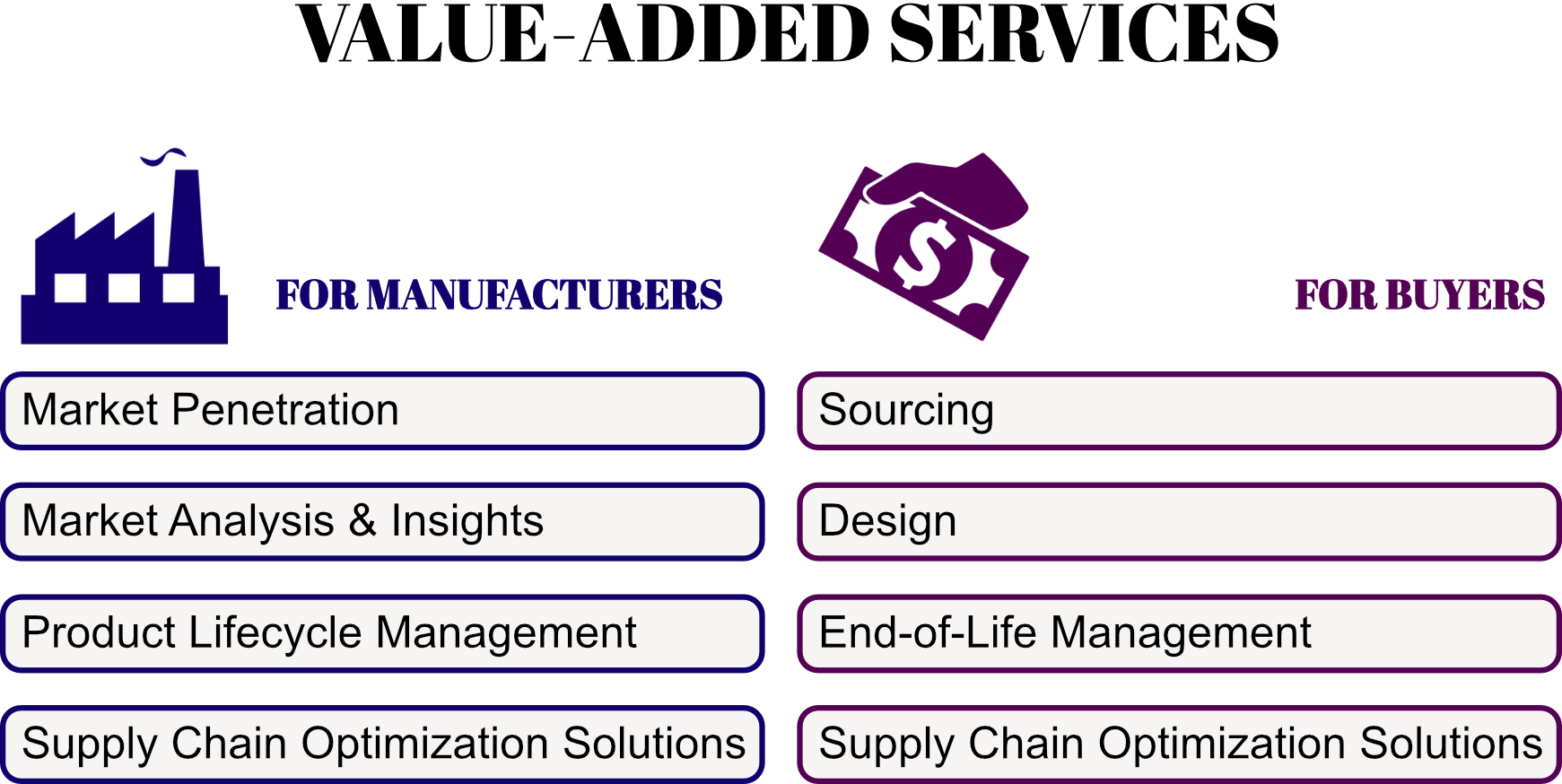

Service offerings for manufacturers:

- Help manufacturers penetrate the market by using in depth knowledge of markets in different geographic areas.

- Provide insights in terms of market trends, customer needs and competitiveness analysis.

- Early involvement in the design phase of manufacturers’ products and engagement in full product lifecycle management.

- Offer supply chain optimization solutions to manufacturers. For example, help manufacturers design and implement digitalized supply chains based upon their needs.

Service offerings for buyers:

- Provide sourcing services to help buyers find customized components at the right price.

- Participate in designing products by leveraging advanced knowledge in components and their applications.

- Supply end-of-life management services such as component recycling for customers to securely dispose of defective and obsolete parts.

- Help buyers design and establish a digital supply chain in their companies.

Instead of making money by relying on the existence of supply chain inefficiencies such as inadequate channels from manufacturers, slow delivery and information asymmetry, component distributors should provide value and gain profit by offering solutions which strive for supply chain efficiency and visibility. Players proactively developing and sharpening their capabilities to become supply chain solution providers will gain the upper hand in this untapped new market, enjoying decent profits which match the value they provide.

Han Di is a contributor at the operational and strategic levels in supply chain development and is a Supply Chain Specialist at Silecta Inc., a supply chain services company.