Is risk a synonym for uncertainty?

The thesaurus in Microsoft Word suggests that it is and a Google search confirms it however, when thinking about managing supply chains, there are a different set of actions for risk than those taken to address uncertainty. The primary supply chain actions to reduce risk involve alternate sourcing, inventory and supplier selection criteria whereas actions to remove uncertainty involve data. If they really are the same, the risk reduction approach should be the same.

Paraphrasing a key point made in a 2016 article about Big Data predictions by Robert J. Abate , he suggests:

“Our analytical capabilities and, in turn, insights are starting to grow exponentially and will soon change organizations to become more data driven and less ’business instinct’ driven.”

Are our actions to avoid risk more business instinct driven and less data driven? Could analytics drive better risk reduction approaches at lower cost?

In my role as CTO of Lytica, I see many companies operating supply chain strategies based on multi-source allocations. I am a strong supporter of multi-source approvals in a product design but does paying a higher price for components from a second approved and active source (and hence a higher overall product cost) really reduce risk or do anything about supply chain uncertainty? I plan to write more about this in a future blog but for now, in our example, we have the certainty of higher cost and the uncertainty of improved security of supply. Business instinct seems to be the driver in this strategy.

I’m not suggesting that data isn’t used in the design of supply chain or in the selection of manufacturer components but I advocate that more or new and different information could have led to a less costly allocation strategy. The arguments that support keeping multiple manufacturers of a component active are varied but usually constitute the need to:

- Exercise the manufacturer so that shifts in the manufacturing process can be detected and addressed before they become a supply constraint,

- Maintain a level of business with a manufacturer so that they see you as a valid customer, and

- Have two or more active, flowing sources so that you can manage demand increases with greater dexterity.

Without too much thought, it is easy to see options that fulfillthese needs at a lower cost than keeping multiple component level sources active. For example, sample builds to test AML (Approved Manufacturer List) alternative components address the first need while understanding inventory positioning amongst manufacturers and distributors address the short term supply needs of two and three. Additionally, maintaining business levels to remain a valid customer can be achieved by splitting procurement at the commodity level but allocating supply to only one supplier for each individual component (the lower priced one).

Most companies do a fairly good job of managing supply and recovering from supply disasters. This is probably due to the wealth of experience derived from weaknesses in their supply base design which has caused them to exercise their skills too often. Better information on supplier risk and competitiveness would lead to a more robust supply chain design yielding fewer issues and greater cost effective supply certainty.

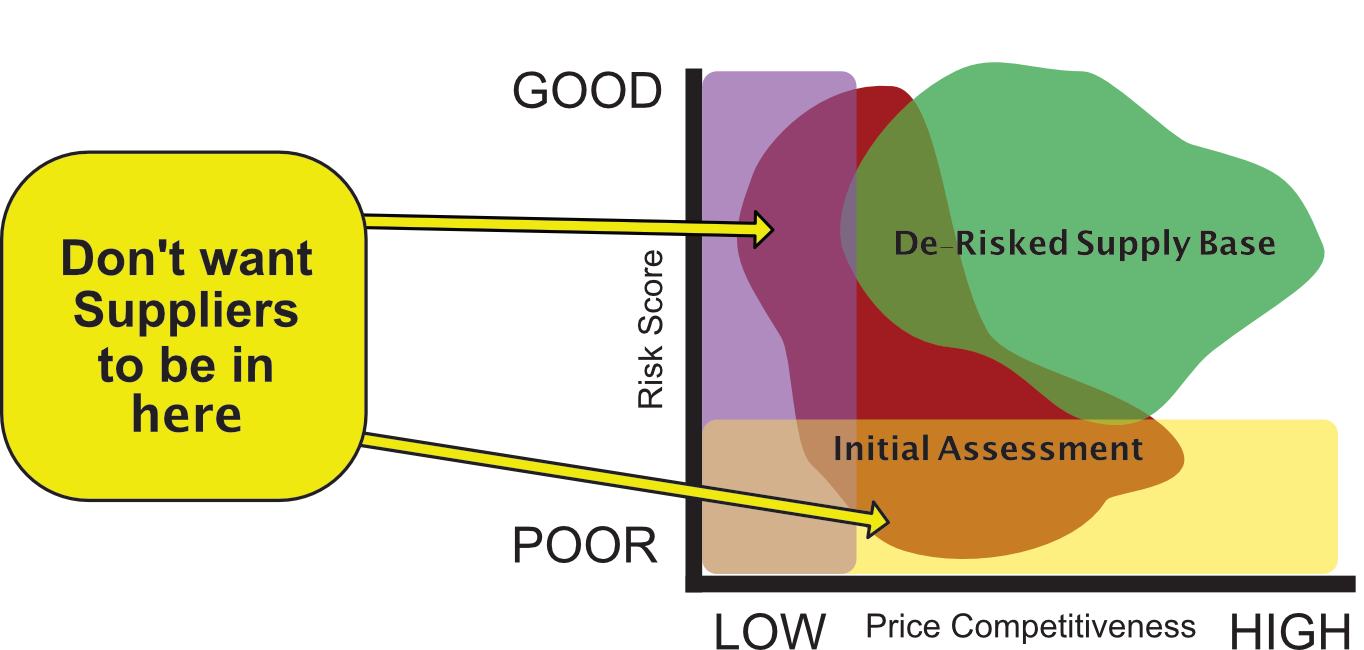

Imagine if you could plot a scatter gram of all of your suppliers where one axis was their price competitiveness and their risk score was the other. The (0, 0) point represents the poorest competitiveness and highest risk. Suppliers near (0, 0) are most likely the ones to cause supply disruptions and cost issues. Draw bands across the scatter gram showing the worst 1/3 competitiveness scores and another for the worst 1/3 risk scores. Any supplier falling within either of these bands should be a concern and is most likely causing grief. This method of graphing is extremely valuable as it can be used to derisk supply chains by moving supply to companies that are closer to the upper right hand position on the plot. While risk will never be completely eliminated, you don’t need to live with so many dimensions of uncertainty; Big Data analytics can provide information like this which has been missing in most supply chain designs.

Ken Bradley is the founder of Lytica Inc., a provider of supply chain analytics tools and Silecta Inc., a SCM Operations consultancy.